Morningstar: Global sustainable funds collect $ 22.5 billion in Q3 2022

Morningstar: Global sustainable funds collect $ 22.5 billion in Q3 2022

Morningstar today published the quarterly Global Sustainable Fund Flows Report, which examines recent activity in the global sustainable fund universe and details regional flows, assets and launches for Q3 2022.

Global sustainable funds attracted $ 22.5 billion of net new money in the third quarter of 2022, amid investor concerns over a global recession, inflationary pressures, rising interest rates, and the conflict in Ukraine. Sustainable funds continued to hold up better than the broader market, which experienced $ 198 billion of net outflows over the period.

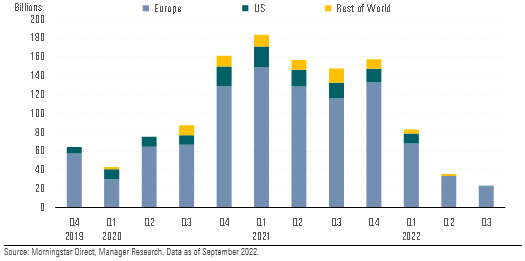

The graph below shows quarterly global sustainable fund flows for Europe, the United States, and the rest of the world, since Q4 2019.

|

|

:

- In Europe, the quasi-totality (96%) of the net new money ($ 22.6 billion) poured into passive funds, while active sustainable products registered the worst quarter in at least five years.

- Global sustainable funds attracted $ 22.5 billion of net new money in the third quarter of 2022, less than the revised $ 33.9 billion of inflows in the second quarter.

- Amid investor concerns over a global recession, inflationary pressures, rising interest rates, and the conflict in Ukraine, sustainable funds still held up better than the broader market, which experienced $ 198 billion of net outflows over the period.

- Assets in global sustainable funds slipped to $ 2.24 trillion at the end of September, from the restated $ 2.28 trillion in June. The 1.6% drop was less pronounced than the 7.5% decline for the broader market.

- Product development slowed down in the third quarter after stabilizing in the first half of 2022. An estimated 148 new sustainable funds hit the shelves globally.

Hortense Bioy, Global Director of Sustainability Research at Morningstar, commented: 'Sustainable funds are not immune to the global macro environment. Not only has it been a turbulent year for all investors, but a trying one also for sustainability-focused investors who’ve had to deal with being underweight in fossil fuel companies, greenwashing concerns, and growing politization of ESG in the US. So far this year, flows into sustainable funds have proven more resilient than those into traditional funds. Investors in sustainable strategies tend to focus on the long-term and are less inclined to pull their money out in jittery markets.'