Fidelity International: The climate emergency needs decarbonisation solutions

Fidelity International: The climate emergency needs decarbonisation solutions

Governments need to deliver ambitious packages of detailed plans, pressing timelines, large scale investment and an integrated system of incentives for corporates and consumers. A critical aspect of the policy response is support for emerging decarbonisation solutions. These technologies are under-penetrated and some are nascent, but with policy support have the potential to grow dramatically, becoming economic and widely applicable across industries.

Climate change is an existential emergency

The challenge of climate change is more urgent than most people think. For years we have underestimated the scale of the climate emergency and the world is only recently waking up to the monumental challenge in front of us.

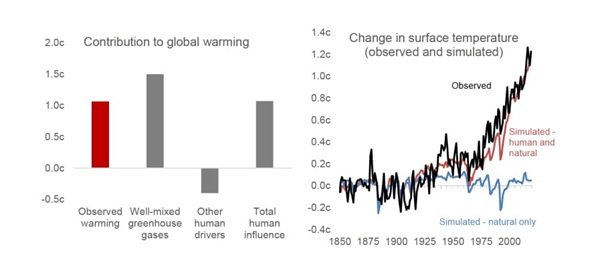

The data on global warming could not be more emphatic. Perhaps the most comprehensive and weighty scientific review on climate change is the UN’s Intergovernmental Panel on Climate Change’s (IPCC) August 2021 report. What is clear from the publication is that we are living through climate change, and its effect is only starting to be felt. The report concludes that increases in GHG concentrations since 1750 are unequivocally caused by human activities and atmospheric CO2 concentrations are higher than at any time in at least 2 million years.

As a result of this, they observe that the earth’s surface temperature in the last decade is 1.1oc higher compared to 1850-1900 - this finding is broadly accepted now. What is not so appreciated is that if the cooling effects of aerosols are removed - mainly attributed to burning biofuels and fossil fuels, which temporarily cool the earth but are very short lived compared to their long-lasting warming effects - then temperatures have already risen by 1.5°C.

Human activity has driven global warming

Bron: UN IPCC: Climate Change 2021.

The 1.1°C temperature rise might sound small but the effects on our environment are already being felt, from increased precipitation to the retreat of glaciers to the warming of oceans. Weather and climate extremes such as heatwaves, droughts and heavy rainfall have increased in frequency and severity. These effects will continue to exacerbate. We can only limit global warming to 1.5°C if we halve greenhouse gas emissions by 2030 and cut them entirely by 2050, but current national determined contributions (NDCs: each country’s individual plan to stay within the 1.5°C target) would represent an emissions reduction of just 1% in 2030 compared to 2019 levels.

Policymakers must support decarbonisation

A big part of the problem is the lack of action by policymakers. Only 113 of the 191 countries that signed the Paris agreement have submitted new or updated targets so far. Some big emitters including China, Japan and South Korea have yet to send new targets to the UN despite informally announcing new goals. Some countries that submitted new targets have actually watered them down, including Brazil and Mexico, which set new emissions levels that were higher than their old targets.

How is it possible that despite 195 countries approving the UN IPCC report and acknowledging the catastrophic consequences of climate change, we are only on course to maintain emissions by 2030 rather than cut them by 50%? The answer is to do with growth. Economic development, particularly in developing countries, means increasing consumption of goods and services and that requires fast and cheap forms of energy, which are often carbon intensive.

For already developed countries to deny developing populations the opportunity to improve their lifestyles is a difficult argument to make. Even within developed countries, mandating that living standards must be sacrificed would likely face a backlash. Governments must think of ways to address climate change while minimising harm to peoples’ quality of life. In other words, economies must transition to a low carbon world through decarbonisation.

