Monex: Turkish central bank sharply increases interest rates to support lira and limit inflation

Monex: Turkish central bank sharply increases interest rates to support lira and limit inflation

This is a commentary by Ima Sammani, FX Market Analyst at Monex Europe, on the interest rate hike of the Turkish Central Bank (CBRT).

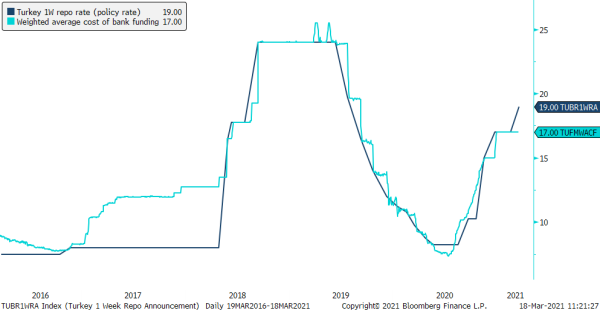

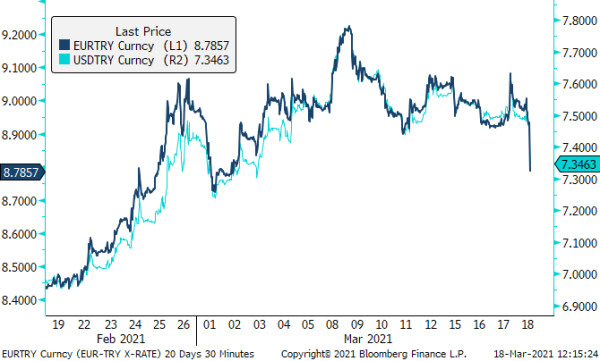

Not one to be outshone by the central bank of Brazil, the CBRT doubled expectations by increasing rates by 200bps today as its commitment to reducing the inflationary channel and meeting its end-2021 target was clear. The policy statement was explicit in highlighting most of the move was due to the adverse impact the exchange rate has had on the inflation outlook, with the lira weakening 7.5% between February’s meeting and today’s. The commitment to driving inflation lower and sheltering the lira from external pressures was welcomed warmly by markets. The lira jumped by over 2% against the US dollar and euro on the news with rates now sitting at a whopping 19% and real rates just shy of 3.5%.

Chart: Turkish lira welcomes CBRT’s commitment to driving down inflation.

The overdelivery signals to markets that the CBRT remains seriously committed to higher rates despite political pressure as mounting inflationary pressures remain a risk for the Turkish economy and the lira. Previous hiking cycles such as that of 2018/19 resulted in a terminal rate of 24%, but brought heightened political pressure in doing so. President Erdogan has never been an advocate of high rates as it undermines growth and runs contrary to his neo-fisherite view, but since last year’s change of guard, the CBRT has consistently signalled it aims to drive down inflation back to single digits, even if that requires “swallowing a bitter pill” according to Erdogan in November 2020. Since then, the central bank has been willing to go above and beyond market expectations to win back investors’ confidence that the orthodox policy is here to stay. The communication by the CBRT has arguably become even more important since the recovery in crude oil markets further compounded the impact weakness in the lira had on inflation.

Going forward, the CBRT’s decision on when to end the hiking cycle and at what point the terminal rate sits at will largely be determined by how quickly it can flatten the inflation channel and to what extent FX markets deem this acceptable. The next month or so will prove pivotal in this sense, but for now, it is a case of job done for Governor Agbal as the lira drives back towards the 7.00 handle.