Fidelity: The race is on for companies to achieve net zero

- According to Fidelity International (Fidelity) analysts, almost a quarter of all companies will be carbon neutral by 2030

- European companies are leading the pack, but other regions are closing in

- 25 per cent of analysts covering China report a growing emphasis on ESG at most of their companies, up from around 15 per cent in the previous 3 years

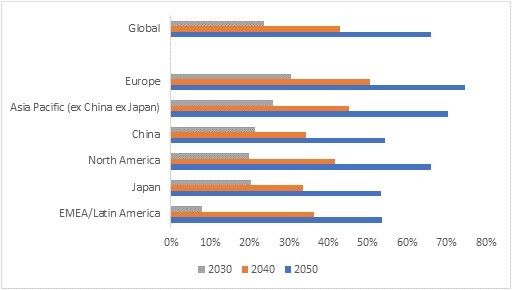

Almost a quarter (24 per cent) of all companies will be carbon neutral by the end of this decade, according to Fidelity International’s annual Analyst Survey, spotlighting the ongoing emphasis on environmental, social and governance (ESG) across a wide spectrum of industries and regions. European companies are further along in this journey, with analysts estimating that 30 per cent will be carbon neutral by 2030, but Asian firms are catching up, with at least one out of five firms (23 per cent) across Asia Pacific expected to reach the same milestone in this timeframe.

Fidelity International’s annual Analyst Survey studies the views of its in-house analysts across the world, aggregating bottom-up information from around 15,000 individual company interactions to find key trends in the corporate landscape*.

Chart 1: Almost a quarter of all companies will be carbon neutral by the end of this decade

“What percentage of your companies do you estimate will be carbon neutral (scope 1, 2 and 3) by: 2030, 2040 and 2050?” Source: Fidelity Analyst Survey 2021

Jenn-Hui Tan, Global Head of Stewardship and Sustainable Investing, Fidelity International comments: “We believe that climate change is one of the greatest threats to society, business and the long-term profitability of companies and markets. That’s why we expect the companies we invest in to be directionally aspirational in their efforts to address the potential impact of climate change on their business.

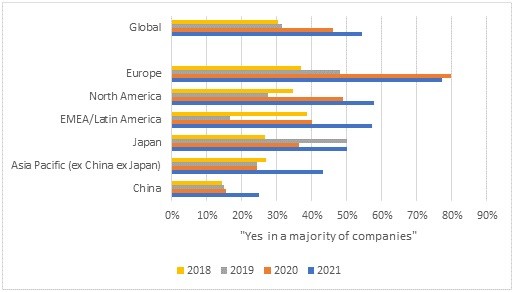

“We are encouraged to see that sustainability issues are climbing the agenda every year across industries and across geographies - a mind shift that has been accelerated by the pandemic. This year for the first time more than half (54 per cent) of Fidelity analysts report that the majority of their companies now regularly discuss sustainability issues. This compares with 46 per cent in 2020 and just 13 per cent as recently as 2017.

“Our net zero forecasts are based on companies’ current plans, so we expect them to be revised higher in the coming years, as regulations tighten and robust environmental, social and governance (ESG) practices become a baseline for attracting investor capital.”

China’s 2060 net zero goal is a high bar, but possible

Of Fidelity analysts covering China, 25 per cent report a growing emphasis on ESG at the majority of their companies, up from around 15 per cent in the previous three years. This may be an early reflection of China’s 2060 net zero target.

Chart 2: Focus on ESG continues to rise everywhere

“Have you seen a growing emphasis among your companies to implement and communicate ESG policies in the last year?” Source: Fidelity Analyst Survey 2021

Flora Wang, Director, Sustainable Investing and Assistant Portfolio Manager at Fidelity International comments: “China’s carbon emissions are expected to peak around 2030, which means the country has less than 30 years to cut emissions from their peak to achieve its 2060 target. By comparison, carbon emissions in Europe peaked in the early 90s and at a much lower intensity level.

“Though this is an ambitious target, based on the conversations we are having with companies on the ground, I am confident that corporates will be able to rise to the challenge - indeed, our recent China Stewardship Report reflects steady progress across the board when it comes to investment stewardship in China. China has a lot to lose if climate change is not kept in check.”

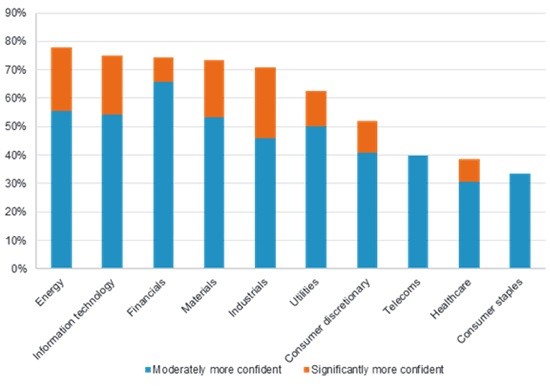

Confidence for 2021 is high

Despite many countries still facing restrictions due to the pandemic, Fidelity’s Analyst Survey found that managers across the board are upbeat on the prospects for their companies in 2021 thanks to low interest rates, negative real yields and supportive fiscal policy - signaling a favourable environment for a rebound in global growth in 2021 and beyond.

Chart 3: Confidence for 2021 is high

“How would you describe the confidence level of your companies' management teams to invest in their businesses over the next 12 months compared to the last 12 months?” Source: Fidelity Analyst Survey 2021.

Terry Raven, Director, European Equities at Fidelity International comments: “The pace of recovery will differ across countries and industries, depending on vaccine rollouts and the potential impact of new Covid variants. China’s ‘first in, first out’ advantage in 2020 should carry through into 2021. Europe and the US will gradually recover as vaccines are rolled out and economies reopen, with the potential for a big upswing in the second half. Some of those sectors that suffered most through the pandemic we expect to bounce back very strongly, albeit the picture will be far from uniform.”

*The Fidelity Pulse Survey was conducted between 1 - 10 December and 6-13 January and featured 177 responses from 144 analysts around the globe (analysts who cover more than one sector or region take the survey more than once).