Capital Four: Northern European direct lending, an attractive diversification strategy

Capital Four: Northern European direct lending, an attractive diversification strategy

With a current yield well above 10% in euro for senior secured loans, Northern European direct lending has become attractive to investors over the past decade and has seen strong growth.

By Torben Skødeberg, Co-founder, Partner and Portfolio Manager, Capital Four

Northern European economies are resilient and have lender-friendly jurisdictions as well as robust but flexible social security systems. This makes restructuring and merging companies relatively less complicated. In addition, Nordic countries in particular have a long tradition of private equity, dating back to the 1980s. The type of business model that requires relatively large amounts of debt to support concentrated ownership is well established in the region. The direct lending market has developed rapidly and has great potential to attract investors who have previously invested in private debt in the US or the broader pan-European market.

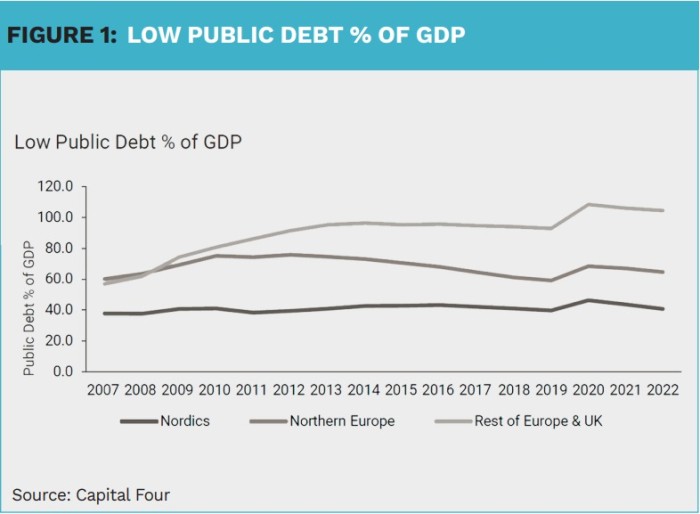

Furthermore, Northern European countries offer a very resilient economic environment. They have low debt-to-GDP ratios, so there is greater fiscal headroom to preserve stability in times of slowing growth. These countries are also less reliant on investment-heavy or cyclical industries. Sectors that are equally attractive to private equity and private debt investors, such as healthcare, technology and business services, are very resilient. The countries have strong legal protections for property and creditors’ rights, similar to the UK and much better than countries such as France or Italy.

Growth is likely to continue

Traditionally, Europe has been reliant on banks for the provision of capital. Dependence on a single source of finance can put companies in a difficult position. Through a gradual expansion of direct lending, the broader economy benefits from richer and alternative sources of financing for companies, which improves the capital efficiency.

Northern European countries are still underrepresented in direct lending.

In Europe, these advantages were certainly first recognised in the UK and France, where direct lending has already become established as a form of financing for M&A transactions by private equity investors, so-called ‘sponsored deals’. Northern European countries are still underrepresented in direct lending transactions. Today, more than 50% of these transactions take place in the UK and France, while approximately 40% of the transactions are located in the Nordics, the DACH countries and the Benelux.

At the same time, private equity funds investing in Northern Europe have grown and transactions are increasing in recent years. As typically 20% to 45% debt is brought into each leveraged buyout (LBO) transaction, it is consistent that direct lending forms of financing will continue to expand in Northern Europe.

Sustainability plays a crucial role

Transparency is key for investors and insights into ESG data, KPIs and new PAI data are increasingly available. Data are typically not available from ESG data providers, as borrowers are usually private equity owned. Aligned interest across private equity and debt investors on ESG results in a fruitful partnership to drive the transformation.

Northern European companies in particular have been taking ESG as a key focus area for a long time. This fosters integration of sustainability considerations in the deal structuring. In addition to assessing the sustainability profile of companies, incentivising companies for continuous improvement is essential. Through a systematic process for scoring ESG profiles, a dialogue with companies on sustainability is established at an early stage, ensuring that companies increase their attention on ESG. By integrating appropriate ESG KPIs into credit documentation, companies must examine their value chains with regard to sustainability risks and are incentivised to drive continuous improvement.

Mid-market opportunities

Financing for leveraged buy-outs or other M&A transactions has traditionally been provided by banks, and they are often still the cheapest source of debt capital for private equity, but not the most efficient. The banks’ risk appetite is curbed by increased regulation. This is particularly evident in companies with EBITDAs of € 5 to € 25 million. Rigid credit conditions with restrictions on dividend take-outs, ongoing loan repayments and lengthy decision-making processes do not harmonise well with the nature of private equity transactions. Private debt funds, on the other hand, can offer the better financing option, although this comes at higher financing costs. They offer attractive credit terms and are often able to offer larger loan volumes with additional credit lines for acquisitions. This in turn saves private equity sponsors from having to negotiate with several lenders. At the same time, borrowers accept relatively stronger covenants from direct lenders in Northern Europe, compared to similar transactions done in the US or broader Europe. Funds can often provide reliable credit decisions more quickly, which plays a decisive role especially in the context of M&A transactions. Here, private equity sponsors seek secure funding before they win the bid for a company.

For medium-sized firms, management’s competence has a major influence on the company’s success. In this context, sponsored transactions are particularly interesting as additional transparency on the financial condition and expertise are provided, which – ultimately – can contribute positively to risk reduction.

Direct lending does not only offer higher yields, but also a relatively shorter cash flow profile.

Increased attractiveness

Corporate direct lending has increased its attractiveness compared to other asset classes in the current market environment. Direct lending does not only offer higher yields, but also a relatively shorter cash flow profile. As a result, investors can expect steady returns from interest payments shortly after investing, and thus receive earlier cash flows, driven by a running yield of 10+%. This increases the attractiveness of corporate direct lending in terms of total return, but also contributes to its role as a diversifier in an alternative portfolio.

The rise in funding costs offers investors a higher expected return, which must be protected through prudent deal structuring to avoid defaults.

There is no doubt that the resilience of business models and portfolios is currently at the forefront of investors’ asset allocation. A characteristic feature of the mid-market is that attractive business models can be found across almost all sectors. As a result, protection against economic cycles and shocks does not necessarily require broad exclusions of sectors that are generally considered as being cyclical. Rather, there are attractive investment opportunities across a wide range of sectors. In order to tap into these, a comprehensive credit analysis with prudent deal structuring and a rigorous bottom-up investment process are required to provide investors with downside risk protection.

|

SUMMARY Private equity and debt investors focus their attention more towards ESG. This creates a meaningful leverage on the sustainability transformation of companies. Significant regional differences prevail across Europe. Northern Europe – Benelux, Germany, and Scandinavia – provides a diversifying allocation to broader pan-European direct lending portfolios, which typically have a low exposure to the region. With yields well above 10% in euro, senior direct lending provides a unique risk-return profile. |