Data framework feeds insight into tracking error - carbon reduction tradeoff

Low-Carbon Corporate Bond Strategy: Case Study

While reducing carbon exposure in equity portfolios has been a leading sustainability priority for several years, interest in expanding this objective to fixed income has become a top priority for many institutional investors around the world.

In the last quarter of 2018 and first quarter of 2019, the State Street Global Advisors team of fixed income portfolio specialists presented to multiple corporations, pension funds and other investors in the Netherlands about how they could reduce the carbon emissions of their European corporate bond portfolios.

Drawing on insights from our painstaking work to create reliable, high-quality data about the carbon intensity of the corporate bond universe, we are helping investors understand the quantifiable tradeoffs between carbon reduction and tracking error. Most importantly, our research is demonstrating that significant improvements in carbon intensity can be achieved with minimal impact to credit quality or interest-rate risk relative to corporate bond benchmarks.

To provide a glimpse into how we’re helping investors identify their ‘sweet spot’ on the carbon reduction curve through our Low-Carbon Corporate Bond Strategy, we examine:

- State Street’s work to improve the quality of climate-related data for fixed income

- Findings from our research into the tradeoffs between carbon reduction and tracking error at different levels of exclusions

- Implementation considerations related to liquidity, turnover and transaction costs

- How the Low-Carbon Corporate Bond Strategy can work in tandem with green bonds and State Street’s spectrum of climate strategies

Solving the Climate Data Challenge for Fixed Income

Reducing a portfolio’s carbon intensity starts with being able to measure carbon emissions for each issuer, and this has been a major challenge for fixed income managers.

It’s well documented that data providers’ information about carbon emissions and other environmental, social and governance (ESG) factors is less extensive for fixed income than for equities. Historically, ESG data providers have built their coverage based on listings of publicly traded equities.

This has proved to be problematic for two reasons:

- It excludes bond issuers that don’t have publicly listed equity shares.

- Given that some companies have hundreds of bond issuances and the codes used for identifying bonds are complex and inconsistent, translating information from the equity universe to the fixed income universe is challenging. Mergers of issuers make this exercise even more difficult.

At State Street, we have devoted time and resources into solving these challenges. We have built a proprietary framework based on multiple sources of best-in-class data that maps information about a company’s carbon emissions and other climate and ESG data from equities to fixed income. Our framework provides reliable coverage for approximately 85% to 95% of the corporate bond universe in developed markets, depending on the region.

This data provides the foundation of our efforts to guide investors through the process of understanding the tradeoffs between tracking error and carbon reduction at varying levels of exclusions.

Presenting Our Findings to Investors

Over the past year, addressing climate risk in fixed income portfolios has surged to the top of the list for many investors. This is being driven by top-down forces (government regulations and developments related to the 2015 Paris Agreement on climate change) as well as bottom-up factors (desire from pension participants, boards and other stakeholders to address climate thematically across asset classes).

As a result, we received requests from multiple corporations, pensions and other investors to learn more about our Low-Carbon Corporate Bond Strategy. Essentially, these investors came to us with one overriding question: ‘Could they apply their goals for reducing carbon emissions to their European corporate bond portfolios without compromising their investment objectives or deviating significantly from their chosen benchmarks?’

We were able to provide them a simple and compelling answer: ‘Yes, you can. And we have the data to prove it.’

Through a series of responses to requests for information (RFIs) and requests for proposal (RFPs) and in-person meetings with their investment teams, we presented historical and forward-looking results from our research into the tradeoffs between various levels of carbon reduction and tracking error, as measured by various forms of risk in European investment-grade corporate bond portfolios.

Key findings from our research, which closely track the results we found for U.S. investment-grade corporate bonds, include:

