Swissquote Bank: Chips and banks

Swissquote Bank: Chips and banks

By Ipek Ozkardeskaya, Senior Analyst, Swissquote Bank

Yesterday’s US inflation data was… mixed. Headline CPI rose 0.3% month-on-month, exactly as expected, pushing the annual rate up to 2.7% from 2.4% in the prior month. But core inflation came in softer than anticipated, briefly lifting market sentiment. Since core inflation is what really guides Federal Reserve (Fed) decisions, the initial reaction leaned bullish. However, the relief didn’t last long. Signs of tariff-driven inflation are already starting to show, as some companies begin passing on higher costs to consumers. Bloomberg highlights that appliance prices jumped the most in five months, while toys, furniture, and sports equipment saw their steepest increases since 2021 and 2022, respectively.

Consequently, the market didn’t digest the US CPI report well. Treasury yields climbed across the curve: the 2-year yield—which reflects Fed policy expectations—rose to 3.95%, the 10-year yield reached 4.50%, and the 30-year yield hit 5.00%.

Japanese yields, one of the drivers of the global rise in sovereign yields, continue to edge higher. This morning, the 10-year JGB yield hit 1.60% for the first time since 2008, amid concerns about unsustainable fiscal spending. If the LDP retains its majority in Sunday’s Upper House elections, fears are that spending could accelerate further. The yen remains under pressure despite rising yields, with the USDJPY approaching the key 150 level.

Forget about a July cut

Fears of tariff-fueled inflation and the continued strength in labour market data are pushing expectations of Fed rate cuts further out. The Fed is not expected to cut rates at its meeting later this month—and may skip the September meeting as well. Fed funds futures currently assign only a 54% probability to a rate cut in September.

If inflation accelerates while jobs data remains solid, the Fed will likely stand pat. This shift in sentiment has helped the US dollar find a bid. The dollar index climbed past 98.50 yesterday. The net bearish speculative positioning appears stretched enough to allow for further upside in which case the USDJPY could break above 150 (depending also on the Japanese election), the EURUSD may fall toward the 1.12–1.15 range, and Cable could drift toward 1.3150–1.32. Still, the dollar remains in a medium-term downtrend and current strength is better seen as a correction rather than a reversal.

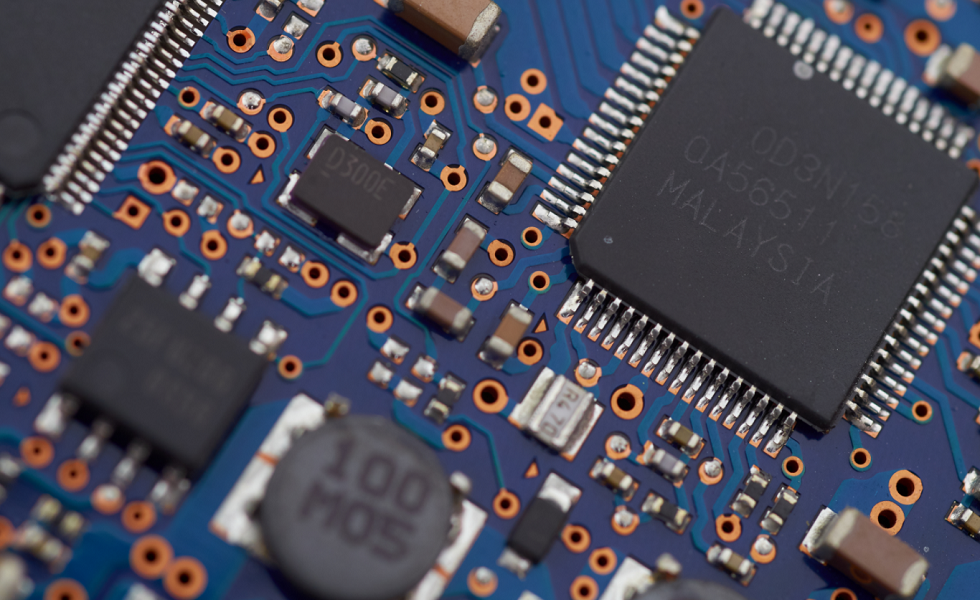

Chips and banks

Nvidia jumped 4% on Tuesday after reports that the White House will approve exports of its H20 chips to China—a logical policy pivot given the Chinese export ban had cost the company an estimated $10 billion in revenue. AMD rallied 6.4% on similar optimism.

ASML this morning reported stronger-than-expected Q2 results. Orders came in well above forecasts, fueled by AI demand. The company said full-year sales could be up ~15% from last year. The update may help support a recovery in ASML’s share price, which had lost nearly 50% between last July and April in Amsterdam.

BUT note that semiconductors could give some of the latest gains as Donald Trump freshly said that tariffs on pharmaceuticals could be effective from the end of this month and levies on semiconductors could follow soon...

Elsewhere, the first wave of US bank earnings surprised to the upside. JPMorgan, Citi, and Wells Fargo struck a confident tone, citing the resilience of consumers and businesses, and a still-solid labour market despite rising inflation expectations. Regulatory easing is also expected to free up capital.

Still, reactions were mixed. Wells Fargo fell over 5% after cutting its net interest income guidance. JPMorgan slipped 0.74% despite upbeat investment banking revenues. Citi jumped more than 3.5% to its highest level since 2008, helped by a new stock buyback program. Provided the first results and the market reaction, we could see consolidation in S&P500 financial stocks after a 24% rally since the April dip.

Oil falls, uranium gains

US crude has been testing the 200-DMA to the upside despite news – earlier this week - that Saudi Arabia exported above its quotas last month in a rush to get its oil out of the Persian Gulf as Israel went to war with Iran (which by the way, was probably a one-off breach of the quota and doesn’t change the cartel’s plans to completely exit the 2.2mbpd restrictions and stop there). But yesterday’s API data – that showed 19 mio barrel build in US inventories last helped to push oil bulls to the sidelines and led to an almost 3% slide in US crude. Note that, the softer US dollar has been a supportive factor for oil prices (along with geopolitical tensions), and the ongoing recovery in USD and relatively softer Mid East tensions (at least slower headlines) could limit the upside potential near the 200-DMA and keep oil in the $65-68pb range until fresh direction.

Meanwhile, the Global X Uranium ETF just hit its highest level since 2013. The move reflects growing demand for energy infrastructure to power AI-driven data centers—some of which are now the size of small cities in the US. Against this backdrop, energy and cybersecurity investments remain compelling complements to portfolios anchored by AI heavyweights like Nvidia.