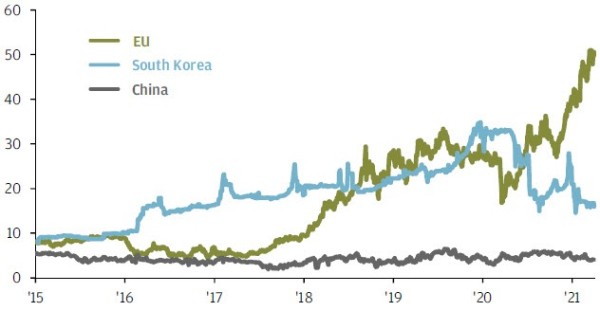

J.P. Morgan: Prices on the EU’s Emission Trading Scheme have hit record levels

J.P. Morgan: Prices on the EU’s Emission Trading Scheme have hit record levels

Prices for CO2 emissions allowances in the European Union’s Emission Trading Scheme (EU ETS) have surged to record levels. While some of the recent uptick likely reflects strong demand for emissions allowances as firms meet rising demand, regulatory interventions are also playing a role.

As we discuss in our recent On the Minds of Investors article – The implications of carbon pricing initiatives for investors – regulators face a delicate balancing act. Higher carbon prices in Europe can support domestic climate ambitions, but risk damaging the competitiveness of European corporates versus international peers absent a global approach to carbon pricing. We expect this to be a key discussion point when global leaders convene at November’s COP26 summit. Ultimately, we expect regulation to underpin higher carbon prices not only in Europe, but around the world.

ETS prices, USD per tonnes of CO2 equivalent

Source: International Carbon Action Partnership, J.P. Morgan Asset Management. China ETS price is based on the average of seven regional ETS prices. Data as of 31 March 2021.