Fidelity International: Pole position for China’s electric autos

Fidelity International: Pole position for China’s electric autos

Despite rising materials costs, supply bottlenecks, and cloudy global macro conditions, China’s electric vehicle sector still looks charged for growth, according to Fidelity Intenational.

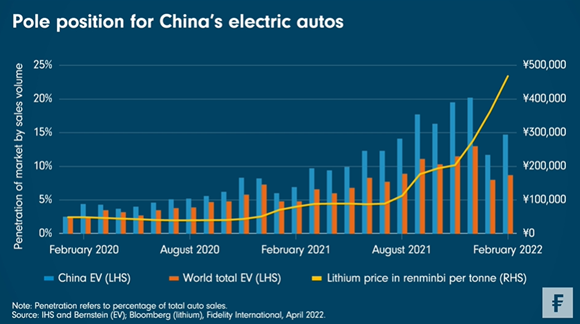

Lithium prices, a key component of electric car batteries, have soared nearly 500 per cent in the year to March. Other electric vehicle battery metals are also trading significantly above the levels that we have seen in recent years. One might expect these to weigh on the electric auto market, given that batteries are half the manufacturing cost of a new energy vehicle (NEV) on average. And, indeed, automakers from Tesla to Xpeng started hiking prices in March.

In many parts of the world, stagflation and geopolitical conflict loom large, demand is faltering as supply bottlenecks persist, and recession risks are rising.

But in China, the world’s biggest NEV market, the latest indications are vastly more encouraging. Electric car sales were up 142 per cent year-on-year as of February, and are expected to remain strong despite the recent price hikes. Even at the more pessimistic end of the spectrum of growth projections, the view is that NEV penetration will more than double over the next three years to 39 per cent of the overall car market. The more bullish projections see NEVs accounting for 80 per cent of auto sales by 2030.

Sum of the parts

But supercharged prices for input materials, most notably for lithium but also other key metals such as cobalt, remain a constraint. For the moment, rising materials costs are adding up to 20,000 renminbi (around $3,100) to the price of each battery-powered car. Global lithium supply is still tight and is likely to remain so whilst demand stays high, though availability is expected to progressively improve from the second half of the year.

Still, manufacturers have so far been able to pass most of these increases on to consumers. And so far, the overall impact on NEV demand remains mild. For example, BYD posted an increase in orders and higher penetration in March after increasing its prices in China. For consumers weighing comparable internal combustion models, the mathematics are still compelling. A gasoline car costs about $800 more a year on average, assuming 15,000 kilometers driven.

Network effects

NEVs in China enjoy some peculiar advantages compared with the rest of the world, even though policy support and NEV-friendly infrastructure such as off-street parking underpin penetration in markets like Europe. For one thing, more of the global battery supply chain from cell plants to charging infrastructure is concentrated in Northeast Asia, reducing China’s comparative logistics bottleneck worries.

Analysts say that the higher cost of mining battery metals is driving R&D and innovation to reduce costs and uncover ever more inexpensive solutions. For example, sodium-based batteries, which Tesla’s China supplier Contemporary Amperex Technology Ltd began to offer last year, provide a cheaper innovation that could integrate with older technologies.

The high input costs likely will be felt most sharply in China by smaller players in the electric car segment like SAIC-GM-Wuling, Chery Automobile, and Great Wall ORA. At the higher end, NEV orders still are backlogged for three months at best-selling brands. Total NEV sales in China in February - seasonally the weakest period of the year thanks to the Lunar New Year - were still more than double year-on-year.

Of course, these amped up NEV growth projections could come unplugged on a deteriorating macro picture, but such a slump in China would impact the entire auto sector and the broader economy, both at home and abroad. All the supporting factors that sparked the case for China’s NEVs in the first place, from cost savings to evolving consumer attitudes, remain resilient - even in the gathering global gloom.