BlueBay AM: Pandemic pandemonium

BlueBay AM: Pandemic pandemonium

By Mark Dowding, CIO at BlueBay Asset Management

Fear replaces greed as the virus spreads

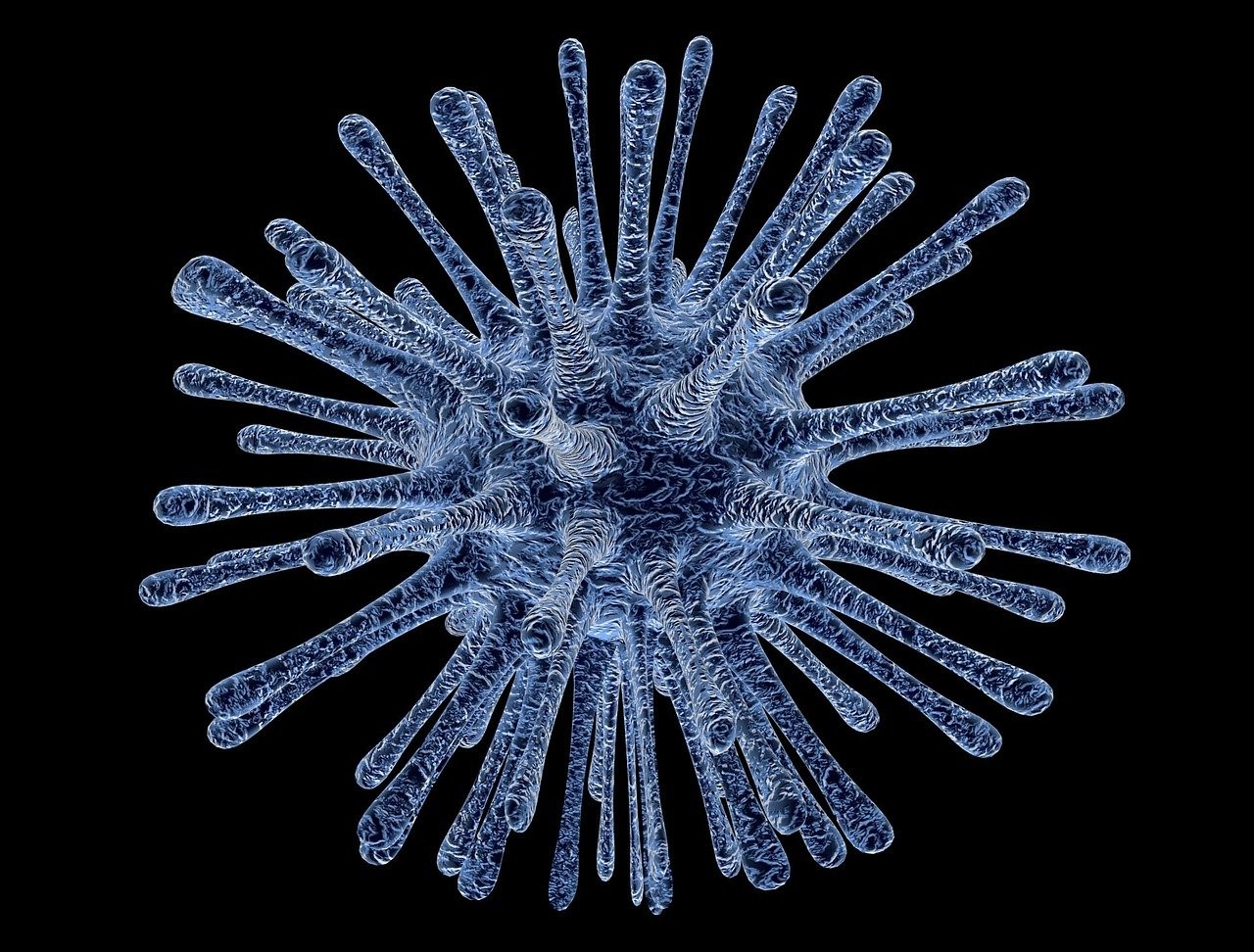

Markets traded in full-on flight to quality over the past week as the coronavirus spread globally, with more cases being recorded outside of China than within China for the first time. Increasingly, it would appear that the spread of the disease is becoming somewhat inevitable, just as the efforts to control the outbreak in Hubei Province seem to be paying off.