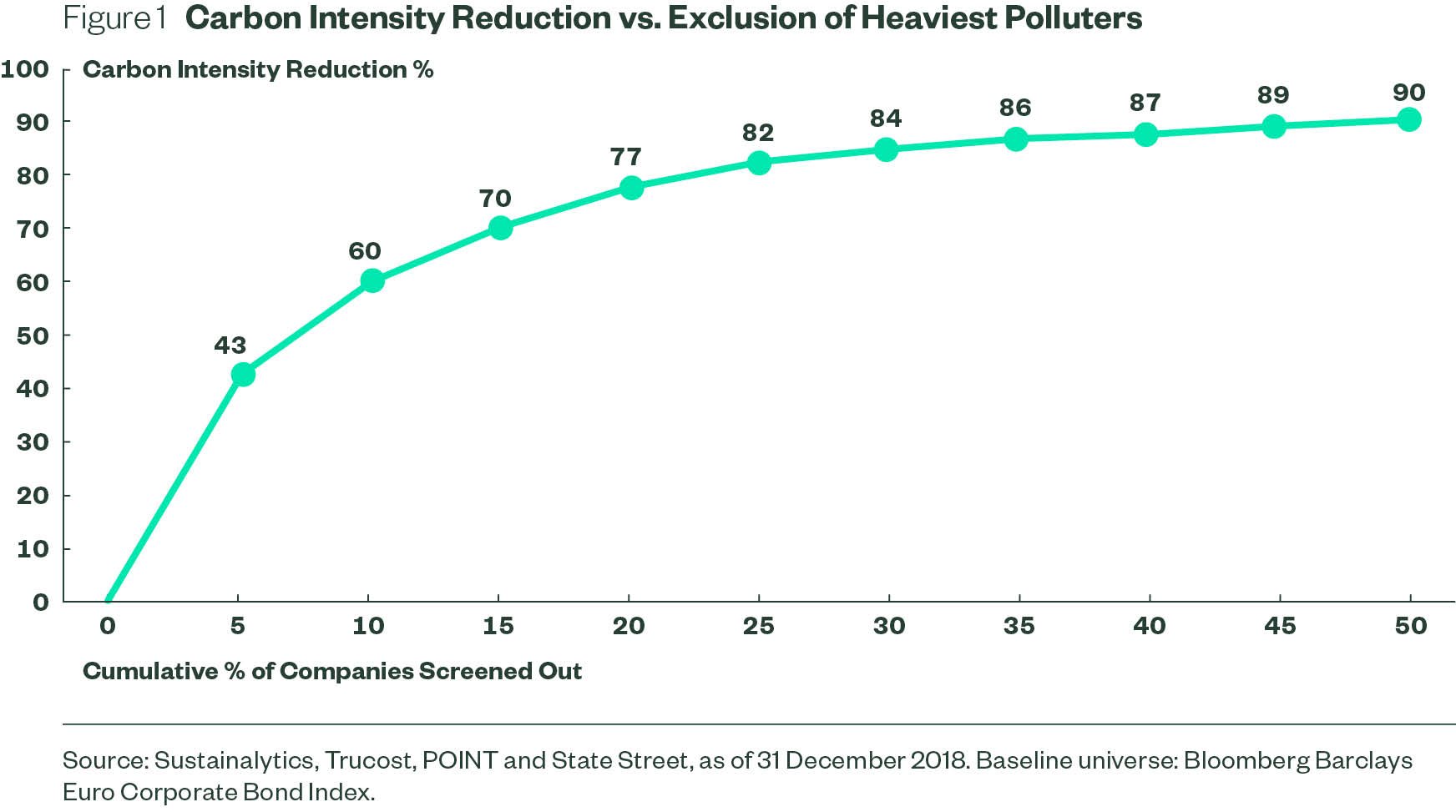

The carbon reduction curve is steep initially; then, there are diminishing returns. Our research showed that, similar to equities, carbon intensity among corporate bonds is concentrated among a relatively small number of companies. As a result, screening out a small percentage of the heaviest-polluting companies leads to significant reductions in carbon intensity. As shown in Figure 1, to reduce a portfolio’s carbon intensity by 60%, an investor would need to exclude only the top decile of heaviest-polluting companies. The corollary of this is that the marginal benefits of additional screening decline rapidly when excluding more than 30% of the heaviest polluters.

Figure 1. Carbon Intensity Reduction vs. Exclusion of Heaviest Polluters

The ‘sweet spot’ is likely in the 10% to 30% exclusion range. Given the steepness of the carbon reduction curve and its diminishing returns, the ‘sweet spot’ in the tradeoff between carbon reduction and tracking error is likely found between excluding 10% to 30% of the heaviest polluters. Where a specific investor ends up within this range depends on their specific climate-related objectives and their risk budget.

