MUFG Daily Snapshot – Agressieve Fed houdt dollar in bedwang

MUFG Daily Snapshot – Agressieve Fed houdt dollar in bedwang

USD: Fed’s aggressive policy response is helping to dampen USD strength

The US dollar has softened during the Asian trading session as it continues to reverse last month’s surge higher especially against commodity-related currencies and the pound in the G10 space. The ongoing improvement in global investor risk sentiment in the near-term combined with the Fed’s aggressive policy response is beginning to weigh down more on the US dollar.

The size of the Fed’s balance sheet had already jumped to just over USD6 trillion in the week ending the 8th April, and is set to continue its unprecedented pace of expansion in the coming months after the Fed’s announcement of a another package of support measures totalling up to USD2.3 trillion. Fed Vice Chair Clarida has stated that the Fed will “use our authority forcefully and aggressively until we’re confident the economy’s recovered”. He believes demand has been impacted very adversely, and they’re trying to offset that with our policy to get the economy through this disinflationary period. He expects the Fed to keep rates where they are until the economy is on track to achieve maximum employment and price stability. In addition, he also defended the Fed’s decision to begin purchasing some types of high-yield bonds. He stated “several companies in

the US were investment grade up until this crisis hit…and what we said in our programs is if they’ve been downgraded after the date of the crisis they will have access to these new facilities”. He is not concerned by the threat of moral hazard in the current circumstances.

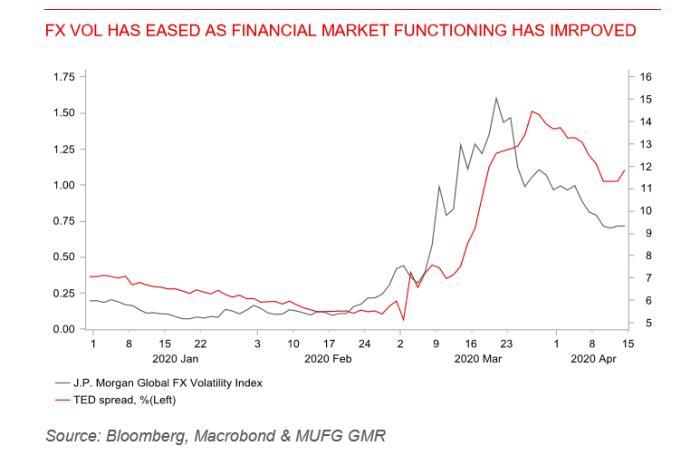

The Fed’s aggressive policy actions in recent weeks have helped to improve market functioning as well as reversing US dollar strength. It is now allowing the Fed to dial back some of their emergency operations. From the 4th May onwards, the Fed will conduct one rather than two overnight repo operations each day. A step that will half the amount of funds available to USD500 billion. It also plans to halve the frequency of its three-month repo operations, which also have a maximum size of USD500 billion, to once every two weeks. It follows an announcement from the Fed that it has started to slow the pace of US Treasury daily purchases to around USD30 billion from USD50 billion. Daily purchases peaked at USD75 billion from the 19th March to 1st April. Despite the recent slowdown in the pace of QE, we still believe the Fed’s aggressive policy response poses downside risks for the US dollar.

Commodity FX: China trade data & oil production cut agreement offer support The commodity-related currencies of the Aussie, kiwi, Canadian dollar, and Norwegian krone continue to outperform amidst broad-based US dollar weakness. It has resulted in the AUD/USD rate rising back above the 0.6400-level overnight to an intra-day high of 0.6432 as it continues to move further above the low of 0.5510 recorded on the 19th March. Commodity-related currencies are deriving support from the ongoing improvement in risk sentiment in the near-term. They have been boosted further overnight by the release of better than expected trade data from China.

The latest trade report revealed that the contraction in Chinese exports eased from an annual rate of -17.2% in January and February combined to -6.6% in March. The annual rate of contraction for imports also eased from -4.0% to -0.9%. The pick-up in shipments reflected the re-opening of factories in China while domestic demand began to recover as well. However, the improvement is expected to prove short-lived as external demand is set to slump in Q2 as other major economies have since adopted lockdown measures. China’s economy will struggle to return to pre-Covid growth even as domestic demand appears set to recover further in the coming months. It should though help imports to hold up better than exports.

Oil-related currencies have also derived support from the largest oil-supply agreement in history (click here). The oil production agreement saw OPEC+ commit to i) reduce exports by 9.7m b/d in May and June; (ii) followed by a relaxation to 7.7m b/d in H2 2020, and to; (iii) 5.8m b/d between January 2021-April 2022. Meanwhile, other non-OPEC+ members are “committing” to “involuntarily” reduce output by 3.7m b/d. However, our oil analyst Ehsan Khoman believes that “the prospects of a sustained oil price rally are vanishingly slim”. We maintain our view that the unprecedented oil price collapse is not yet over. The recent rally in oil-related currencies such as the Canadian dollar, Norwegian krone and Russian rouble are built on shaky foundations and vulnerable to another correction lower.