State Street Global Markets: Why is the uneven recovery in consumption means inflation still higher than reported?

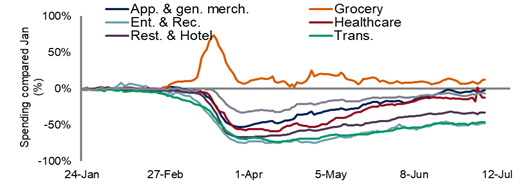

“Spending may be recovering sharply, but the uneven nature of that recovery means the basket of goods that consumers are buying is still significantly altered, thus distorting measured inflation. Consumers continue to spend less than normal on items such as entertainment, recreation and transport. As a result of this, inflation indices are putting too much weight on the prices of these goods based on past consumption patterns.

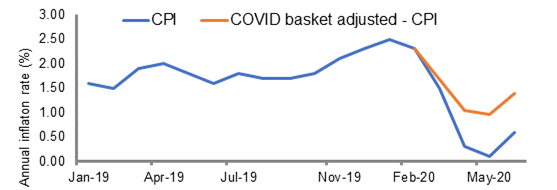

“Whilst official headline inflation posted the first signs of a bounce in June to 0.6 percent, Alberto Cavallo, Edgerley Family Associate Professor at Harvard Business School, academic partner of State Street Associates and Co-Founder of PriceStats*, estimates that the actual inflation rate adjusting for the new COVID consumption basket is already much higher, at 1.4 percent. Remarkably this is only two-tenths below where inflation was this time last year in the midst of a very different economic environment.