ACTIAM: Energy transition - the future is now

By Sebastiaan Masselink, Senior Impact Investment Manager Energy Transition, ACTIAM

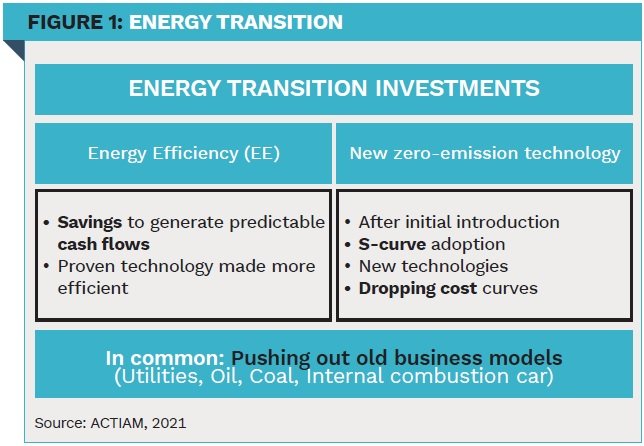

The acceleration in the adoption of both energy-efficiency measures and zero-emission technologies will continue to be disruptive to the energy sector and hence to investors.

The planet and hence humanity are under threat from severe climate change due to rapidly growing concentrations of greenhouse gasses (GHGs). The threshold of the atmosphere is 450 ppm, beyond which Greenland’s and Antarctic ice will melt, changing sea-level and weather patterns in giant proportions, with devastating economic and social consequences.

At the same time, due to global population growth from 3.7 billion in 1970 to 10 billion by 2050 (according to an estimate of the United Nations), and the world’s real income increasing over 100% (2011-2050), global energy-consumption will rise 50% from 2014 to 2040 and demand for electricity will almost double between 2010-2050.

Disruption and energy efficiency

Consumers and shareholders increasingly demand more sustainable efforts from the companies and new business models in energy-efficiency as well as new technologies are developing and entering the market at a high pace. When both effects will continue to converge, old business models will inevitably be pushed out.

Investing in energy efficiency generally leads to savings, which are directly margin-enhancing for a company, creating extra free cash-flows. At the same time, risks are limited as energy savings can be realized using proven technologies, while the CO2 reduction effects are the same or better than for example renewable energy. Opportunities in efficiency can be sought mostly in the industry, in real estate or in recycling. Often, measures come in packages and may include insulation, LEDlighting, heat-pumps, sensor systems, battery storage, biomass, et cetera. Initiatives towards accelerating energy-efficiency have had a steep growth path since 2009 that will continue in the next decades, not in the least because of the savings leading to an attractive return on investment.

|

EXAMPLE: SOLAR PV The costs of solar energy drop 22% every time the installed base doubles. In 2020, Solar PV share of electricity generation has increased 2,8%1. The cost price of solar electricity, depending on the geography, has reached € 0.03 - € 0.052. In the sunniest places, the latest solar PV power purchase agreements (PPA) have been struck at € 0,04/kWh. That’s a level competitive with a barrel of oil at $ 9 or $ 10. Now that solar electricity has become among the lowest cost sources, its application and use are expected to accelerate.

|

Zero-emission technologies’ growth Zero-emission technologies start to see an acceleration, due to rapidly falling cost curves and equally fast improving technological achievements. The combination leads to a typical S-curve growth: for years the market share remains at (early adopter) low single digit percentages, and suddenly it reaches a 85%-95% share within a few years. The effects are likely to be most imminent in energy generation, in energystorage and in transportation.

Currently, up to 115 mega battery factories are being built, which will drive down battery prices and with that the average price of EVs well below ICE cars. As a result, the market for new and second-hand ICE cars will disappear, especially because EV’s operational costs are only a fraction of ICEs. Annual charging costs amount to just 6% of fuelling costs, while maintenance costs are 65% lower as EVs have 95% fewer moving-parts, which also leads to a much longer technical lifetime (>800.000 km) and hence lower depreciation. The consequences for automotive companies will be severe. The challenges to the oil industry have started to be priced in equity valuations with oil majors loosing around 50% of their market value during 2020.

|

EXAMPLE: THE HOLY GRAIL: HYDROGEN When burning hydrogen as a fuel for engines, only clean water comes out as waste material. In turn, hydrogen can be produced by so-called ‘electrolysers’, the hardware that facilitates the process called ‘electrolysis’. For electrolysis, all we need is water, an electrolyser and a source of electricity. The production price of hydrogen is driven by the electricity price, the cost and the efficiency of the electrolyser. A combination of cost reductions in electricity and electrolysers, combined with increased efficiency and operating lifetime, can deliver 80% reduction in hydrogen cost3. When this electricity comes from (excess) renewable sources such as wind or solar, hydrogen then is a highly sustainable super fuel. Now increasingly large amounts of hydrogen are being produced in Germany and Canada, from peak-production of wind- and solar energy, i.e. a means to store power. Recently in the UK, hydrogen was produced from electrolysis at € 0,06/kWh, a level competitive with all other energy sources. S-curve type of adoption for hydrogen should be expected as of 2023 in applications such as energy storage, generators, lifts, drills, tractors, trucks and ships.

|

Investment positioning

Since the field of energy-efficiency and energy-savings is quite fragmented, private debt investment funds aggregating those type of projects seem attractive for asset owners. Such funds are likely to provide both better CO2 reduction and better returns than renewable energy, derived from steady cashflows from savings based on proven technologies. For the energy transition, attractive returns can be made in private markets, conditional upon careful company selection, transaction structuring and effective transaction documentation. Alternatively, asset owners may consider investing directly in the corporate bonds and equities of companies active in energy efficiency, such as in insulation, LED, heat-pumps, energy services and monitoring-sensors.

To get exposure to new technology like generation (solar, wind and tidal), there are good investment opportunities in high-tech upstream, for example more efficient solar cells, wind turbines and tidal turbines, via selected listed equities, private equity funds, and to a lesser extent (private) debt. In steadier cashflow downstream, one might think about park developments, via both debt and equity markets (liquid and private). That said, the downstream market for wind and solar is becoming a market for strategic investors like oil companies and utilities and hence may not provide the best returns to investors.

Investment opportunities in storage and transportation are increasingly abundant too. Large amounts of debt and equity will be needed to finance energy storage through both batteries and hydrogen. Exposure can be obtained via both project-financing of storage-facilities (direct debt or via a fund) and through investing in corporate bonds and equities of leading companies (makers of anodes/cathodes, battery materials, hydrogen engines and applications, megafactories). In transportation, automakers launching successful EVs need to be watched, while also charging-infrastructure poses an investment opportunity in both debt and equity.

|

SUMMARY

The effects of energy efficiency measures and the rapid growth of zero emissions technology adoption could lead to 10% to 50% revenue drops for some utilities between now and 2025. Share-prices of utilities are underperforming since many years. Stock prices of regular utilities and coal companies have been underperforming indices for years and worse performances are expected. Similarly, traditional oil, gas, coal and automotive companies will come under further pressure should they not adapt rapidly.

|