ASI: Emerging markets: investing in financial inclusion

ASI: Emerging markets: investing in financial inclusion

Nearly a third (31%) of the world’s population still had no access to a bank account in 2017. That’s according to the World Bank’s data on financial inclusion. And it’s no secret that the problem affects some areas disproportionately. The same study showed that 58% of the people in developing nations are ‘unbanked.

Over the past ten years, however, the financial inclusion rate has been improving. This coincides with a similar increase in electronic transactions made by individuals. The matching patterns tell us something important about what drives financial inclusion. Where mainstream banks don’t meet the needs of a large part of the population, innovation and technology are stepping in to fill the gap.

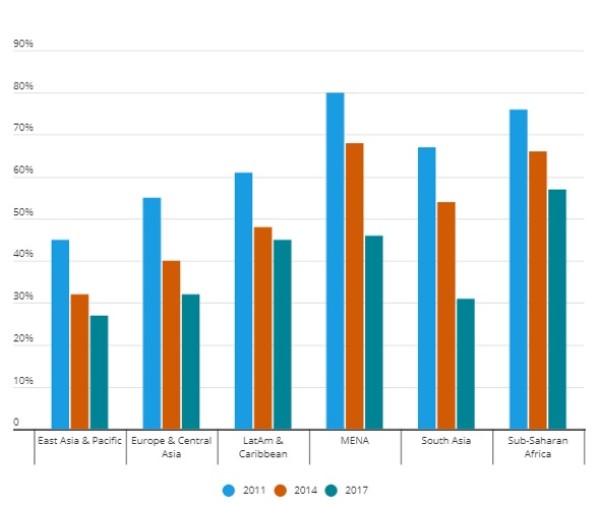

Chart 1: Unbanked adults by region

Source: World Bank, Aberdeen Standard Investments (as at June 2020)

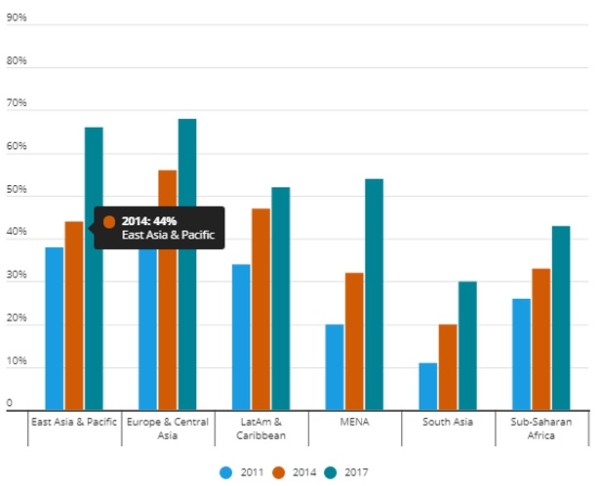

Chart 2: Adults transacting electronically by region

Source: World Bank, Aberdeen Standard Investments (as at June 2020)

The traditional model

The traditional model of micro-lending supports the working capital needs of community groups with small cash loans. It started in Bangladesh back in the 1970s. Since then, the system has expanded and evolved. Today’s micro-lenders operate in markets from Indonesia to Mexico to sub-Saharan Africa. They offer a range of loans, savings and entry-level insurance products. The group-lending model is a tried-and-tested way to make use of development capital and public markets to make a positive impact.

It may also be an attractive source of returns for investors. Several micro-lenders have performed very well over past decades, aside from during market shocks such as the global financial crisis and the current pandemic.

We cannot yet know the full effects of Covid-19 on the global economy. Still, it is likely that this type of traditional lending model will be important in the coming months and years. That’s because micro-lenders can offer a re-entry point to the formal market. As such, they could provide valuable support for the recovery process.

More opportunities

Over the last ten years, technology has allowed for more access to finance. For example, the expansion of mobile phone infrastructure has been key to developing new business models that support micro-enterprises and individuals. In 2007, Vodafone, in partnership with its subsidiary Safaricom in Kenya, seized a commercial opportunity to drive mobile transactional banking through its M-Pesa platform.