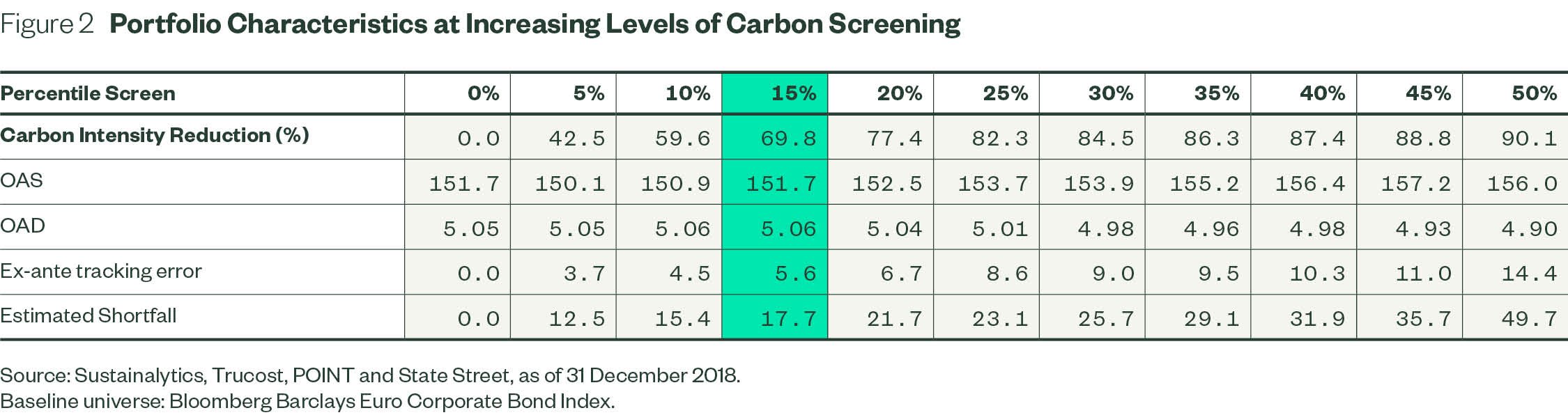

To guide the investors through this decision, we presented detailed information about how key portfolio characteristics—carbon intensity reduction, option-adjusted spread (OAS), option-adjusted duration (OAD) and forward-looking (ex-ante) tracking error—at increasing levels of exclusionary screening. Based on this data, many of the investors have expressed interest in 15% screening, which

results in a 70% reduction in carbon intensity and minimal deviation from the Bloomberg Barclays Euro Corporate Bond Index.

Figure 2. Portfolio Characteristics at Increasing Levels of Carbon Screening

Within this range, there is minimal impact on credit quality and interest-rate risk exposure. The beauty of our findings is that investors can achieve significant carbon intensity reduction without compromising their investment objectives or parameters of their corporate bond portfolios. We found that most of the tracking error is driven by idiosyncratic and sector bets, rather than top-down bias in terms of credit quality or interest-rate exposure.

