La Française: The central banks challenge

La Française: The central banks challenge

By Jean-Luc Hivert, Chairman and Chief Investment Officer, La Française AM

Last December, we pointed out that the inflation trajectory would be the element capable of derailing the markets and this is the scenario that is currently materializing.

We must go back to the summer of 2008 to observe comparable conditions. Jean-Claude Trichet, former ECB president, was then faced with a 4% rise in consumer prices and had therefore raised rates from 4% to 4.25%.

Today, the increase in consumer prices continues to accelerate and is now over 5% in the Eurozone while it still displays negative key rates.

Central banks, in particular the ECB, were ultimately unable to maintain their position of conducting their monetary policy by looking beyond the peak of inflation and the markets were shaken by this turnaround.

Beyond the current focus on inflation, we must look at the subject of growth, which could soon be added to our concerns. Indeed, the post-pandemic rebound is decelerating and the rising prices will accentuate this slowdown, affecting purchasing power.

The economic pattern showing too much inflation and not enough growth is an adverse markets scenario, and despite not being the central scenario today, it is nevertheless likely to be mentioned soon.

Of course, it is also a complex scheme for central banks to manage. Remember that in 2008, Mr. Trichet had been criticized for his rate hike when growth was already showing signs of running out of steam.

EQUITIES

Since the beginning of the year, equity markets have been impacted by announcements of monetary policies tightening in the United States and Europe as well as by the geopolitical tensions between Russia and Western countries.

Even today, volatility levels in equity markets remain high, mainly fuelled by fears of geopolitical concerns. At the same time, the results of the publication season remain very positive overall and continue to support the markets. Revenue growth exceeded expectations, thanks to a better momentum in business activity in the last quarter. Earnings per share growth also exceeded predictions, standing at +28% and +44%1 in the United States and Europe, respectively.

Added to this dichotomy between the macro and micro situations, we are noticing a few factors that are supporting the equity markets. Leading indicators remain buoyant, inventory levels stand at historically low levels and the business investment cycle should accelerate. In addition, shareholder return policies and mergers and acquisitions are keeping a dynamic level of activity.

Ultimately, we believe that there is still upside potential in the equity markets. However, given the current market environment, the attention paid to securities selection must be strengthened.

RATES

Inflation remains the main concern for fixed income markets, with figures again above expectations since January in both Europe and the United States. Inflation came out at 7.5% across the Atlantic and at 5.1% in the Eurozone, which caused a change of tone both from the FED and the ECB. The transitory inflation point of view seems now difficult for central bankers to defend, especially when the question becomes more and more political in connection with the sharp increases in gasoline and food prices.

All forecasters have had great difficulty predicting the evolution of inflation for many months now, and this uncertainty around the future evolution of prices does not seem likely to disappear in the short term. Following this shock mainly linked to supply issues, central bankers have no choice but to try to slow down demand by making financial conditions less accommodating, leading in parallel to a sharp increase in all financial assets’ volatility.

Expectations of rate hikes have therefore logically accelerated sharply since the start of the year: in the United States, the markets were anticipating around 100 bps of rate increases during the year 2022, these expectations have now risen to 200 bps, a much faster pace than during the last cycle of rate hike cycle. Similarly, a 50 bps rate hike is now expected from the ECB, whereas nothing was anticipated at the start of the year.

Simultaneously, central banks are also winding down their quantitative easing programs faster than expected in an attempt to slow the inflationary spiral.

How far can central banks go without disrupting growth? The question is still to be answered, but it seems to us that without significant budgetary support, the combined effects of fewer accommodating financial conditions and rising prices should have a rapid impact on final demand, potentially "forcing" the authorities to choose between fighting against the rise in prices and maintain satisfactory growth.

Keeping that in mind peripheral countries spreads are likely to remain under pressure. It also seems likely to us that the short parts of the American and European curves will continue to tighten, at least if growth (and therefore consumption) remains resilient.

HIGH BETA

1- High Yield

The High Yield market was also hit by the more restrictive than expected change in communication from the various central banks.

This change of stance from the central bank communication led to a significant rise in risk-free rates2:

- + 43 bps for the US 10 year since the start of the year (from 1.510% to 1.937%)

- + 57 bps on the France 10 year (from 0.191% to 0.762%)

- + 46 bps on the Germany 10 year (from -0.186% to 0.292%. The highest level observed since 2015)

But also, to a rise in YTD corporate debt spreads2:

- The HY US index widened by 52 bps to 357 bps

- The HY euro index widened by 34 bps to 321 bps

- The EM index widened by 3 bps to 564 bps

In total, the rise in risk-free rates and corporate debt spreads led to a negative total performance2 (carry + change in bond prices) YTD of:

- 3.96% on the US index

- - 3.22% on the HY euro index

- - 3.11% on the EM index

As indicated in our “back to business” note published at the start of the year (17/01/2022) we believe that the volatility will persist in the first half of the year given health risks and the exit of central banks. However, we maintain that companies’ fundamentals are solid and default rates should therefore stay relatively low, which is favourable for the high yield asset class.

Our High Yield spread forecast for S1 2022 was 350-400 bps3, which is in line with current levels.

