Columbia Threadneedle: Our thoughts on the world today

Columbia Threadneedle: Our thoughts on the world today

By Maya Bhandari, Portfolio Manager, and Felicity Long, Client Portfolio Manager

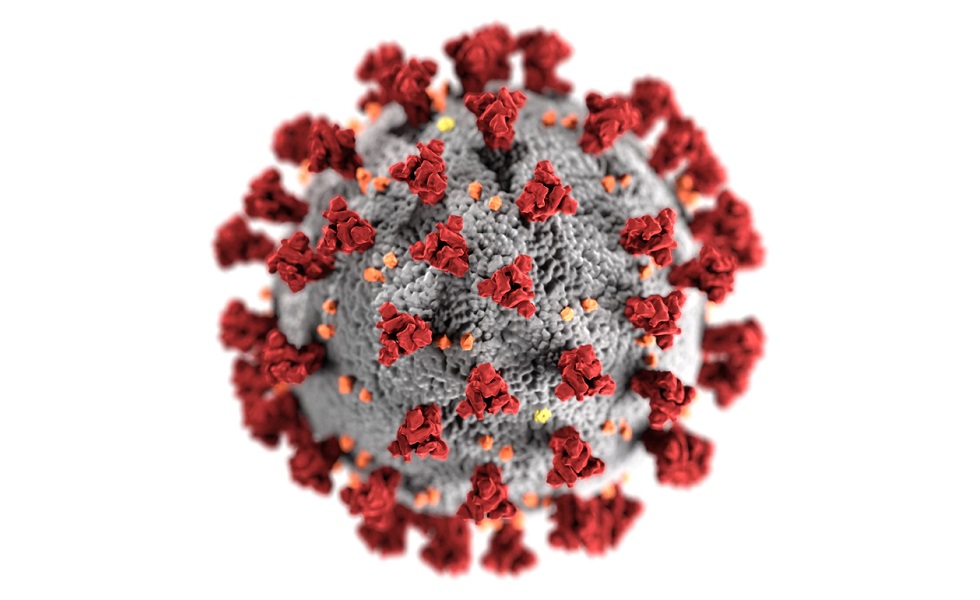

Global economic activity has suffered a “sudden stop” as authorities have sought to contain the spread of the Covid-19 virus by shutting down economies. We have seen early signs of its impact in the data; for example, low single-digit European PMIs, and US employment where the entirety of all jobs created since the Global Financial Crisis (GFC) have been lost in six weeks. Indeed, the current quarter, covering much of the lockdown period itself, is set to worsen considerably.

Against this, stimulus from central banks and governments has been tremendous, far exceeding what we saw in the GFC in scale and speed. Balancing the cost of shutdowns with the benefits of stimulus, our central forecasts point to economic activity in the US regaining Q4, 2019 levels by the end of next year, in something of a “U-shaped” recovery. Europe, the UK and Japan meanwhile, are more likely to experience a more protracted slowdown, recovering to last year’s GDP level some time after the end of 2022.

To our minds, therefore, the economic consequences of the pandemic will be very large but ultimately temporary, albeit longer lasting than the current consensus expects. Companies will also emerge with more indebted balance sheets.

With the depth of weakness in economic data even more pronounced than many expected and yet to be reflected in analysts’ earnings expectations, we have sought to reduce cyclicality in multi-asset portfolios, notably through reducing UK and Japanese equities in favour of the US.

At the same time, we want to participate in select risk markets, particularly those that have cheapened, and which stand to benefit from policy measures. Through the crisis, therefore, we have increased both the quantity and quality of risk that we are taking.