Nicole Downer: The role of ESG in private assets

Nicole Downer: The role of ESG in private assets

Assets managed by the private capital industry have seen unprecedented growth over the last decade. With this trend set to continue, assets are expected to increase by 74% between 2021-2026 according to S&P. Managers across all private asset classes are expecting to benefit from this level of growth.

By Wim Groeneveld

So what role does ESG play against this backdrop of vast capital allocations shifting towards private assets? Financial Investigator sat down with Nicole Downer, Managing Partner and Head of Investor Solutions at MV Credit.

To what extent did private capital managers move to address ESG concerns?

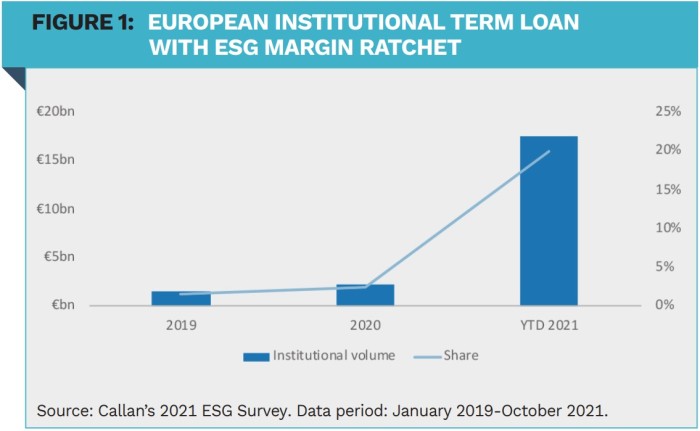

‘The prevalence of ESGlinked assets has grown across all corners of private markets. Within the private debt and equity space, for example, fund managers are financing an increasing number of new investments with ESG-linked debt instruments. Figure 1 shows how the volume and the share of European ESG Term Loan debt have increased between 2019 and 2021. These ESG instruments feature mechanisms whereby the loan pricing steps up or down according to whether the private equity owner manages the company to hit a set of KPIs. Such KPIs can include carbon emissions, but also topics such as gender diversity, staff training and corruption.’

What about the broader private capital industry?

‘The industry architecture that supports the private capital industry, including branches like banks and lawyers, has made significant advancements in providing new services that allow managers to address ESG concerns. Many lenders have dedicated ESG teams to help funds structure their facilities so that the ESG goals of the lenders and borrowers are aligned. Law firms are channelling more and more resources to help managers align their ESG goals with investors when structuring new funds and financing facilities.’

Which different mechanisms do private capital managers use to align their funds and businesses with ESG objectives?

‘Primarily, private capital managers align their funds towards ESG objectives via the investment process. Recent academic research of the public fund market suggests that there is a return premium to be harvested from ESG assets. The rationale being that by screening out non-ESG aligned investments, the manager reduces downside risks inherent in companies that are over-reliant on fossil fuels or outsourcing labour to developing countries for example. Private capital managers for example implement ESG considerations within the investment process through:

- Negative exclusion: excluding entire sectors, companies or countries based on ESG criteria, moral or ethical views. Think in this context of tobacco, weapons, nuclear energy, pornography, gambling and alcohol.

- Positive screening: investing in assets demonstrating positive ESG performance relative to peers.

- ESG integration: the inclusion of ESG factors and non-credit considerations alongside financial analysis in the due diligence process.’

Of what importance are the relationships with sponsors?

‘Clearly, the ESG credentials of portfolio companies are important. However, and in addition, the manner in which deals are originated is also a key consideration. Within the private credit space, debt managers typically partner with private equity sponsors only when the sponsor’s values align with those of the lender. Many private credit lenders originate via deep, longstanding relationships with sponsors. These relationships are built and solidified over the years not only though investment performance, but through shared ideals and values, with ESG being a key example.’

Law firms are channelling more and more resources to help managers align their ESG goals with investors when structuring new funds and financing facilities.

How have private capital managers innovated to meet the ESG requirements of institutional investors?

‘Over recent years, institutional investors have increased the use of ESG as a criterion to evaluate managers, hence managers have innovated to focus ESG efforts. One such innovation is ESG linked performance fees. Innovative managers are calculating performance fees of new funds based on fund/ corporate ESG performance (measured by predetermined KPIs) together with fund performance. The KPIs used will vary by asset class. However, examples include:

- Diversity and Inclusion at the manager level and GPs.

- ESG scoring of portfolio assets. This is typically measured and verified by an independent third party.

- Portfolio concentration of ‘green assets’ – more relevant in the infrastructure and real estate fund spaces.

- The number of portfolio companies where ESG credentials have been strengthened by the manager’s active participation in the business – more relevant in the private equity and venture capital fund spaces.’

In which ways do private capital managers communicate ESG performance transparently with investors?

‘The recently introduced SFDR requires fund managers to explicitly categorise the degree to which their funds target ESG objectives. Article 8 funds aim to ‘promote environmental or social characteristics’, while article 9 funds are even more ambitious as the investment strategy must include a ‘sustainable objective’. Examples of article 9 funds include funds investing in green bonds or renewable energy infrastructure. Article 6 funds do not integrate any kind of sustainability into the investment process.

Many proactive managers already use independent third parties to regularly assess the portfolio by scoring each asset through an ESG framework (typically co-constructed by the third party and the manager). Asset by asset ESG ‘performance’ is tracked over time so that regular reporting can be provided directly to investors.’

|

SUMMARY Private capital markets continue to evolve, building on dramatic industry wide changes, in order to address the ESG concerns of investors. Private capital managers have integrated ESG considerations into their investment processes and their fund terms/structure, including performance fees and fund financing. Investors can rely on new regulation to increase market transparency regarding the extent to which ESG plays a role within fund objectives. Some managers provide their investors with independently calculated ‘ESG score’ reports. |

|

Marketing Communication For Professional Investors only. All investing involves risk, including the risk of capital loss. Provided by Natixis Investment Managers International, Nederlands (Registration number 000050438298). Registered office: Stadsplateau 7, 3521 AZ Utrecht, the Netherlands. MV Credit is an affiliate of Natixis Investment Managers. |