ECB preview door Monex - Geen plaats voor ECB-haviken

ECB preview door Monex - Geen plaats voor ECB-haviken

Bart Hordijk, valuta-analist bij Monex Europe, blikt in het Engels vooruit op de ECB-beleidsvergadering die aanstaande donderdag plaatsvindt.

'Confidence in the European Central Bank’s inflation expectations is eroding while risks to growth accumulate, which implies the ECB has but one trail to walk: a more dovish one. The main reason is pretty straightforward: core inflation remains stubbornly low, while headline inflation is falling as well, despite the higher energy prices in recent months. This demonstrates how the Eurozone economy continues to struggle to produce anything that even resembles the most lukewarm version of inflation. On top of that, the horse the ECB is betting on for higher inflation – inflation stemming from tight labour markets – is failing to clear all hurdles, and while not completely out of the race, it’s definitely not shining in the front. The tight labour market in most notably Germany is finally producing the expected wage growth, but for reasons about which economists at the moment speculate heavily, this wage growth refuses to be translated into a higher inflation rate.

Meanwhile, the manufacturing sector continues to struggle, with the latest Purchasing Manager Index showing new orders have declined for 8 consecutive months, demand remains weak in domestic as well as in export markets and employment growth was negative in this sector for the first time in 56 months. The Services sector looks less pale in comparison according to activity indicators like the PMI reports but is not strong enough to boost economic growth tremendously. Q1 saw a positive surprise after low PMI scores, suggesting purchasing managers had been overly pessimistic. However, such a feat may not be repeated again in Q2 and when the moment of reckoning comes with Q2 hard output data, GDP growth rate may come in at a rate of a mere 0.2%.

Finally, the recent breakdown of the trade talks between the US and China in all but name have made it abundantly clear the Eurozone economy can forget about global demand lending its ailing manufacturing sector a helping hand. This is unlikely to happen in a moment when volumes of global trade flows are under pressure. In short: domestic as well as external headwinds keep economic growth pinned at a low rate.

The policy implications from the ECB this coming Thursday will revolve mostly around details concerning the Targeted Long Term Refinancing Operations that provide banks with more liquidity. On a surface level, it seems like the main questions being how generous the LTRO programme will be and how much of it will actually be used as some banks can already obtain funding at the open market at a rate lower than would be offered under the LTRO program. We argue that the main impact of LTRO announcement will lie in their signalling function, as a generous TLTRO programme implies a pessimistic ECB, which also pushes back the first rate hikes further into the backend of 2020. It goes without saying that such a dovish signal through the TLTROs would send EURUSD further towards 1.10.'

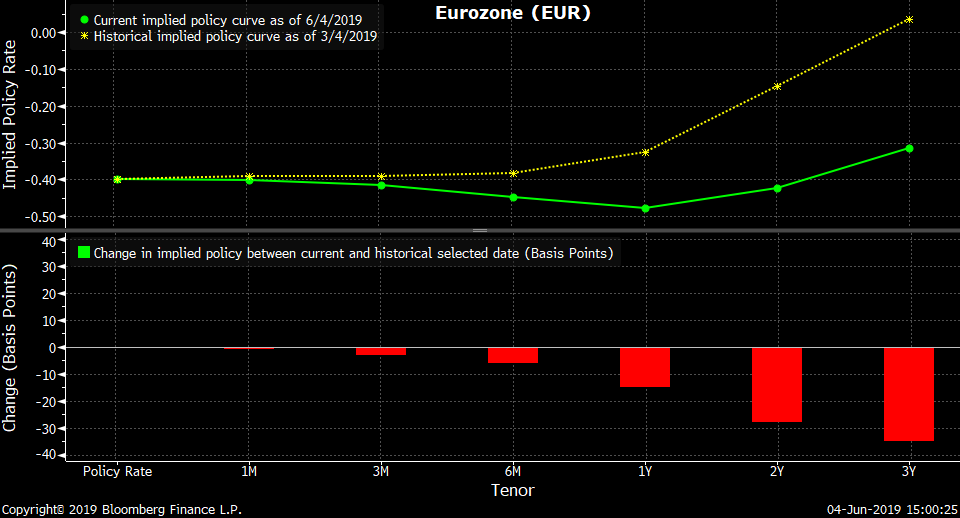

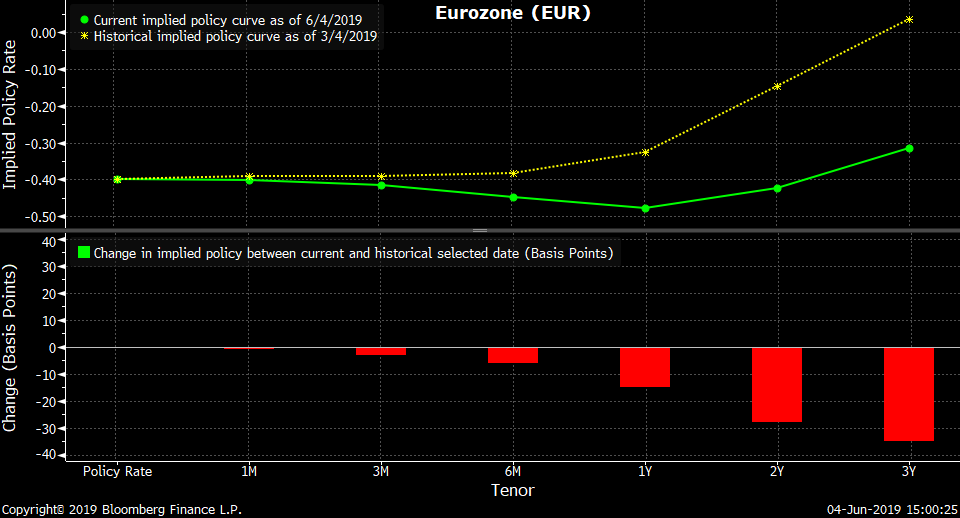

Chart 1: Pricing for ECB policy rates fell across the curve over the last three years, indicating much of the dovish shift of ECB policy is already priced in.'