SSGA: Market implications of Omicron

SSGA: Market implications of Omicron

- Omicron seems poised to become the dominant COVID-19 variant globally.

- The virus’s higher transmissibility and rapid spread could signal a new phase as COVID-19 morphs from being a “pandemic” to being “endemic” in much of the world.

- Omicron hit too late in 2021 to alter the year’s macro performance and early enough in 2022 that any Q1 hit could potentially be offset by a subsequent bounce back.

- Nonetheless, the Fed turning more reactive in the event of persistent inflation could precipitate a recession-like scenario, during which risk assets tend to fare poorly.

Macro Implications

The emergence of Omicron will undoubtedly have some negative economic impact in the short term. However, it is occurring too late in the year for it to noticeably impact 2021 annual growth. It will also occur early enough in 2022 that there will be ample time for a compensatory bounce back after the likely hit to growth in Q1. For the time being, we have left our 2022 US growth forecast unchanged at 4.4%. However, we have trimmed our eurozone forecast by two tenths to 4.4%, although that is only tangentially due to Omicron.

The global growth forecast remains unchanged as well, at 4.6%, although we see some downside risks, primarily around China and emerging markets. Our 5.0% expectation for China’s 2022 growth is starting to look a bit generous, even with the recent easing policy bias.

More than Omicron, we are concerned about the massive hawkish tilt in the stance of developed market central banks this month. There is a high likelihood that the removal of accommodation accelerates and gathers critical mass just as economic growth moderates and inflationary pressures ease notably (in the latter part of 2022). With reduced excess savings, less support from inventory rebuilding, a slowdown in hiring (due to lack of workers) and softening housing demand, it would not take much to tip the US economy into a shallow technical recession in early 2023, regardless of Omicron.

Investment Implications

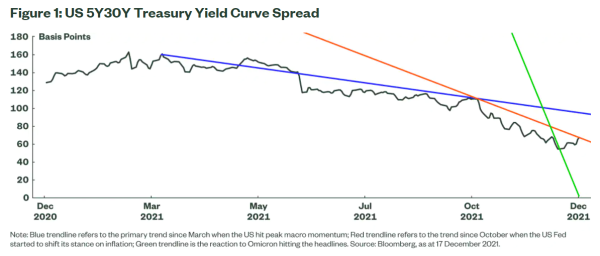

Omicron has the potential to exacerbate the current cyclical dynamics that are at play. If the number of cases were to dramatically rise, amplifying the supply and demand dynamics that have developed over the last year, we could be staring at a higher or more persistent inflationary regime, which could push the Fed to an even more hawkish stance. This would amplify the anticipated deceleration in growth. Implications could include short-term rates moving higher and long-term rates moving lower, which suggest the possibility of a yield-curve inversion and a recessionary scenario where risk assets would tend to fare poorly (Figure 1).

Figure 1: US 5Y30Y Treasury Yield Curve Spread