Fixed income in 2023: Invesco’s flexible approach for navigating market uncertainty

Fixed income in 2023: Invesco’s flexible approach for navigating market uncertainty

By Paul Jackson, Global Head of Asset Allocation Research at Invesco

|

Key takeways Across Europe, consumers are facing the same trend of higher inflation. Investors, too, face a complex macroeconomic environment – further complicated by geopolitical factors. If inflation has peaked, as our Base Case suggests, there are a range of fixed income plays for investors. In our Model Asset Allocation, we prefer high-yield credit and emerging markets. In the Alternative Case of more persistent inflation, there’s a preference for defensive assets such as cash and government bonds. We like investment grade credit in both scenarios. |

Where are we now and how did we get here?

Prices rose across the board in 2022. By the end of the year, a loaf of white bread in the UK hit an average of £1.30 from about £1.00 compared to a year earlier.1 Across the Channel, a cut of beef rump in France set consumers back an extra 6%.2 Germans paid almost 35% more for milk.3 In Italy, the cost of eating out at a restaurant rose almost 8% year on year.4 On the Iberian Peninsula, Spanish wine cost 9.3% more.5 The price of flowers in the Netherlands went up some 7%6 and, further north, a pastry in Sweden cost 16% more.7

Inflation, as the data above shows, surprised to the upside last year, causing most central banks to abruptly remove the support that had propelled financial markets to elevated levels. Russia’s invasion of Ukraine didn’t help, with commodity prices pushed higher than they would otherwise have been.

Vladimir Putin’s war has also underscored Europe’s reliance on Russian oil and gas. Every European country has had to rethink its energy mix and consider energy security, balancing that against the demands of the energy transition. In many ways, the conflict in Ukraine has proved to be a real-world stress test for environmental, social and governance (ESG) investing.

Last year was a tough year for most assets, including fixed income. In addition to inflation, most asset categories were expensive at the start of 2022 – a result of the extremely accommodative fiscal and monetary policies introduced during the global pandemic.

Now, high inflation and the higher interest rates central banks have responded with are a recipe for economic slowdown, in our opinion. The fact that we anticipate further deceleration in the global economy could suggest that we will remain in a contraction regime over the coming months. In other words, below-trend, falling growth with a risk of recession. Yet there is scope in our view for investors to find returns in fixed income, despite the challenging economic environment.

Fixed income strategies in 2023

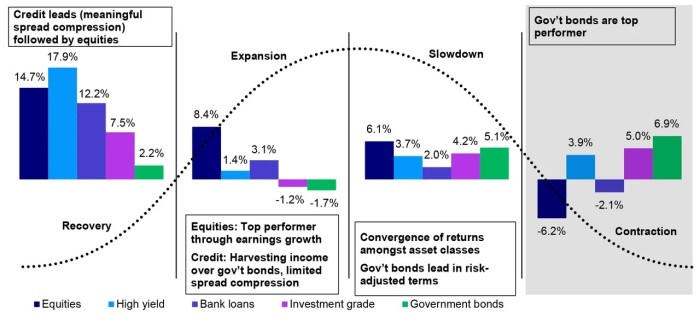

Under normal circumstances, defensive fixed income assets (government bonds and IG credit) are usually among the best performing assets in periods like these (based on historical performance – see Figure 2). However, we note that financial asset performance in 2022 did not fit the usual contraction regime, with fixed income assets performing as badly as stocks, for example.

Recent market performance suggests that financial markets may be transitioning to a recovery regime, with riskier assets (like high yield credit) performing better. Though economic deceleration could bring market volatility and periods of doubt, we suspect that the transition to a recovery regime could be complete by the end of the first quarter of 2023.

We suspect that market participants are looking ahead to the end of Fed’s tightening cycle, anticipating a peak in interest rates in mid-2023. We would agree with this.

Figure 2. Historical excess returns on US assets during the economic cycle

Where is the yield curve heading?

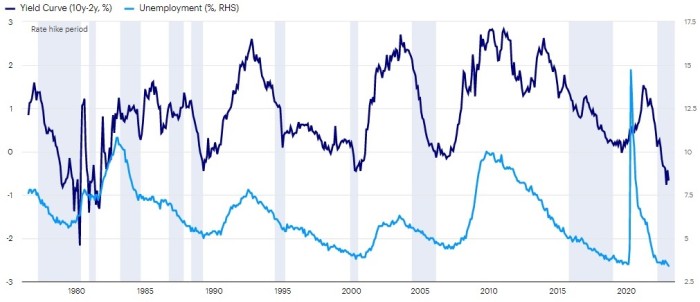

In our Base Case, there is a market expectation that central bank rates will continue climbing, providing successively higher potential returns on cash and possibly leading to further inversion of yield curves. Figure 3 shows that the Fed typically keeps tightening until around the time that unemployment bottoms. However, given that unemployment was already extremely low when the Fed started this tightening cycle (and that inflation is consequently high), the Fed may want to make sure that unemployment is rising before it stops hiking. Normally, the yield curve (10y-2y) continues to invert until unemployment bottoms (see Figure 3). If unemployment is bottoming (as we believe) then we would normally expect the yield curve to steepen from here (except when measured from very short maturities, such as three months). Even if short-term yields fall more than long yields, we believe the effect of duration will favour long bonds and therefore lengthening duration.

