Morningstar: European Investors Regain Confidence as Market Tide Lifts Many Boats in the Second Quarter

Morningstar: European Investors Regain Confidence as Market Tide Lifts Many Boats in the Second Quarter

Highlights from the report include:

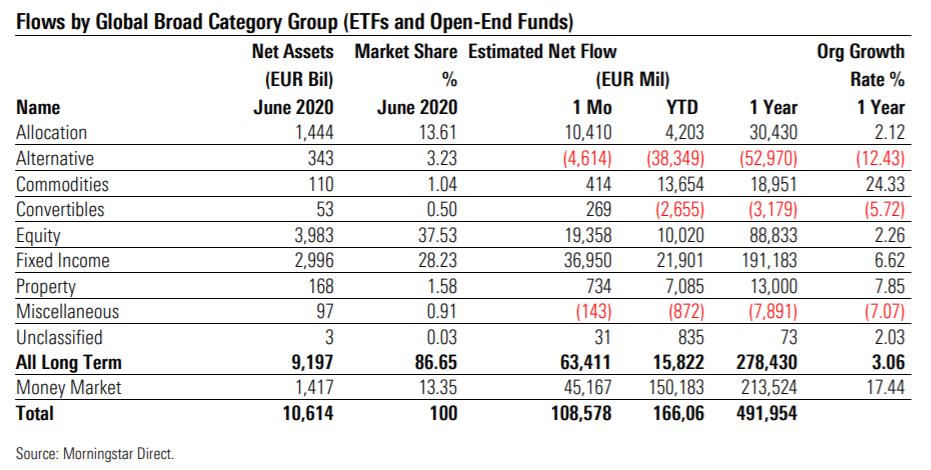

- Europe's fund industry benefited from the remarkable upward market journey. Assets under management in long-term funds rose to EUR 9.197 trillion at the end of June from EUR 9.00 trillion at the end of May. When including money market funds, assets rose to EUR 10.614 trillion from EUR 10.385 trillion.

- Long-term funds enjoyed their strongest month since January 2020, posting inflows of EUR 63 billion in June; second-quarter inflows amounted to EUR 164 billion. Those inflows more than compensated the outflows of EUR 148 billion that exited funds in the first quarter.

- Fixed-income funds attracted the highest inflows, gathering EUR 37 billion in June and EUR 105 billion in the second quarter.

- Equity funds took in net EUR 19 billion in June and EUR 51 billion in the second quarter. This compensated outflows of EUR 41 billion in the first quarter.

- Actively managed funds received subscriptions of net EUR 48.2 billion and thus upped index funds, which took in EUR 15 billion, on an absolute basis; when adjusted by size, however, flows sent to index funds were higher.

- By branding name, ING took in EUR 8.5 billion in June, followed by iShares and Pimco. IShares, Pimco, and BlackRock were the most successful fund families in the second quarter; Eastspring Investments, WisdomTree, and Merian Global Investors suffered the highest June outflows. Eastspring, La Francaise, and Invesco were the laggards in the second quarter.

Ali Masarwah, Director, EMEA Editorial Research, comments: “The first half of the year was a tale of two markets: While hell broke loose at the end of February as the crippling effects of the coronavirus pandemic on the global economy became clear and investors fled the fund market, asset prices bottomed out only one month later and started a spectacular recovery. The extensive monetary and fiscal support measures by central banks and governments worldwide have heartened investors, who still appear confident that the economy will rise from the doldrums in a V-shaped recovery. This is reflected by the inflows of EUR 164 billion that investors sent to the European fund market in the second quarter.”

Valerio Baselli, Senior Editor, EMEA Editorial Research, comments: “Bond funds were again the products of choice for investors in June. This holds true for actively managed funds and index funds alike. Actively managed bond funds enjoyed inflows of EUR 26 billion in June, bringing the second quarter’s total to EUR 75 billion. Corporate-bond funds, including the high-yield bond categories, enjoyed the strongest demand yet again. Actively managed global emerging-markets bond funds had their first positive month since December 2019, which reflects a return to confidence of bond investors for the prospects of emerging economies. In a remarkable turn of events, inflows sent to actively managed equity funds hit a 29-month high.”