ASI: Invest today. Change tomorrow. Emerging market sovereign bonds – an ESG perspective

ASI: Invest today. Change tomorrow. Emerging market sovereign bonds – an ESG perspective

By: VIKTOR SZABÓ, INVESTMENT DIRECTOR FIXED INCOME EMERGING MARKETS, ASI

Traditionally, emerging market (EM) credit analysis has focused mainly on economic and financial variables. These included public debt, inflation, fiscal deficits and current account balances. Additionally, it is widely understood that political risk is a key factor that can influence EM sovereign creditworthiness. Meanwhile, many professional investors have long recognised the importance of ESG (environmental, social and governance) factors. However, owing to conceptual and practical issues such as defining and measuring material ESG factors and limited data availability, few have attempted integration in a systematic way.

Despite the challenges, we think there is a strong and growing case for systematic integration of ESG metrics into EM sovereign research.

Empirically well-grounded

Empirical evidence supports the notion that ESG factors can help give a more complete picture of material EM sovereign credit risks over the long term. There is a wealth of research showing that ESG factors are correlated with EM sovereign credit risk.1 More specifically, higher composite ESG scores (irrespective of differences in scoring approaches) are associated with lower EM sovereign credit spreads and reduced borrowing costs.

While ESG factors can be correlated with EM sovereign credit risk, some components are more ‘material’ than others.

Governance: a number of academic studies and our own research show that by some margin the most important ‘material’ variable for EM sovereign credit risk is governance. This is consistent with numerous historical instances where there is a clear link between EM defaults and economic and budgetary mismanagement.

Social: although less important than governance, social factors are also material to EM sovereign credit risk. In essence, this is due to the importance of human capital for long-term economic growth. Measures such as demographics, education standards, poverty levels, income inequality and health quality, all tend to influence countries’ competitiveness. All else being equal, improvements in these factors should boost long-term growth, supporting increased tax generating capacity and improved ability to service debts.

Environmental: traditionally, many have considered environmental considerations to be the least material factors for EM sovereign risk. However, climatic vulnerabilities have always been an important risk factor in some cases. For example, countries that are more exposed to natural disasters (such as seasonal flooding, earthquakes and droughts) have greater budgetary risk.

ESGP framework – our systematic approach to integrating ESG factors

At ASI, we have long included ESG factors in our EM sovereign credit research. However, over the last few years, we have moved towards a more structured and systematic approach to ESG integration. To this end, we have developed an ESGP (environmental, social, governance and political) scoring framework. We apply this to all our universe of 91 EM sovereign debt issuers.

In our proprietary ESGP framework, although closely related, we choose to make a distinction between the governance and political factors. This results in four assessment categories, detailed below.

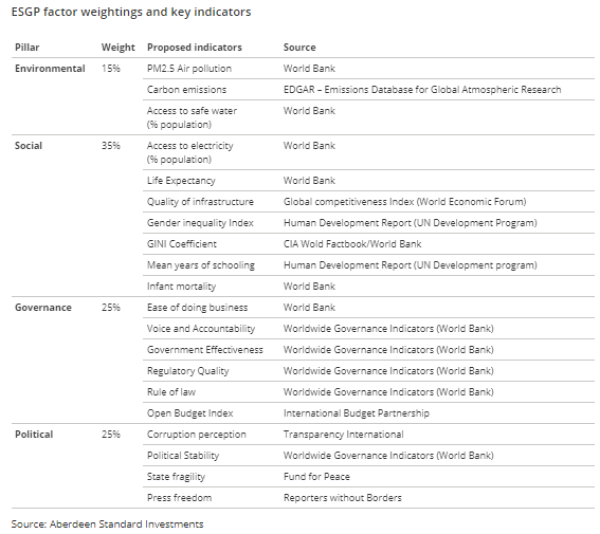

ESGP factor weightings and key indicators

For each indicator, we calculate Z-scores, which signal where each country lies relative to the average on that particular indicator. We then average the Z-scores for each of the four factors, resulting in a score for each. To get an overall ESGP score, the four factors are weighted as follows: environmental 15%, social 35%, governance 25% and political 25%. The scores are then normalised on a scale from 0 to 100. The worst-performing country receives a score of 0 and the best-performing country scores 100. Of note, the combined political and governance factors account for 50% of the overall ESGP score. This emphasises their high importance for EM sovereign debt risk.

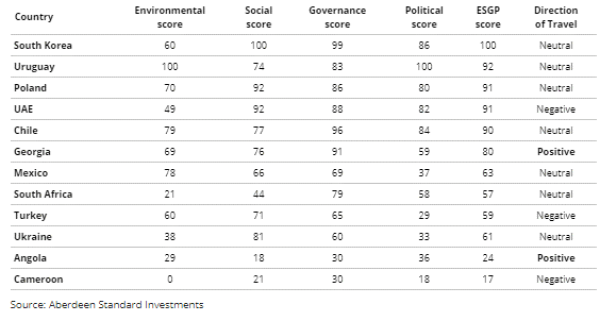

ESGP final output example extract

The key objective of the ESGP framework is to invest in sovereign bonds with attractive credit fundamentals, good growth prospects and, crucially, attractive pricing relative to the risks. The primary benefit of this ESG approach is its potential to give a more complete and refined picture of the risk side.

As active investors, our aim is to find instances where credit fundamentals and risks may be mispriced. In this respect, as shown in the example extract above, we place great emphasis on the ‘direction of travel’ of ESG factors and scores. This is because such dynamics are more likely to be mispriced by the market.

We place great emphasis on the ‘direction of travel’ of ESG factors and scores. This is because such dynamics are more likely to be mispriced by the market.

Another key advantage of a forward-looking emphasis is the reduced risk of excessively penalising (and therefore under-allocating) to less developed countries whose static (backward-looking) ESG scores might be low but where the direction of travel may be clearly positive. Conversely, the reverse risk of over-allocation to developed countries with high scores but unfavourable dynamics might also be lessened.

Final thoughts…

We believe an ESG approach is well suited to EM sovereign debt investing. As we have shown, our in-house proprietary ESGP framework helps us integrate our ESG factors into our research process in a systematic manner. By doing so, we believe we complement our existing research, gaining a more complete picture of EM credit risk – potentially promoting better investment outcomes.

1 ‘Measuring the effect of government ESG performance on sovereign borrowing cost’ by Crifo, Diaye and Oueghlissi (CIRANO Scientific Series, July 2014).