Figure 3. US unemployment, the yield curve and Fed tightening cycles

The case for high yield and investment grade credit

In our Base Case we now favour both HY and IG credit versus government debt. In our Alternative Scenario, we see government debt and IG credit as preferred options.

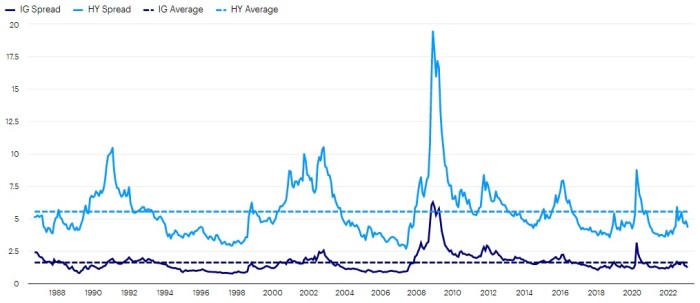

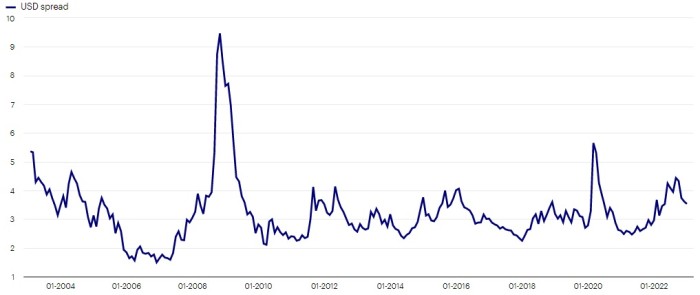

When considering spreads, we note that US credit spreads have widened towards historical norms during 2022 but remain just short of those benchmarks (see Figure 4). We see the potential for credit spreads to widen further as economies weaken, but we note a recent narrowing as markets start to look forward to an end to central bank tightening and eventual economic recovery. Even if we allow for a slight widening of those spreads, our projections suggest that total returns on credit will be higher than those on government debt in 2023.

Figure 4. US credit spreads versus treasury yields (%)

Fixed income in emerging markets

Even better, the spread on emerging market (EM) debt appears more generous than usual. Figure 5 suggests that the spread on US dollar-denominated EM government debt versus that of the US is wider than normal (outside of the extraordinary periods of the global financial crisis and the Covid pandemic recession). The weakening of the US dollar that we expect in 2023 should help EM assets (in our view). We are more optimistic about EM fixed income assets than we are about their developed market (DM) counterparts, based on the assumption of a narrowing of those spreads. Furthermore, with a weakening of the US dollar, we suspect that local currency versions of EM debt will outperform hard currency versions, though with more volatility.

Figure 5. Emerging market USD government bond yield spread versus US (%)

Fixed income and ESG: the opportunities

Russia’s war in Ukraine has had serious consequences for the energy mix of European countries, many of which have been dependent on cheap Russian energy. In response, governments in the European Union and UK have had to, in the short term, shift their focus to energy resilience rather than the energy transition. As a result, oil and gas stocks had a bumper year in 20229.

Broadly speaking, ESG shouldn’t normally be a cyclical phenomenon but its lack of exposure to energy stocks introduces a cyclical element. Part of our Base Case disinflation thesis is that energy prices are falling, with gas most likely to fall during 2023. We think this will weaken energy stocks, which could enable ESG indices to outperform.

Private credit and a diversified portfolio

Private credit is seen as a robust option for a diversified portfolio regardless of the economic environment. When compared to public assets, private markets offer enhanced income due to the exposure to additional credit and liquidity risk. But uncorrelated returns compared to traditional listed equities and bonds often drives strong and differentiated income, while reducing volatility.

There are a number of reasons for this. Senior secured loans, for example, take priority in the capital structure and have proved to be resilient through full economic cycles and interest rate environments. By way of example, senior loans posted positive returns in 28 years out of 31 in the period beginning 1992. Even in recessionary periods, the assets performed well. Data also shows that actual defaults undershot implied defaults throughout the market cycle.

In the distressed debt market, investors can find evergreen opportunity regardless of the credit cycle.

Direct loans to the middle market, meanwhile, offer some of the most attractive yields in performing credit and premiums to liquid debt markets. The middle market is vast, too. In the US alone it comprises more than 200,000 companies and there is significant private equity dry powder available that targets investment in this market.

