La Française: European CoCos, a safe haven?

La Française: European CoCos, a safe haven?

- Yields on global subordinated debt, and especially CoCos, are very attractive in absolute and relative terms;

- Banks worldwide benefit from unprecedented regulatory and liquidity support;

- Risks on European CoCos have never been so low.

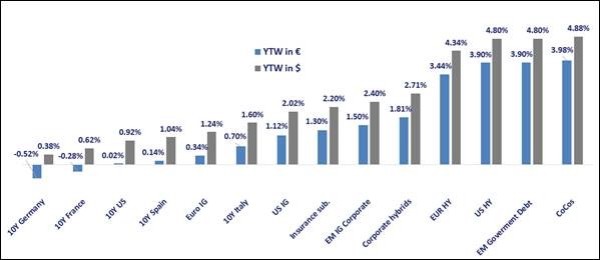

The impact of Covid-19 is unprecedented in terms of speed and significance. “We have never seen such a sharp shock especially on subordinated debt indices benchmarked in Euro”, says Jérémie Boudinet, Credit Fund Manager, La Française AM. But despite the sharp market correction in March, subordinated debt indices, especially CoCos, have recovered quickly compared to other asset classes and offer very attractive yields. The YTW is 3.98% for EUR-denominated CoCos and 4.88% for USD-denominated CoCos (figure 1). Boudinet expects the rally to continue even in case of worsening macroeconomic conditions.

Figure 1: Market yields of different types of fixed income instruments

Sources: Bloomberg, Bank of America. Data as of November 12, 2020. Past returns are not a reliable indication of future results. Indices: 10Y Germany = GTDEM10Y ; 10Y France = GTFRF10YR ; 10Y Spain = GSPG10YR ; 10Y Italy = GBTPGR10 ; Insurance Sub =EB1N ; Corporate hybrids = ENSU ; EUR HY = HE00 ; US HY = H0A0; COCOs = CCEUTOYC. EM IG Corporate = EMHG. EM Government Debt = JPM EMBIGD

“Central banks and regulators will stay accommodative which benefits European CoCos. In fact, we are back to pre-2008 regulatory thinking: banks must not die and should be too big to fail”, summarises Boudinet. Furthermore, the investment expert expects further easing. “There could be more lenient rules for coupon distribution if capital ratios fall below required levels. Regulators in the UK and in the US have already relaxed rules about CoCo coupon payments – so called MDA limits. We expect the ECB to follow through”, says Boudinet. In this environment Boudinet favours EUR-denominated European CoCos because they are the cheapest on average and profit from the stability within the Eurozone.

Performance of CoCos versus high yield bonds

Although we have seen significant volatility during the last few month, liquidity was much better than during former crises. “Even this past March, we were able to sell or buy bonds. In fact, it was more difficult to trade high yield bonds than to trade CoCos”, explains Boudinet. “However, investors should keep in mind that liquidity has been different for CoCos depending on the currency in which they were traded. The performance of USD-denominated bonds has recovered more quickly than EUR-denominated bonds”, states Boudinet. There are three reasons for this development: The broader investment space for EUR-denominated CoCos, an overweight of peripheral European banks (Italian, Spanish, Irish and Portuguese) in EUR-denominated indices and the lower cost of hedging USD bonds. Though the investment expert observes a similar path of recovery for EUR and USD high yield markets, he sees a clear trend towards CoCos. “On CoCos, the last nominal LTM default rate was zero for quite some time while on the high yield side the US high yield issuer-weighted LTM default rate was close to 7% and in EUR it was close to 2%. Liquidity is also different as it is much easier to trade a single CoCo than to trade a single high yield bond as Cocos have higher outstanding amounts.”

Hunt for yield continues

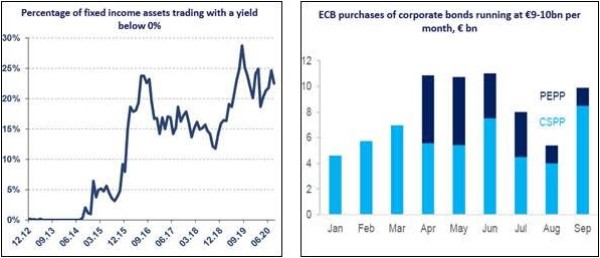

EUR- and USD-denominated AT1-CoCos have outperformed the high yield market while USD-denominated AT1-CoCos recovered faster. Regarding EUR-denominated investment grade bonds the trends are quite similar though. “EUR-denominated AT1-CoCos trade quite wide versus investment grade bonds on a historical basis. We view investment grade bonds as an anchor for the spread.” The hunt for yield will continue because central banks need to stay accommodative. “We have never seen such a high amount of fixed income assets trading with a yield below zero percent”, says Boudinet. Yields are still very low, especially in the Eurozone, while at the same time the ECB is buying investment grade bonds to impact the outlook for yield (figure 2). “In terms of returns, CoCos, and subordinated debt as a whole have impressive results. Because of the accommodative stance, we are sticking with European CoCos, as the macroeconomic impact of Covid-19 remains, and central banks will still limit fixed income market yields.”

Figure 2: The hunt for yield is set to continue

Source: La Française, Bloomberg, Citi Research (October 2020). Data as of end-August, 2020, for the graph on the left. Past returns are not a reliable indication of future results.

What about the risks when investing in CoCos?

When investing in CoCos there are three main risks: Loss absorption risk (“Bail-in”), coupon non-payment risk and extension risk. However, the regulatory decisions of governments and central banks to avoid a systemic financial crisis have reduced these risks tremendously. Bail-in and capital rules have been temporarily removed to enable banks to continue to lend money to the economy. The same is true for the coupon non-payment risk. “Usually when a bank is not able to respect the solvency ratios, it isn’t allowed to pay out coupons on AT1-CoCos. The dividend payments especially in Europe have been suspended but there was no ban on CoCos as a regulatory ban would have been counterproductive. New regulations made sure that coupons will be paid”, analyses Boudinet. The economic impact of Covid-19 will be felt for quite some time. As a consequence, banks' balance sheets are expected to deteriorate somewhat in 2021/2022. However, due to new regulations, banks will have more room for provisions than in 2015. “We have never before seen banks so solid. They have more than sufficient means to keep comfortable solvency ratios while increasing credit risk provisions”, says Boudinet. The extension risk is negligible as well because not calling an AT1-CoCo is no longer a taboo as the markets are already pricing it in. “For example, in 2019 Santander was the first bank not to call its Coco bond. But it had no impact on the markets at all because it was a case-by-case scenario”, states Boudinet.