In many respects, it may be the case that in months and years to come, Covid19 ends up being regarded as just another flu-type bug, which is unpleasant in itself but principally only a significant threat to the old and the sick in society. However, for the time being, the fear associated with a new killer pathogen sweeping the globe means that economic activity is being disrupted in a mix of both negative supply and demand shocks.

Attempts to contain it via quarantine have seen businesses close and workers sent home. Travel plans are being curtailed and kids are being kept away from school – even when, in some cases – this is only on the fear that individuals may meet others who may have happened to have travelled through areas deemed ‘at risk’. Undoubtedly, some of this may represent an over-reaction, but the reality is that in the current phase, fear in itself is enough to create a negative economic shock on a global basis.

Market impacts

Against this backdrop, a fall in government bond yields, weaker equity markets and wider credit spreads are understandable.

For the time being, fear has replaced greed and should virus fear continue to grow in the next few weeks, it may be difficult to project how this will turn much better in the short term – even if a normalisation of activity in China should add some reassurance.

Meanwhile, we anticipate focus will shift to what can and needs to be done in terms of a policy response. In this context, we believe that much of the heavy lifting will need to come from fiscal policy – particularly in Europe, where interest rates are already so low and where cutting them further is questionable in terms of the prospective benefits.

Noting this, we have been interested by steps taken in Hong Kong to grant all citizens over the age of 18 years a sum of HKD10,000. In a sense, this could be viewed as a fiscal version of ‘helicopter money’ and in many respects this seems like a constructive policy step designed to alleviate a temporary shortfall in aggregate demand.

Prehistoric politics in Europe

We continue to hold policymakers in Europe – and notably Germany – in much lower esteem. Scholz from the Social Democratic Party argued for fiscal easing in Germany this weak but the dinosaurs around Merkel were quick to shoot this down.

Intrinsically, Germany remains paranoid of countries in Southern Europe spending too much, yet in our eyes, excessive conservatism from Berlin could represent the biggest risk to the monetary union in the months and years to come.

From an ECB perspective, we would advocate an increase in bond purchases skewed towards the periphery and corporate bonds in order to avert a tightening of credit conditions – but it is unlikely that Lagarde will be able to move away from the capital key. An increase in quantitative easing seems unthinkable in many parts of the Governing Council and this could lead to renewed discussion with respect to lowering the policy rate. But with this potentially harming banks, insurers and savers, it could serve to do as much harm as good.

A much more material fiscal easing is projected in the UK. In this context, we would be more hopeful that the UK economy can weather the current storm better than the Continent.

More Brexit bumps for the UK

Meanwhile, it now seems wrong to rule out the possibility of a Bank of England rate cut – particularly in a scenario where the US Federal Reserve and other central banks with room to ease are lowering their policy rates.

At the same time, it appears that trade discussions with the EU are off to a bumpy start, in line with our thinking.

Over the past week, we have flattened a short stance in Gilts (following Gilt underperformance versus other markets) and remain short with respect to the pound versus the euro.

In the eurozone, the angst and envy at UK outperformance following Brexit may make it difficult for compromise in the short term and with public opinion in the UK hardening in some disgust that the EU won’t honour equivalent terms as Canada, the coming month or two could provide some challenging newsflow.

That said, if hard Brexit fears lead to a weaker pound, we doubt anyone in Westminster will be especially worried.

Looking ahead

The landscape remains very uncertain. For now, there is a sense with the coronavirus that things will need to get worse before they can get better.

At the same time, we would observe that in a supply shock combined with a demand shock, it may be wrong to automatically extrapolate lower inflation. Rather, some prices may rise (due to scarcity) as others fall.

In financial markets, position capitulation may lead to mis-pricing opportunities and anomalies and in this context, the current environment can be characterised as one which, we believe, will ultimately lead to alpha opportunities as the dust settles.

However, for the time being, the nature of this shock is largely without precedent (the example of SARS now largely irrelevant it seems) and uncertainty will reign. Therefore, keeping risk levels low remains prudent, in our view.

Although the coronavirus is a difficult thing to build into one’s analysis, we would observe that the point of maximum bearishness may be reached in the next couple of weeks. Indeed, this could coincide with the moment that Covid19 is officially declared a pandemic by the WHO.

In our understanding, such a step could set the groundwork for the delivery of a co-ordinated global policy easing response. It is tempting to think that as the weather improves and fear subsides, there can be a return to normality. Panic can persist for a time, but once the stabilisation comes, a rebound in activity could prove to be strong if policy easing is delivered just as the sun comes out.