J.P. Morgan: Markets are pricing positive European rates in Q3 2022

J.P. Morgan: Markets are pricing positive European rates in Q3 2022

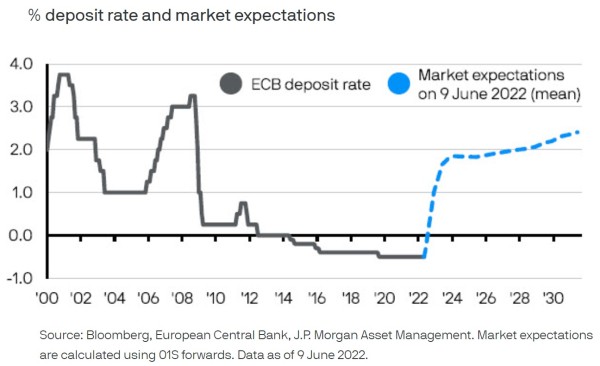

At its meeting on 9 June the European Central Bank (ECB) confirmed that it intends to end net asset purchases by the end of the month and raise rates by 25 basis points (bps) at its July meeting.

It also sounded a hawkish note suggesting that a 50 bps hike in September might be appropriate if inflation remains persistent. Looking further out markets are currently pricing positive rates in September 2022 and rates around 1.9% by the end of 2023.

The ECB has taken pains to stress its decision making is driven by data and this applies in both directions. While it is keen to exit negative rates, it may move slower than the market is currently pricing if the growth outlook deteriorates on the back of higher food and energy prices.