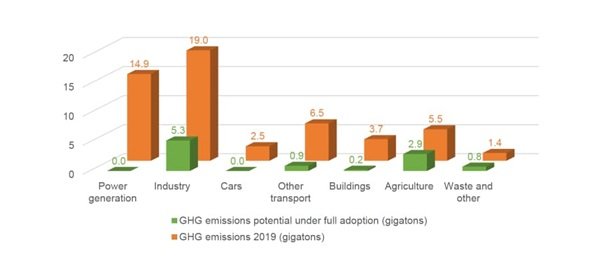

Decarbonisation isn’t some abstract idea that still needs to be transformed into real world solutions. Decarbonisation solutions are available and at our disposal today. We estimate that existing decarbonisation technologies have the potential to cut over 80% of global carbon emissions, if fully adopted globally, but to do so these innovations need policy support.

Existing decarbonisation solutions can cut global carbon emissions by over 80%

Fidelity International, January 2021. Calculations are based off multiple sources including reliable secondary research sources, company filings and Fidelity analyst estimates. The CO2e emissions reduction achieved by low/zero carbon technologies is based on full adoption with 100% replacement/penetration displacing legacy technologies/processes. We used secondary research published post 2010 for our calculations.

The market for decarbonisation

Decarbonisation is the conversion of the economic system to one that sustainably reduces and compensates for carbon dioxide emissions. The ultimate objective is to create a global economy that is free of carbon emissions.

A low carbon or carbon neutral world requires integrating all aspects of the economy including resource extraction, manufacturing, agriculture, construction, transport, and power with technologies that generate energy and materials with little to no carbon output. This means that populations, buildings, machines, and consumer products are operated and disposed of with minimal emissions. Decarbonisation is nothing short of a green revolution of our economy.

There are varying estimates of the cost to fully decarbonise the global economy, but the best forecast we have seen is that at current prices decarbonisation will cost US$4.8 trillion per year, with a total spend of US$144 trillion by 20501. If we decarbonise by 50%, the annual cost will be US$1 trillion.

Public and private entities are going to have to massively ramp up funding for decarbonisation solutions and this is going to force entire industries to re-think their business models. For companies innovating these solutions or able to efficiently adopt them, there are substantial multi-decade growth opportunities ahead. For companies not able to transform into sustainable businesses quickly enough, there is a real risk of redundancy.

Key policy areas that can stimulate decarbonisation include establishing a price for carbon. The current price is too low, making the opportunity cost for businesses to emit carbon relatively easy to absorb. This will require establishing the Border Adjustment Mechanism to prevent carbon leakage (import of goods from jurisdictions where no carbon price is set).

Another policy to support decarbonisation is subsidising new technology. Subsidies for renewable energy in Germany, the US and the UK helped scale the technology so that renewable power is now the lowest cost form of energy generation in most parts of the world. Policymakers could also restrict the use of high emissions technology, for example the low emissions zones in cities such as London, Paris and Amsterdam or cutting road taxes for electric vehicles.

The potential of green hydrogen

Decarbonisation solutions include an array of technologies such as energy/tech companies, reuse platforms, recycling, buildings efficiency, industrials efficiency solutions, sustainable food developers, 5G and cloud computing and many others. One crucial technology is green hydrogen.

We cannot electrify everything, and some industrial processes and heavy transport need gas to operate. Green hydrogen can fill this gap. Most of the gas used as an industrial chemical is either generated through the gasification of coal or lignite, or through steam methane reformation, which typically uses natural gas as the feedstock. Neither of these processes are carbon friendly. Green hydrogen could nearly eliminate these emissions by using renewable energy to power the electrolysis of water - the process to extract energy in the form of gas.

Renewable energy such as wind or solar are competitively priced, but big electrolysers are expensive and in short supply. In addition, the infrastructure to store and transport hydrogen still needs to be built out. Just as wind and solar power were supported by governments through subsidies and tax breaks to become economically viable on a standalone basis, green hydrogen would benefit from similar assistance.