Figure 3. Credit Rating Allocations at Increasing Levels of Carbon Screening

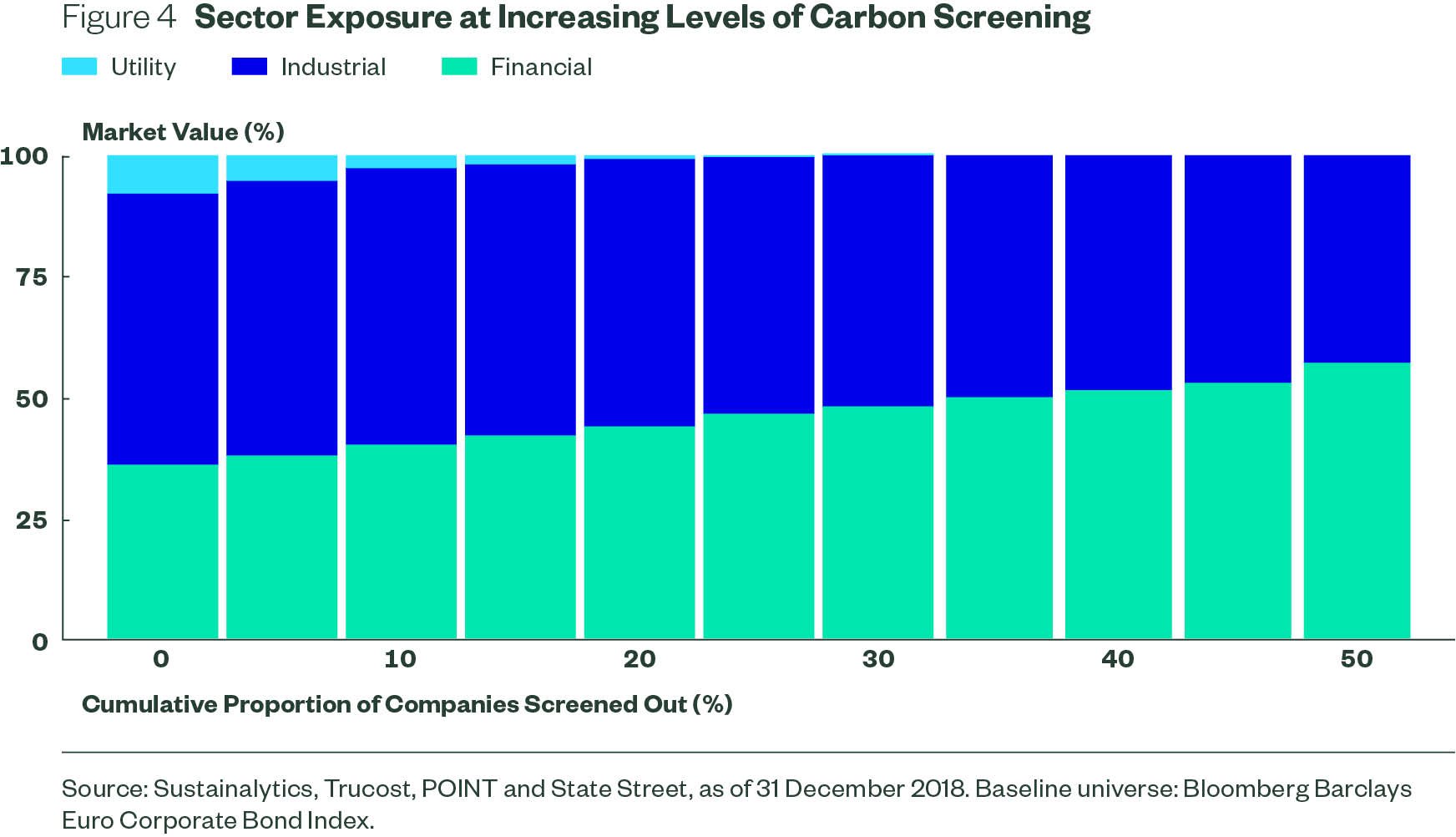

Sector exposure is affected—but only gradually. Unsurprisingly, screening out the heaviest-polluting companies introduces a degree of sector bias, tilting the portfolio away from utilities and toward financials. Our research found that this effect is gradual, but it is something that investors should still consider as they determine the level of screening that is appropriate for them.

Figure 4. Sector Exposure at Increasing Levels of Carbon Screening

Moving From Guidance to Implementation

In addition to helping investors determine the optimal position on the carbon reduction curve, we also guide them through the process of implementing the Low-Carbon Corporate Bond Strategy.

The strategy is customizable based on the level of targeted carbon reduction and the index used as the benchmark; the available benchmarks include any corporate bond index in developed markets. We also work with clients to identify any bespoke constraints they want applied to their portfolio, such as additional screens for controversial weapons, tobacco, firearms or non-compliance with the United Nations’ Principles for Responsible Investment.

With any fixed income portfolio, liquidity, turnover and transaction costs are paramount. The Low-Carbon Corporate Bond Strategy aligns well with these concerns. Because the targeted carbon intensity reductions can be achieved with low levels of exclusions, investors don’t need to renormalize and rebalance large portions of the portfolio. Furthermore, our historical research found that the list of companies included among the ranks of the heaviest polluters doesn’t change much over time, limiting the amount of monthly turnover in the index.

Another way we look to minimize transaction costs is by participating in new bond issuances when possible. This tactic allows us to capitalize on the slight discount that often is applied before bonds begin trading on the secondary market.

Whether through the Low-Carbon Corporate Bond Strategy or other strategies, our deep knowledge of fixed income market structures and indexing allow us to skillfully implement customized portfolios for our clients in the most efficient way possible.

Exploring the Spectrum of Climate Strategies

At State Street, we know that implementing climate thematically into portfolios is a journey—and investors around the world are traveling on this journey at different speeds and from different starting points. That’s why we have developed a spectrum of climate-focused investment strategies that can be customized across asset classes to align with each investor’s unique objectives and constraints.

In addition to the Low-Carbon Corporate Bond Strategy, we offer a Low-Carbon Solutions Framework for investors looking to take the first step in mitigating their equity exposure to climate risk. This flexible framework builds customized portfolios either by minimizing tracking error for a targeted level of carbon reduction or by maximizing carbon reduction for a targeted level of tracking error.

For investors focused on proactively preparing for the transition to a low-carbon economy and aligning with the most ambitious goals stemming from the 2015 Paris Agreement, we offer the Sustainable Climate Strategy. This multi-pronged strategy uses a mitigation + adaptation approach to target reductions in current and future carbon emissions, increased exposure to ‘green’ revenues and increased resiliency to the physical risks posed by climate change.

Most importantly, we encourage investors to understand that these strategies represent a spectrum of possible approaches, rather than a list of finite, mutually exclusive options. For example, many investors are looking to do more than just limit the carbon emissions of their fixed income portfolios. In these cases, the Low-Carbon Corporate Bond Strategy can be paired with allocations to green bonds, combining carbon reduction with increased exposure to energy-efficient technology and other forms of green revenue.

To learn more about how our climate-focused strategies can be customized for your investment goals, please contact your State Street representative.

State Street Global Advisors Worldwide Entities

Important Risk Discussion

The information provided does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your tax and financial advisor.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information.

The whole or any part of this work may not be reproduced, copied or transmitted or any of its contents disclosed to third parties without State Street Global Advisors’ express written consent.

© 2019 State Street Corporation - All Rights Reserved

2491821.1.1.GBL.RTL 4/10/2020