LeaderXXchange: Diversity amplifies climate integration

By Nina Hodzic Advisory Board Member, LeaderXXchange and Director ESG Integration and Solutions, Allianz Global Investors, and Sophie L’Hélias, Founder and President, LeaderXXchange

Bringing together diverse perspectives from companies, investors, regulators and other stakeholders is critical when seeking to incorporate climate risks into business strategy and to accelerate climate integration and transition.

|

SUMMARY

|

Changes in the global climate are having profound impacts. Boards of directors are searching for ways to account for these changes as they help guide their organizations and investors are increasingly concerned about how these changes might impact their portfolios. Climate change remains on top of investors’ sustainability agendas when engaging with boards of the companies they invest in.1 A key component of this competency, which is likely to be a significant question of corporate governance in the coming years, is climate risk management.

A global survey, conducted by a team of researchers at the Ira M. Millstein Center for Global Markets and Corporate Ownership at Columbia Law School and experts at LeaderXXchange, seeks to understand how — if at all — institutional investors and board directors incorporate climate-related issues into their investment decisionmaking process and their oversight responsibilities respectively.2 It is the first global survey of its kind targeting both investors and directors to probe their responses on climate risk management, using two tracks aggregated in a single survey. There were more than 130 respondents: consisting of approximately 40% directors and 60% investors from Europe (including the United Kingdom) and North America.

MATERIALITY, TRAINING AND CLIMATE CHANGE DISCLOSURE

Responses suggest that both investors and directors believe climate change issues are material, with more than 60% of directors and 70% of investors indicating that climate risk is already impacting their business today. The main reasons for incorporating climate risks into strategy and investment decision making are that doing so: (i) helps identify business and investment opportunities, (ii) helps manage risk, and (iii) is the right thing to do.

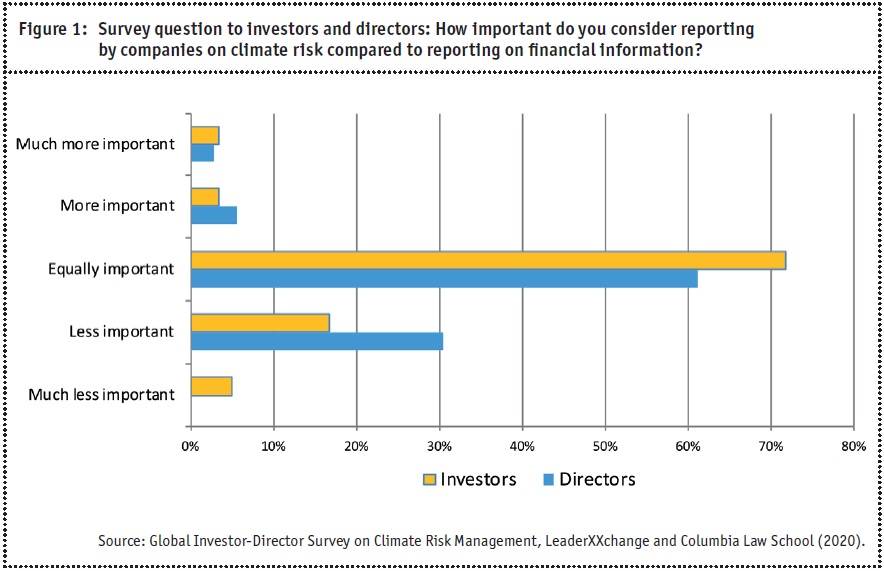

A majority of both investors and directors developed expertise on climate change by following current events and news reports in the media, reviewing publications by scientists and think tanks, and reading company CSR or annual reports. However, investors, more so than directors, also turned to sell-side reports and reports from ESG rating agencies as their preferred source of information. A large majority of respondents found reporting on climate to be equally important as reporting on financial information (see Figure 1).

The recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) are gaining traction among investors: more than 50% of investor respondents in both North America and Europe are already asking companies to follow them.

CLIMATE RISK MANAGEMENT, BOARD OVERSIGHT AND STEWARDSHIP

Climate appears to be an important topic for boards as well, with more than 40% of director respondents indicating climate-related topics are discussed annually by the Board, while 30% of directors indicated they are discussed quarterly. Our survey results support prior research findings that the board receives climate-related information primarily from the head of CSR/ Sustainability, to a lesser extent from the General Counsel/Corporate Secretary, and more rarely from Investor Relations. Approximately a quarter of directors indicated that no one reports to the board on climate-related topics.

According to director respondents, investor engagement on climate-related issues takes place primarily at the CEO level and the Investor Relations level. This finding is also in line with prior findings showing that engagement does not take place on the CFO level. Investor respondents said that engagement with companies on climate topics is increasingly done not only by ESG or investor engagement specialists, but also by mainstream portfolio managers and analysts. Almost 65% of investor respondents indicated they engage directly with board directors.

VARIATION BY AGE, GENDER AND REGION

Our survey results suggest that interest in climate-related issues is tied to age: the younger the respondent, the greater the interest in climate-related issues.3 The results also support findings of other academic research studies that suggest that women are more engaged on climate-related issues than men.4 However, the gender gap narrows as respondents get younger, particularly under the age of 35.

The findings also suggest the interest in climate-related issues is dependent on region. Investors in Europe seem to have a higher interest in climate-related issues and higher expectations in terms of disclosure in this area.

CONCLUSION

This global survey of directors and investors supports prior research findings that there are several demographic and regional differences in directors’ and investors’ expectations around climate-related issues and disclosure. We believe that these findings deepen our understanding of how directors and investors take climate-related issues into account in their boardroom and investment decision making, respectively, and how their views may differ across demographic and regional groups. We hope to be able to augment this survey in the months and years ahead, to consider how investor and director views are evolving, particularly with the onset of the worldwide COVID-19 pandemic, which has spawned a lively debate about whether to accelerate or rein in the reconsideration of stakeholder governance. «

1) Paulina Pielichata, Climate Change, Human Capital Top Investors’ Agendas, Pensions & Investments (2020). https://www.pionline.com/esg/climate-changehuman- capital-top-investors-agendas.

2) Global Investor-Director Survey on Climate Risk Management, LeaderXXchange and Columbia Law School (2020). https://papers.ssrn.com/sol3/papers.cfm?abstract_ id=3722958

3) These findings are consistent with previous findings of the CFA Institute, https://www.cfainstitute.org/-/ media/documents/survey/esg-survey-report-2017. ashx. The same study also found that male investors are more likely than female investors to think that ESG issues are not material.

4) Gender Differences in Public Understanding of Climate Change. Yale Program on Climate Change Communication (2018).

5) The article is adapted from a previous publication co-authored with Columbia Law School. The views expressed in this paper are those of the authors and do not necessarily reflect the views of Allianz Global Investors.