MUFG: Impact delta variant on EM EMEA larger than anticipated

MUFG: Impact delta variant on EM EMEA larger than anticipated

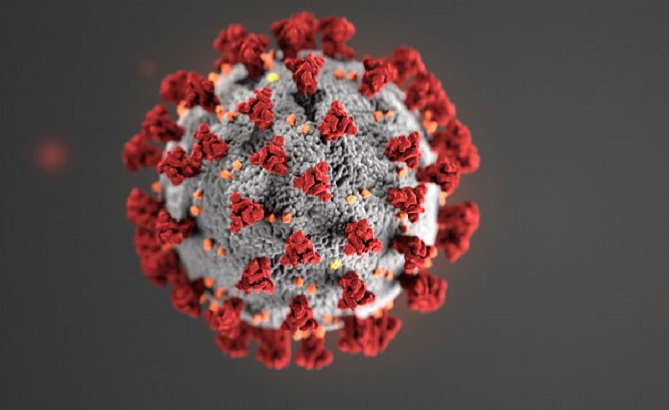

The impact of the COVID-19 delta variant on growth and inflation across EM EMEA is proving to be somewhat larger than we (and markets) had anticipated. We have lowered our Q3 GDP forecast to 3.2% (from 4.3%), reflecting hits to both consumer spending and production, whilst we raise our Q4 GDP estimate to 3.8% (from 3.5%), as delta is likely to ebb and the service sector recovery as well as the inventory rebuild resumes.

The delta variant and other disruptions are also likely to further raise prices of supply-constrained durable goods through year-end, albeit this will be more than offset by a normalisation in commodity prices. As such, we now forecast Q3 and Q4 inflation to ease to 7.2% (from 7.8%) and 6.5% (from 7.1%), respectively – likely signalling a slower rate hiking cycle going forward.

FX views

Concerns about slowing delta-led growth are weighing on EM FX, with all bar CLP, COP, INR and KRW down last week. After little new information regarding the FOMC’s policy stance in the July minutes last week, the market turns its eye to Jackson Hole (26-28 August) for future guidance (which may in fact not materialise).

Trading views

To put down last’s weeks price action to summer markets would ignore the huge size of outflows seen in some places which have opened up a significant discount for EM to DM markets signalling an uneventful Jackson Hole could trigger a meaningful (short) relief bounce.

Week in review

Over the previous week, Saudi Arabia and Qatar recorded marked improvements in their Q2 2021 fiscal data, whilst inflation eased in South Africa and Q2 GDP surprised on the upside in Israel.

Week ahead and calendar

In a light week ahead, Hungary and Romania report flash Q2 2021 GDP readings, whilst we get South Africa inflation data for July.

Forecasts at a glance

We expect full year EM EMEA growth of 4.3% (consensus 4.1%), reflecting the view that post-vaccine reopenings, accommodative fiscal policies, pent-up savings and limited scarring effects will support the recovery – albeit with considerable heterogeneity. We provide our real GDP, fiscal and current account balance, inflation, rates and FX forecasts for this year and 2022.

Core indicators

A stronger USD and continued risk-off stemming from delta variant apprehensions witnessed outflows from EMs for the second consecutive month (EM equity funds USD-2.4bn w/w; EM bond funds USD-0.2bn w/w).