J.P. Morgan: Markets now expect the ECB to exit negative rates this year

J.P. Morgan: Markets now expect the ECB to exit negative rates this year

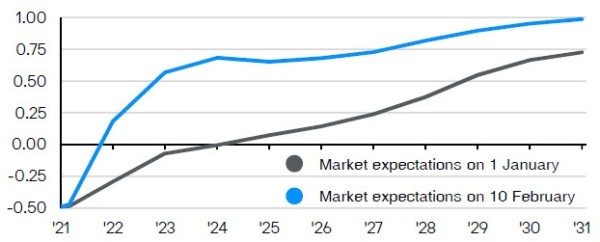

There appear to be few doves left at the central banks. Markets are now expecting several rate hikes this year in the US, UK and even the eurozone.

At its recent meeting the European Central Bank (ECB) refused to rule out a rate hike this year, causing markets to expect the ECB to exit negative rates by the end of 2022 rather than in 2024, as was expected just a month ago. The ECB faces conflicting pressures though. Inflation is elevated in Germany but is lagging in France, Spain and Italy. Meanwhile energy is driving more than 50% of headline inflation.

However, eurozone inflation is at its highest rate on record and the current situation may represent the central bank’s best chance to end asset purchases and negative rates. Negative rates in Europe have helped anchor developed market sovereign yields and so an exit of this policy could help bond yields rise elsewhere too.

%, market expectations for ECB deposit rate

Source: Bloomberg, J.P. Morgan Asset Management. Market expectations are calculated using OIS forwards. Data as of 10 February 2022.