J.P. Morgan: Markets currently expect one rate hike in the UK next year

J.P. Morgan: Markets currently expect one rate hike in the UK next year

The Bank of England delivered a modestly dovish surprise at its June meeting, acknowledging that despite recent stronger than expected inflation, it still expects this to be transitory.

Since the Bank last met in May, activity has continued to rebound strongly and headline inflation has now risen to 2.1% year on year in May. Our view is that inflation will continue to rise further above the Bank of England’s 2% target in the coming months and that not all of this will prove temporary.

We expect the current signs of tightness in the labour market, which the furlough scheme has preserved so well, to linger and in turn support upward wage pressure. Should this materialise, we expect the Bank to face increasing pressure to raise interest rates in the second half of 2022.

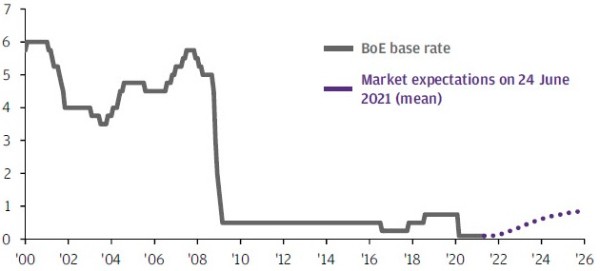

% base rate and market expectations

Source: Bank of England, Bloomberg, J.P. Morgan Asset Management. Market expectations are calculated using OIS forwards. Data as of 24 June 2021.