Morningstar Publishes Taxonomy of European Climate-Aware Funds

Morningstar Publishes Taxonomy of European Climate-Aware Funds

Morningstar today published Investing in Times of Climate Change, a taxonomy to help climate-aware investors navigate the expanding array of options available to them in Europe.

This report analyses European-domiciled open-end funds and ETFs that have a climate-related mandate. These are funds that focus on avoiding climate risk or promoting the transition to a low-carbon economy. Morningstar tested these funds’ claims using a series of metrics, including involvement in fossil fuels, participation in carbon solutions, carbon intensity and carbon risk. Additionally, the report reviews climate-aware funds’ most common holdings and how these funds can fit into an investor's portfolio.

Key findings of the report include:

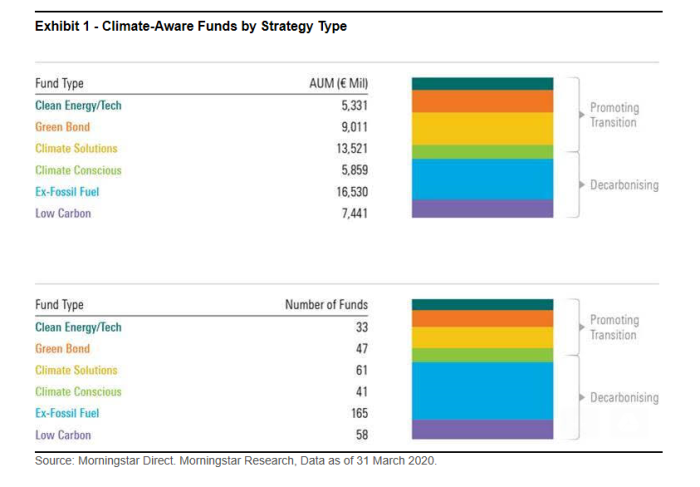

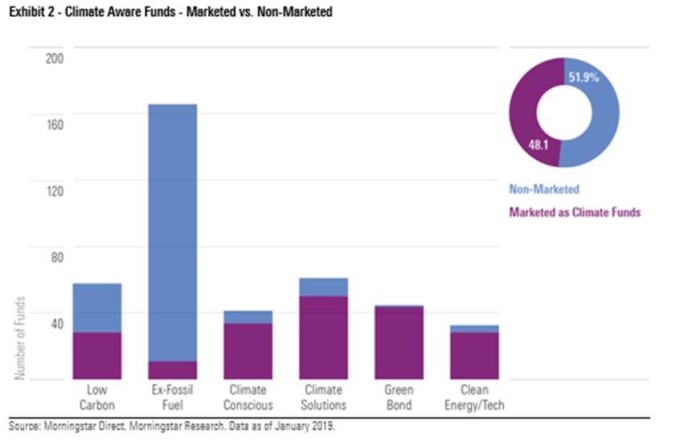

- Morningstar identified 405 open-end and exchange-traded funds in Europe with a climate-related investment objective. Close to EUR 60 billion of assets are held in climate-aware funds in Europe, as of 31 March 2020. Climate-aware funds focus on avoiding carbon risk or promoting the transition and can be sub-grouped into six types: low carbon, ex-fossil fuel, climate conscious, climate solutions, green bond, and clean energy/tech.

- The past couple of years have seen a surge in the number of climate-aware funds. In 2019, 76 new offerings came to market, following 67 new launches in 2018. In addition, many existing conventional and sustainable funds have either changed their mandate to focus on the "climate" theme or added specific climate-related criteria to their investment policy.

- Climate-aware funds largely deliver on their promises. For example, relative to their benchmark, virtually all low carbon funds do provide access to companies with lower carbon intensity, while climate solutions and clean energy/tech funds score high on carbon solutions.

- But there are surprises, too. For example, only 40% of ex-fossil fuel funds are fossil-fuel free. This is due to the varying definitions of fossil-fuel exclusions. Meanwhile, many carbon solutions and clean energy/tech funds carry some of the highest carbon risk.

- Within an asset allocation, low-carbon and ex-fossil fuel funds can substitute for a lot of core exposure, but climate-solutions and clean energy/tech funds, which represent more attractive options for investors looking to take advantage of the opportunities created by the green transition, are more suitable to hold as satellite holdings.

Hortense Bioy, Director of Passive Strategies and Sustainability Research, Europe, comments: “Investors are becoming increasingly aware of the risks and opportunities arising from climate change and are looking to position their portfolios accordingly. Asset managers have responded to this new demand by launching a flurry of climate-aware funds and tweaking existing strategies to incorporate climate-related criteria. Asset managers will continue to innovate, expand, and adapt their fund offerings as they strive to help reorient capital towards more climate-friendly investments, in line with the ambition of the EU Action Plan on Sustainable Finance.”