SSGA: Cautious Optimism for EMD

SSGA: Cautious Optimism for EMD

Emerging bond markets have enjoyed a strong rally since the sharp drawdown experienced in the teeth of the COVID crisis last year. As a result, valuations have recovered significantly even as some of the fundamentals have deteriorated — most notably on the fiscal and debt sustainability side. And while the start of 2021 has shown that smooth sailing cannot be guaranteed, there are reasons for cautious optimism, according to Lyubka Dushanova, Portfolio Strategist Emerging Market Debt at State Street Global Advisors.

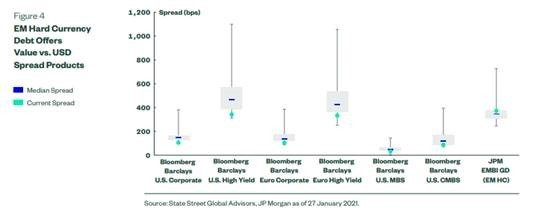

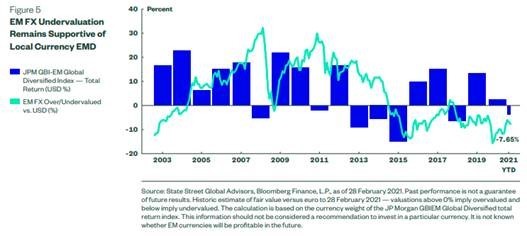

After the strong rally enjoyed since May 2020, the backdrop for EM debt is changing. Valuations have recovered and parts of the asset class are starting to look expensive, while the macroeconomic environment is also evolving; higher US Treasury yields are expected to remain a headwind. However, there are still pockets of value in EM FX and in high yield hard currency debt, and both EMD LC and HC offer compelling yield pick-up versus other fixed income investments. The macro backdrop remains broadly supportive with abundant liquidity and the hunt for yield expected to continue to drive flows into the asset class. On the fundamental side, deterioration in debt and fiscal metrics is balanced out by an improvement in EM external positions and improving growth prospects, although EM countries will need to return to fiscal discipline and invest in structural reforms in order to enjoy positive market sentiment over the medium term”, Lyubka said.