SSGA-SPDR: Prosperous summer ahead for EM Debt?

SSGA-SPDR: Prosperous summer ahead for EM Debt?

It has been a challenging year for emerging market (EM) local currency debt. Losses in Q1 were caused by the combined effect of a sharp rise in US Treasury yields, which hit local bond returns, and the USD rebound. There was also caution toward EM assets given their inability to control the pandemic.

The second quarter saw a partial recovery, largely as currencies rebounded, but also helped by falling Treasury yields and the USD decline, on the growing optimism that EM countries would gradually get back to some sort of economic normality. Then came the FOMC meeting, which again knocked EM off track on fears of a wider market taper tantrum and the rebound in the USD.

Backpedalling by the US Federal Reserve (Fed) and the realisation that the first rate rise remains a long way off has seen many markets revert to where they traded prior to the FOMC announcement. However, the rebound in EM debt has been tepid, possibly because the USD has remained stronger. Indeed, the failure of EM local currency debt to fully rebound from early year losses in the same way that many other risk assets have point to there being some value in the asset class.

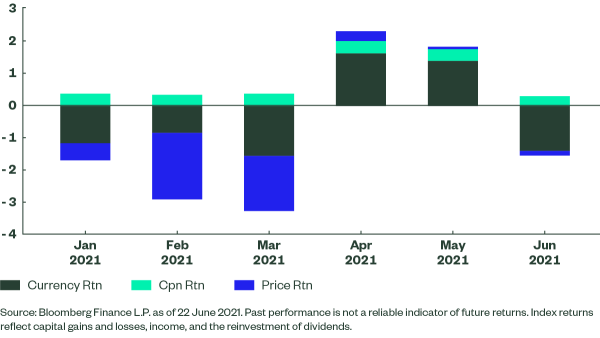

Figure 1: Bloomberg Barclays EM Local Currency Liquid Govt Index Returns

Yield Remains Key Draw for EM Debt

Clearly the big draw of EM debt is its yield, which, as noted above, has remained high in contrast to many other risk assets. The Bloomberg Barclays EM LC Liquid index has a yield to worst of over 4.4%, which is at its highest since the March 2020 sell-off. This is comfortably above the 3.9% yield offered by the Bloomberg Barclays US Corporate High Yield Bond Index, which is close to all-time lows.

Figure 1 shows the decomposed returns of the Bloomberg Barclays EM Local Currency Liquid Government Index and there is a clear 30-40bp of coupon returns that accrue on a monthly basis. For investors seeking returns in a low-yield environment, this is quite a draw. The appeal of yield is likely to increase as we get into the summer, when investors like to lock in trades with strong carry credentials.

Coupon is the least volatile element of returns. Currency returns are of more concern to investors. The post-FOMC rebound in the USD has been a major drag on EM returns in June but this bounce has left the USD looking overvalued. More specifically, when looking at the basket of currencies that comprise the Bloomberg Barclays EM LC Liquid Index, it was calculated to be 2.8% undervalued (cheap) versus the USD at the end of May and the trade-weighted USD (the DXY) has appreciated more than 2% since then.

While the currency markets will have one eye on when the Fed starts to tighten policy, this is likely to be some way off and, in the meantime, the wide current account and budget deficits, coupled with high US inflation, have historically proven to be drivers of currency weakness.

Current Conditions Suggest Strength Heading into Summer

This backdrop suggests that a continued rebound of EM currencies against the USD is a possibility. The catalyst should be stronger economic performance from EM countries as the pandemic starts to fade; data suggests that, even in places such as India, COVID infection rates have fallen rapidly.

The boom in commodity prices has also provided a boost for many EM nations and, as economies start to re-open, central banks are likely to be increasingly confident to start raising rates. This is already starting to occur with the central banks of Brazil, Czech Republic and Hungary all hiking rates. The fact that this process has started early should see local currencies strengthen both on the back of higher rates attracting capital and because it underlines their credibility.

Rate rises are not an ideal backdrop for fixed income assets but signs that central banks are getting ahead of the curve, along with currency appreciation, need not push longer bond yields sharply higher. This would especially be the case if US Treasury yields remain stable. US 10-year yields have fallen from their end of Q1 2021 peak and the summer is often a time when yields gradually grind lower.

With EM assets sensitive to risk appetite, a bout of market stability could enhance the appeal of EM debt as we expect capital inflows to gravitate toward assets where real returns remain high. This is what we have seen so far in 2021, with $155 billion in total inflows into EM debt to the end of May. Much of this has gone into Asian fixed income, a large part of which has been accounted for by China inflows.

With investors still underweight Chinese debt and yields on Chinese bonds at over 3%, we expect these inflows will continue. With the Bloomberg Barclays EM Local Currency Liquid Government Index consisting of 48% allocation to Asian issuers, this should aid stability.