J.P. Morgan: Investors have returned to corporate bond funds as sentiment has improved

J.P. Morgan: Investors have returned to corporate bond funds as sentiment has improved

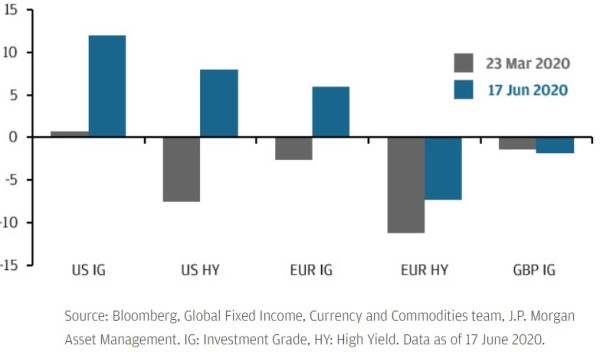

The Federal Reserve's (Fed’s) announcement on 23 March that it would buy corporate bonds for the first time as well as unlimited amounts of US Treasuries was a key factor in the improvement in market sentiment over recent months.

The Fed's credit purchases have since been slow to ramp up with ETF buying beginning in May at a very modest pace, yet the Fed's words alone have been strong enough for investors to flock back into corporate bond markets. Last week's news that the Fed will begin directly buying a broad portfolio of corporate bonds has underlined their commitment to ensuring that credit conditions remain easy. Central bank purchases could continue to provide support for credit spreads in the second half of the year, although investors should probably consider an increasingly selective approach as they look further down the quality spectrum.

Mutual fund and ETF flows as % of fund assets under management, 2020 year-to-date