Product advances mean that, as with the traditional group-lending model, a range of insurance and banking products are available. These are in addition to peer-to-peer and individual-to-business transactions.

The technological shift is continuing still. In many markets across Latin America and Asia, mobile money and e-wallets are leap-frogging traditional banking. The process is creating a wide range of investment opportunities.

In turn, this has forced banks to invest in digital innovation more quickly than they might have done otherwise. They have also had to create new product offerings for retail clients, and small and medium-sized enterprises (SMEs). The pandemic has further accelerated this process. Many banks in emerging markets have reported that mobile services are becoming more popular. In Mexico, for example, clients used to have to present their documents in a branch to open an account. But local bank Banorte has now rolled out a fully digital process.

The way forward – finance for SMEs

The United Nations (UN) has identified the greatest challenges and opportunities facing the world today in its 17 Sustainable Development Goals (UNSDGs). The organisation believes that SMEs are critical to making progress towards the goals.

Together, the International Council for Small Businesses and the UN have identified that micro-enterprises and SMEs “make up 90% of all businesses globally and account on average for 60-70% of total employment and 50% of GDP.”[1] Helping SMEs to be profitable could work towards SDG 8 – ‘Decent Work and Economic Growth’, and SDG 9 – ‘Industry, Innovation and Infrastructure’.

It’s clear, however, that the availability of SME financing is still poor. In Mexico, SME lending accounted for only 20% of business loans in 2016[2]. This is behind regional peer Brazil and many OECD countries. The gap in financing represents an opportunity for all investors, not only those who are looking to allocate capital in alignment with the UNSDGs.

Building on the success of mobile money for individuals, mobile operators and fintech businesses are also turning their attentions to SMEs. The pool of opportunities is exciting and continues to develop, from e-wallet providers to digital point-of-sale devices offering working capital lending. World Bank data[3] showed that small businesses in OECD countries transacted electronically 71% of the time. By contrast, the global figure is only 44%, illustrating the significant possibilities for growth in emerging economies.

Before Covid-19 emerged, the World Bank estimated that the global unbanked population would fall to 10%i by 2022. There is also a clear opportunity to increase financial inclusion for SMEs. The economic set-back will likely delay this process, but the opportunity for growth and development of innovative business models remains compelling. Investors who correctly identify these businesses could both benefit from attractive relative returns and align themselves to the UN’s development goals, helping to achieve positive social change.

Click here for more information on Responsible Investing >

The views and conclusions expressed in this communication are for general interest only and should not be taken as investment advice or as an invitation to purchase or sell any specific security.

Any data contained herein which is attributed to a third party ("Third Party Data") is the property of (a) third party supplier(s) (the "Owner") and is licensed for use by Standard Life Aberdeen**. Third Party Data may not be copied or distributed. Third Party Data is provided "as is" and is not warranted to be accurate, complete or timely.

To the extent permitted by applicable law, none of the Owner, Standard Life Aberdeen** or any other third party (including any third party involved in providing and/or compiling Third Party Data) shall have any liability for Third Party Data or for any use made of Third Party Data. Past performance is no guarantee of future results. Neither the Owner nor any other third party sponsors, endorses or promotes the fund or product to which Third Party Data relates.

**Standard Life Aberdeen means the relevant member of Standard Life Aberdeen group, being Standard Life Aberdeen plc together with its subsidiaries, subsidiary undertakings and associated companies (whether direct or indirect) from time to time.

Issued in the Netherlands by Aberdeen Asset Managers Limited, registered in Scotland (SC108419) at 10 Queen’s Terrace, Aberdeen, AB10 1XL. Standard Life Investments Limited. Registered in Scotland (SC123321) at 1 George Street, Edinburgh EH2 2LL. Both companies are authorised and regulated in the UK by the Financial Conduct Authority.