SSGA-SPDR: Time to hedge for European Investors?

While many fixed income investors are accustomed to hedging their currency exposure, equity investors generally prefer to leave their allocation in an unhedged exposure, accepting the embedded currency risks. However, recent large-scale FX events, such as the GBP devaluation following the Brexit vote and CHF appreciation following the abandonment of a fixed exchange rate have attuned investors to some downsides of this approach.

More recently, the sharp depreciation in USD, coupled with expectations that this could be a continued trend for the currency, has caught investors’ attention, as USD exposure makes up more than 60% of most global equity exposures. Therefore, sustained USD depreciation can have a material impact for non USD-denominated investors.

Another trend that has led equity investors to begin adopting hedged allocations is a reduction in the cost of hedging. The cost to hedge is made up of the interest rate differential and ‘dollar basis’. Both have substantially reduced throughout this year as the Fed was forced to aggressively cut rates to combat the impact to economic growth of the coronavirus.

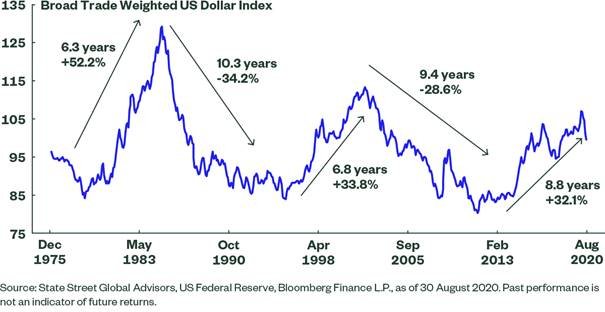

As the chart below shows, once a USD cycle reverses, it is rarely just a flash in the pan, but is generally a multi-year event with wide swings in the currency. Therefore, this currency theme is likely to play on investors’ minds for the foreseeable future, and thus currency-hedged ETFs could become more widely used among European investors.

Running a currency-hedged equity ETF presents issues not always faced by a fixed income instrument, due to recently introduced ESMA regulations that carry the following constraints for UCITS funds:

Over-hedged positions must not exceed 105% of the share class NAV, and

Under-hedged positions must not fall short of 95% of the portion of the NAV of the share class which is to be hedged

Single equity exposure ETFs (e.g. S&P 500 index) are more prone to breach these boundaries. This is because a currency-hedged fund or share class tracking a standard, monthly hedged benchmark is more prone to unexplained tracking error during periods of increased volatility. SPDR has resolved this situation by developing the first hedged benchmark that incorporates the regulatory requirements, through the S&P 500 EUR Dynamic Hedged Index.

Dynamic hedged indices rebalance on a monthly basis but include a mechanism to ensure that the index does not become over-hedged or under-hedged over a certain percentage threshold. For the S&P 500 EUR Dynamic Hedged Index, that threshold is 5% (hedge ratio between 95% and 105%) and the index will be adjusted at the close of the following business day to reset the hedge ratio back to 100%.

The SPDR S&P 500 EUR Hedged UCITS ETF (Acc) (Ticker: SPPE GY) allows managers the flexibility to switch hedging preference within the vehicle in a cost and operationally efficient manner. At a TER of 12bps, the SPDR ETF is the least expensive among the physically replicated exposures.

SPDR also offers the SPDR MSCI ACWI EUR Hdg UCITS ETF, which provides investors with exposure to global equities but with an index that only hedges the developed market currencies in the index, to help reduce the costs of hedging.

USD typically gains/loses 30-35% during a bull/bear market over 6-10 years