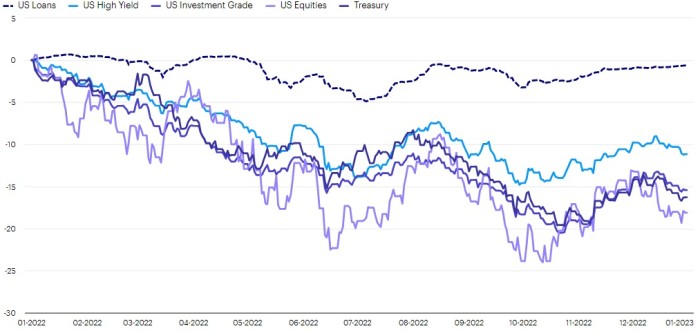

Despite numerous rate increases in 2022, US senior loans performed steadily through the year, and outperformed other risks assets (Figure 6).

Figure 6. Steady loan returns stood in stark contrast to other risk assets in 2022

If you think our Alternative Scenario is more likely to come to bear – i.e., that inflation will prove stubborn with central banks tightening for longer – private credit assets could prove attractive. Many private credit investments have floating rates, meaning that the coupons investors are paid increase as interest rates rise. This can help mitigate inflation and interest rate risk.

If the Fed continues to raise interest rates, investors may start to become concerned about issuers’ ability to service their debt. However, while interest coverage ratios would likely decline in this scenario, the average borrower has entered this cycle in a strong position.

Why we think the base case is one of ‘disinflation’

The outlook for fixed income is inextricably bound up with the outlook for growth versus recession. After a sharp rebound from the deep global recession in 2020, there appears to have been a loss of momentum. It’s not just the manufacturing sector that’s suffering, with housing markets and housebuilding activity also weakening in many countries (the US, for example). To the extent that inflation is squeezing real incomes, Europe is the most likely to suffer recession, in our opinion. This is due to the high natural gas prices in the region – a result of limited supply from Russia (and Europe’s desire to find other energy sources). The negative effect of the trade sanctions imposed upon Russia are also most likely to be felt in Europe. On the other hand, because China has suffered less inflation than many other large economies, with a central bank that has been easing (due to a weak economy), we suspect it can escape the worst of the slowdown in the West.

We think that inflation will fall in most countries during 2023. Firstly, the proximate causes of inflation such as rising commodity prices and supply chain disruptions are now less present. Indeed, commodity prices have been falling over recent months and the and the year-on-year gain has now turned negative. Hence, commodity prices are starting to depress rather than boost inflation. Consequently, we expect headline inflation to fall below core inflation in most countries over the coming months and quarters, which then leaves the question about what will happen to core inflation.

Moving away from the proximate causes of inflation and focusing on the root causes, we suspect the aggressive monetary expansion of recent years was the culprit. Governments had to protect business and household cash flows during the early stages of the pandemic to avoid a deep recession. This required a large rise in government debt, which was facilitated by central banks, especially those that engaged in bond purchases. Figure 7 shows how the acceleration in US money supply growth was followed by an uptick in core inflation. However, money supply growth is now much lower. We believe this opens the possibility of a future decline in core inflation. More concretely, we believe that wage growth is a cyclical phenomenon that will be tempered by higher unemployment. Also, the rise in housing cost inflation (rental costs etc.) is likely to subside as house prices come down, in our opinion.

Figure 7. US money supply and core inflation (% yoy)

We presume that central banks will not wait until inflation falls to their target levels before calling an end to rate hikes. We suspect they will simply need proof that inflation is heading in the right direction. Financial markets would seem to agree, with market implied rates suggesting an expectation that major central bank rates will peak in the middle of 2023, with the possibility of rate cuts by the end of 2023. The supposition is that the Fed and the BOE are closer to the end of their rate hiking cycles than the ECB. We presume this will continue to weaken the US dollar during 2023 (a currency that we believe is expensive and has now peaked).

Last year turned out be more eventful than anticipated from a political perspective. The results of Australian, Brazilian and French elections were as expected, but US mid-term elections were not. UK politics also shook global markets in September. However, the biggest geopolitical move this year (Russia’s invasion of Ukraine) was largely unexpected and may have contributed to a widening of risk premia across financial assets.

Looking ahead, stalemates between Democrats and Republicans in Washington and between Russia and Ukraine may be the dominant themes of 2023, with Sino-US tensions never far away. Now that the US House of Representatives is under Republican control, it is likely that debt ceiling stand-offs will again become a regular feature of the legislative process, which could unsettle markets from time to time.

Though scheduled 2023 elections are unlikely to be of consequence for global markets, in our opinion, a number could be interesting. UK local elections could show whether Rishi Sunak has repaired the damage done to the Conservative Party’s standing over recent years. Spain’s elections appear likely to provide a swing from left to centre-right (based on opinion polls), though forming a government could again be difficult. Finally, opinion polls suggest that Turkey’s presidential election could see defeat for President Erdogan, no matter who stands for the Republican People’s Party (if it is a free and fair election).