Ebury: UK to finally leave the EU; what happens next?

Ebury: UK to finally leave the EU; what happens next?

The UK is finally set to leave the European Union on Friday, almost a year later than originally planned.

Following Boris Johnson’s emphatic election victory, which yielded a sizable 80 seat majority for the Conservative Party, UK MP’s voted overwhelmingly in favour of the Prime Minister’s Brexit Withdrawal Agreement Bill in December. This ensures that the UK will formally leave the EU on 31st January with a withdrawal agreement in place, avoiding the ‘no deal’ scenario that investors have long perceived as the worst-case outcome for both the UK economy and the pound.

But what happens after the UK’s EU exit?

As of 1st February, the UK will enter into a ‘transition period’. During the transition period, which is scheduled to run through to the end of December 2020, the UK will remain within the EU customs union, although it will not be involved in any political decision making within the European Parliament. In reality, very little will change, with the status quo effectively extended until the end of the year.

The main issue with the transition period is its length - slated to be twenty-one months from the original 29th March 2019 Article 50 exit date, although not extended despite the various delays to the Brexit deadline. The UK and European Union now therefore only have eleven months in order to furiously hash out as much of the terms of the future relationship as possible.

Attention in the FX market has already turned to whether or not a full agreement can be reached during this time or whether an extension beyond the 31st December 2020 deadline is required to avoid a cliff-edge exit from the EU. While Johnson has insisted he will not be seeking an extension to the transition period, many political analysts are pretty sceptical as to whether this will provide enough time for negotiations to take place.

Should Johnson wish to backtrack on his pledge, he would have until the end of June to ask for a delay. We think that this end of June deadline will come into sharp focus in the next few months, particularly should it become clear in April or May that there’s simply not enough time for both sides to reach an agreement by the end of the year.

How has sterling reacted?

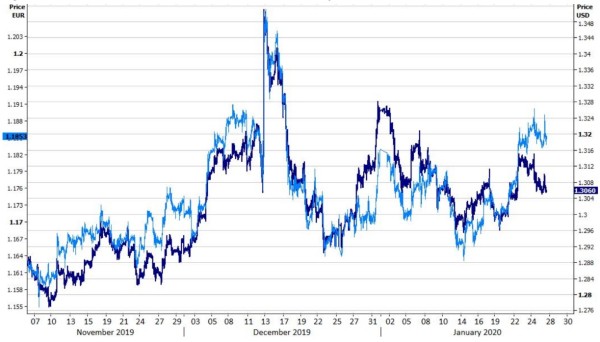

Sterling did, of course, rally sharply following Johnson’s election victory in mid-December as investors cheered the avoidance of a ‘no deal’ Brexit in the short-term. The currency has, however, since given up the entirety of its gains (Figure 1), in large part due to concerns regarding the length of the transition period.

Figure 1: GBP/USD & GBP/EUR (November ‘19 - January ‘20)

Source: Refinitiv Datastream Date: 27/01/2020

Despite the aforementioned retracement in the pound, we remain bullish on the UK currency. We expect either a deal to be struck by the end of the transition period or, more likely, for the Conservatives to cave at the eleventh hour and ask for a delay.

This avoidance of a cliff-edge exit should, in our view, lead to an appreciation in the pound against most of its major peers during the remainder of 2020. The avoidance of a ‘no deal’ Brexit at the end of January should, we believe, also begin to filter its way through to an improvement in domestic data, which is likely to provide further assistance for sterling.