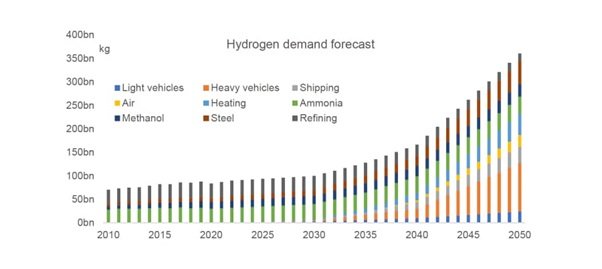

The scope for green hydrogen to be adopted across a wide range of sectors including in energy storage, to power fuel cell vehicles, and for heating, means that there is a large number of companies that could take advantage of a burgeoning hydrogen fuel economy. It has the potential to supply up to 25% of the world’s energy by 2050 and become a US$10 trillion market. It’s current price of US$ 2.5-6 per kg has fallen some 40% since 2015, but its estimated that US$2 per kg is the tipping point to becoming competitive across multiple sectors2.

Strong growth expected in hydrogen demand

Bron: Fidelity International, May 2021.

Green hydrogen is a clean, proven and versatile energy source that has the potential to be a substantial contributor to decarbonisation with the right sponsorship from authorities. Green hydrogen is just one decarbonisation solution; there is a raft of other technologies that span across business and consumer life, that if widely adopted could have a significant impact of cutting emissions.

Decarbonisation solutions are the pathway to net zero

Climate change is an immediate and all-encompassing challenge with the 1.5°C 2050 target already reached if we exclude the temporary cooling impact of coal particles; even the 2°C threshold is in peril based on current carbon reduction commitments. However, we don’t believe the battle is lost, although there is a mountain to climb in front of us. This will require enormous effort and global collaboration, with multiple channels of action including improved quality and transparency in national determined contributions (NDCs), a global carbon tax and pricing regime, support for emerging markets from developed markets, changes in consumer behaviour and large public financing commitments.

But to accomplish net zero, we need a realistic pathway towards the goal rather than just commitments; decarbonisation solutions provide this. These technologies are ready and viable but need to be scaled and some need to become economic first. We know this is possible and have already seen it done for wind and solar power. Game-changing innovations such as green hydrogen need similar support. We need financial backing where solutions are uneconomic and incentives schemes to accelerate adoption in other areas.

For decarbonisation solutions the potential for growth is huge. These solutions are applicable across multiple industries and will be in demand for decades ahead. The world desperately needs these technologies and, fortunately, some financial and policy support is beginning to flow through, but much more needs to be done.

Interested to find out on Climate Solutions? Fidelity Funds - Sustainable Climate Solutions Fund

References

1 Goldman Sachs, 2020.

2 Hydrogen Council: Path to hydrogen competitiveness, January 2020.

Important Information

This information must not be reproduced or circulated without prior permission. Fidelity only offers information on products and services and does not provide investment advice based on individual circumstances, other than when specifically stipulated by an appropriately authorised firm, in a formal communication with the client.

Fidelity International refers to the group of companies which form the global investment management organisation that provides information on products and services in designated jurisdictions outside of North America. This communication is not directed at, and must not be acted upon by persons inside the United States and is otherwise only directed at persons residing in jurisdictions where the relevant funds are authorised for distribution or where no such authorisation is required. Unless otherwise stated all products and services are provided by Fidelity International, and all views expressed are those of Fidelity International. Fidelity, Fidelity International, the Fidelity International logo and F symbol are registered trademarks of FIL Limited.

Continental Europe: We recommend that you obtain detailed information before taking any investment decision.

Netherlands: Investments should be made on the basis of the current prospectus and KIID (key investor information document), which are available along with the current annual and semi-annual reports free of charge from our distributors, and from our European Service Centre in Luxembourg, FIL (Luxembourg) S.A. 2a, rue Albert Borschette BP 2174 L-1021 Luxembourg. In the Netherlands, documents are available from FIL (Luxembourg) S.A., Netherlands Branch (registered with the AFM), World Trade Centre, Tower H, 6th Floor, Zuidplein 52, 1077 XV Amsterdam (tel. 0031 20 79 77 100). The Fund is authorised to offer participation rights in the Netherlands pursuant to article 2:66 (3) in conjunction with article 2:71 and 2:72 Financial Supervision Act.

GLEMUS3878-0122