WisdomTree: What does the recent sell-off tell us about gold as a safe haven?

WisdomTree: What does the recent sell-off tell us about gold as a safe haven?

Nitesh Shah, Director, Research, WisdomTree

In the week of the 9th to 16th March 2020, gold prices fell 10%. In that week the S&P 500 fell 13%, the DAX fell 18% while the IBEX 35 fell 20%. Gold hardly looked like the defensive asset its widely recognised as when looking at these headline figures. However, scratching beyond the surface, we can see that gold was playing its traditional role.

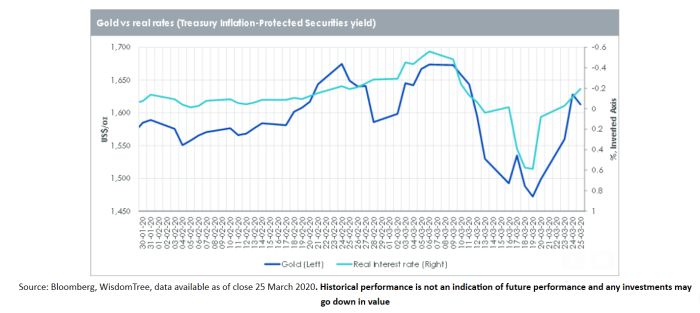

In times of extreme market volatility, when there are lots of margin calls on risky assets, investors often scramble for liquid assets to meet those margin calls. Gold and Treasuries are two important assets in that category. They were both being sold in order to provide liquidity for other purposes. Gold and Treasuries prices fell in tandem. Treasury yields, which rise when Treasury prices are falling, moved in lock-step with gold.

The fact that gold fell alongside equities is not unusual, despite its long-term correlation with equities being negative (-0.15 between 1980 and 2020). During the Great Financial Crisis, gold prices initially fell close to 20% between September and November 2008, before rising 170% to a peak in 2011. So, gold initially fell alongside equities during times of liquidity constraints. As central banks injected liquidity into the financial system, gold began to behave with its usual traits.

We expect a similar pattern in 2020. Already the injections of liquidity and the fact that equities are not in free-fall, has eased selling pressure on gold. The largess of central bank and fiscal authority action in of itself is likely to drive a gold price rally. Gold, is seen as the antithesis to fiat currencies. The fact that its supply can’t be expanded at will means that it should hold its value better than the value of the currencies issued by the central banks that are expanding monetary policy.

Despite all the stimulus offered by central banks and fiscal authorities, the length and amplitude of the current COVID-19 shock is largely unknown. Therefore, it is hard to judge whether the stimulus will be enough. We have developed a number of scenarios for gold based on how long the crisis and therefore policy easing lasts.

In a “v-shaped” economic recovery, where the damage to economic growth is largely in the first half of the year and policy can be tightened in the second half, we see gold prices rising initially to US$1965/oz by June 2020, but to fall thereafter to US$1370/oz by December 2020. In a “u-shaped” economic recovery, where the global economy needs continued stimulus during 2020, gold prices are likely to surpass US$2090/oz in June 2020 and stay close to that level for the rest of the year.

In the “v-shaped” economic recovery investor sentiment toward gold starts to wear lower, as “risk-on” mindset dominates in the latter part of the year. Whereas in the “u-shaped” recovery sentiment toward gold remains very high reflecting the uncertainty in the economy and the longer-term implications of a loose policy setting.

In the “v-shaped” economic recovery Treasury yields rise as monetary policy is tightened. Whereas in the “u-shaped” Treasury yields rise as monetary policy is continuously loosened.

Ours scenarios are based on our model of gold price behaviour, calibrated on data between 1995 and 2017. However, we acknowledge that many aspects of today are vastly different to the past. As we move so far out the historic sample there is potential for gold to surprise either on the upside or the downside.