Federated Hermes: Climate change and inequality, a moral question for investors too

Federated Hermes: Climate change and inequality, a moral question for investors too

When active investors of capital see the markets failing to bring desired outcomes, they must acknowledge this and seek alternative solutions. Perhaps the most obvious example where a free market is contributing to a growing problem, rather than solving it, is climate change.

By Vincent Nobel, Head of Asset Based Lending, Federated Hermes International

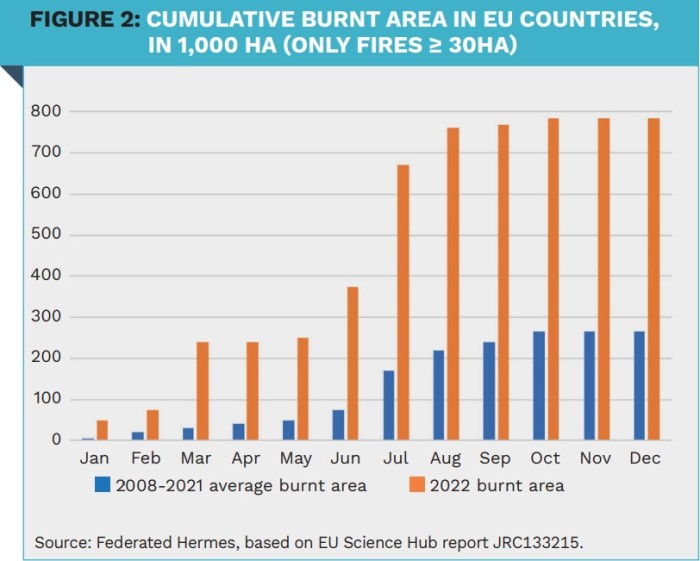

The forest fires that have plagued Europe this year have been a reminder that we are not immune to the impact of climate change. Though classified as a natural disaster, there is nothing natural about the frequency and the extent of the fires we experience. Last year was particularly bad.

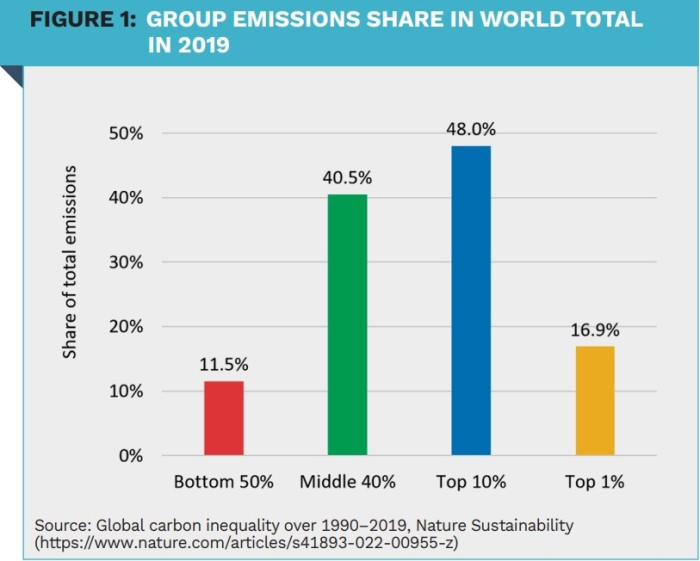

Mitigating the effects of climate change is not just an economic challenge, inequality makes climate change a disproportionately larger problem for the poor. The wealthy are better able to shield themselves from many of the costs and risks of climate change, although their carbon footprint is disproportionately larger. The global top 10% of earners is responsible for 48% of global carbon emissions, while the bottom 50% of earners cause just 11.5%. In simplified terms, the wealthy are creating a global liability that the poor will pay for, which gives climate change a strong ethical dimension.

As early as the 1970s, we understood how man-made carbon emissions cause climate change (then referred to as the greenhouse effect).1 Since then, we have not achieved a reduction in global carbon emissions. Politicians have yet to find both the courage to deliver real change and the rhetoric that secures democratic support for it. The UK government in particular has shown an alarming disregard of its own climate pledges. Without tangible progress, disruptive grass-roots semirevolutionary protests like Stop Oil and Occupy Wall Street will keep emerging. People are understandably fed-up with the leaders that have led us here.

Many politicians look at the world from their own privileged perspective and see spending money as the solution. But installing air conditioning because it gets hot in summer, for example, is neither a solution that addresses the problem, nor one available to the majority of the population. To get better solutions, we should deploy John Rawls’ ‘veil of ignorance’2. If you didn’t know what position you would hold in society, nor what natural talents you would be endowed with, what society would you build? And what solution to climate change would you propose? I think that thought experiment must surely yield fairer results.

Buildings designed with the climate in mind can drastically reduce the need for air conditioning and heating.

Can we think of real asset investments under a philosophical veil of ignorance? The answer may not be simple. In the US lobbyists seem to have convinced law makers that to think of anything other than short term financial gain is a disregard of fiduciary duty. Though clearly short-sighted, it is additionally disappointing because political intervention is often thought of as the mechanism through which market failures are to be addressed. In Europe, state intervention for the common good is more generally acceptable, but even here it is tough for investors to go all the way.

Investors would do well to remember that making their assets, existing or new, as environmentally sound as they can be, is not purely an economic consideration. Naturally we install air conditioning in new buildings, otherwise they become unliveable under rising temperatures. But there is much that can be done in the design of buildings to reduce, if not eliminate, the need for such measures. Buildings designed with the climate in mind can drastically reduce the need for air conditioning and heating. This is true for residential dwellings, as much as for commercial buildings.

Natural ventilation, for example, has been almost completely eliminated from property developments. But, if designed well, it could be sufficient to keep the working and living spaces at an agreeable temperature, even in summer. Windcatchers have fallen out of favour but are used effectively in the Middle-East and North Africa. They can keep temperatures inside buildings 10 degrees cooler than outside3. With 10% of global electricity consumption already going towards the cooling of buildings4, we really must review the potential of this old but energy-free technology.

Though incentives have improved (tenants are starting to pay more rent for greener buildings), in many cases it could still be argued that making a property ‘best-in-class’ is not financially viable. A fair shortterm argument, but it will not be long before society picks up on the fact that it cannot just be an economic question. It is also a moral question, and the allocators of capital have the ability to make this real-world change. It is my firm belief that their investment will actually be repaid, both in financial terms and in wider societal benefits.

1 J.S. Sawyer, Man-made carbon dioxide and the ‘greenhouse’ effect, (Nature 239, 23–26)

2 J. Rawls, A Theory of Justice

3 Radwan Kassir, Passive downdraught evaporative cooling wind-towers: A case study using simulation with field-corroborated results (https://journals.sagepub.com/doi/abs/10.1177/0143624415603281?journalCode=bsea)

4 IEA, Air conditioning use emerges as one of the key drivers of global electricity-demand growth (https://www.iea.org/news/air-conditioning-use-emerges-as-one-of-the-key-drivers-of-global-electricity-demand-growth)

|

SUMMARY Climate change is both an economic and a moral challenge. Buildings designed with the changing climate in mind can drastically reduce the need for energy-hungry air conditioning and heating. As investors look to improve their real assets in an effort to contribute to the pathway to net zero, they must consider solutions beyond the obvious. There are different ways of making properties best-inclass, some more financially viable than others. |

| The views and opinions contained herein are those of the author and may not necessarily represent views expressed or reflected in other communications. This does not constitute a solicitation or offer to any person to buy or sell any related securities or financial instruments. |