1- Subordinated debt

Regarding subordinated debt, valuations already affected by interest rates volatility were also hit hard by the reversal of central banks and the increasing tensions between Russia and the United States.

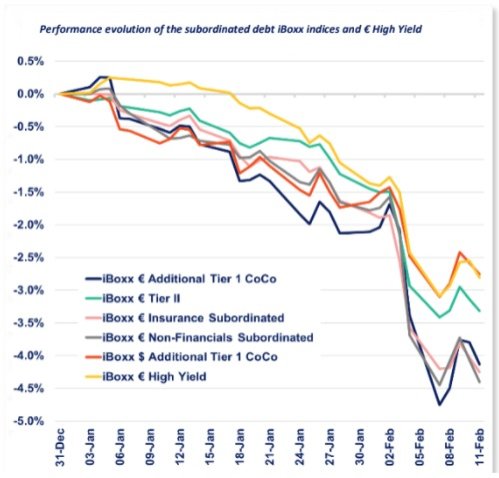

Subordinated debts have displayed three notable behaviours during this period (as shown on the right chart) : (i) Subordinated debt underperformed the Euro High Yield, which is quite normal with regards to this type of market, (ii) all subordinated segments declined similarly, which is equivalent to a very clear underperformance of Tier 2 bank debt, subordinated insurance (mainly Restricted Tier 1) and Corporate Hybrid debt, that deteriorated due to their longer duration on average compared to AT1 CoCos, (iii) € AT1 CoCos clearly underperformed their counterparts in $, due to their greater sensitivity to the widening of the BTP-Bund spread.

We are drawing a few lessons from the beginning of the year turmoil:

(i) Volatility should still be very present in the coming weeks with significant market movements in both directions without significant flows (both investors and counterparties are cautious). It is, therefore, appropriate to limit the average duration of investments and to combine that with high spread securities to maximize the carry and limit the risk of a sudden decline.

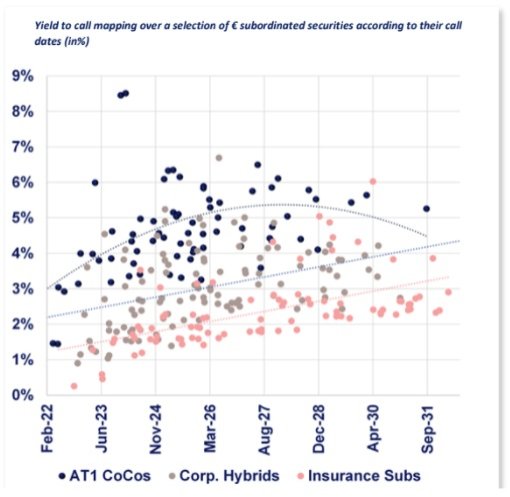

(ii) Appealing entry points – that have not been seen since Q3 2020 – are emerging on many securities, with yield to call between 3 to 7%, in particular on AT1s, Tier 2 bank debt and RT1 insurance (see mapping on the right).

(iii) Subordinated debt spreads should continue to follow the trend of the BTP/Bund government rate spread. Bank subordinated debt should ultimately benefit from the positive bank stocks movement following the “reflation”, but only when volatility is lower.

ASSET ALLOCATION AND OUTLOOK FOR 2022

A complicated start of the year for diversified portfolio managements, that suffered from their bond component and above all from the unprecedented sector rotation that has continued to increase since the beginning of January.

Only the predominantly Value underlying funds manage to deliver a positive performance compared to the more core and growth funds that are heavily penalized by the weight of technology stocks in their portfolios. This observation is true in all geographical areas.

In our diversified allocations, the under-sensitivity to bonds which had been maintained at the beginning of the year helped to offset the disappointing credit performance, which combined the rising rates and widening spreads, while expectations of a gradual withdrawal of liquidities driven by central banks are increasingly integrated by the markets.

Although equity indices have posted negative performances since January, the decline is limited at this stage. To date, 70% of European companies that have already published beat the consensus, and the trend is even better in the United States.

For the year 2022, companies can count on the gradual disappearance of bottlenecks, on the investment recovery, and on the maintenance of consumption that is still strong to anticipate the continuation of this trend. This argues in favour of keeping equity exposure in the allocations with the same proportions (slightly underweighted) even if the impact of inflationary pressures blurs visibility.

We continue to promote European equities in our allocations but are considering arbitrages in favour of the Chinese market by the end of the quarter. Indeed, China is taking the opposite view from other developed countries by relying on a more accommodating monetary policy.

In the meantime, reading the intentions of the American reserve is easier and the withdrawal of liquidity is already well integrated into current prices. The Americans’ advance in their monetary normalization gives the geographical area an advantage that could be exploited in the allocations. Even if the uncertainties surrounding inflation remain high, the peak in the United States is, in our opinion, about to be reached and American equities could therefore regain a comparative advantage.

In terms of valuation, our preference is still for the Eurozone, but a reallocation could be considered in favour of the US zone before the end of the quarter.

1] Source : Bloomberg

2] Source: Bloomberg from 31/12/2021 to 11/02/2022

3] On the HW00 Global High Yield Index