Alain Richier: Money markets - back in the spotlight?

Alain Richier: Money markets - back in the spotlight?

For the first time in over twenty years, the ECB announced a hike of 75 basis points in its deposit facility rate on September 8th 2022, after a first one of 50 basis points in July. And more appears to be on the way. What implications does this have for investing in money markets?

By Wim Groeneveld

By Wim Groeneveld

According to Alain Richier, Head of Money Market at Ostrum Asset Management (an affiliate of Natixis Investment Managers), these increases could present an opportunity for investors in money market funds. Although they suffered from negative returns until recently, money market funds are becoming attractive to investors.

Why are money markets becoming interesting for institutional investors just now?

‘The role of money markets is to enable financial institutions and corporates to borrow and lend liquidity over the shortterm. Short-dated negotiable debt securities are issued and traded on these markets. European regulators require all money market funds to invest in short term securities of very high credit quality (European Money Markets Funds Regulation, June 2017) and to meet liquidity criteria on one day and seven days.

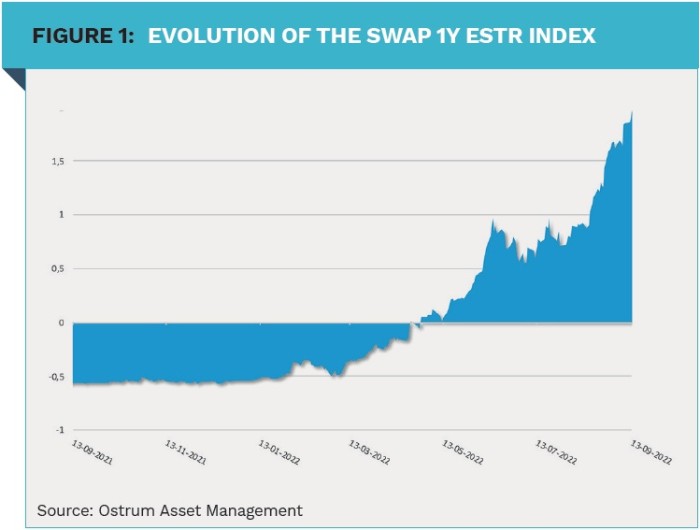

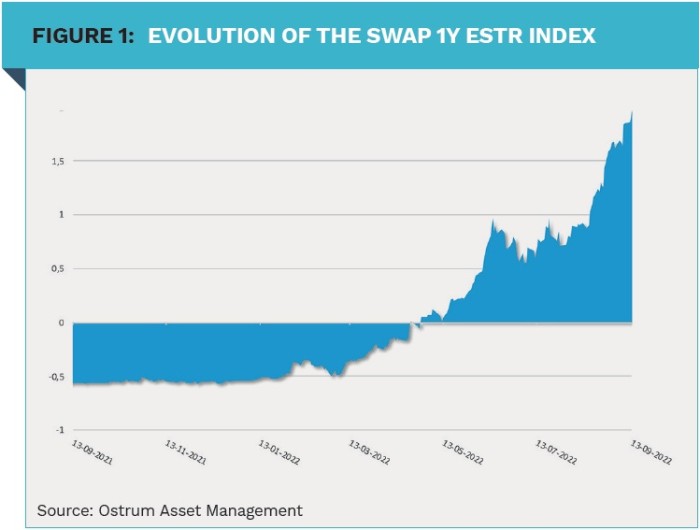

Because of the very high inflation in Europe recently, the ECB seems determined to raise its rates quite significantly. Money market funds, whose objective is to outperform the ESTR Index – which represents the average rate at which banks exchange liquidity – are therefore highly dependent on the ECB deposit rate.

The current market environment – with two hikes of the ECB in July and September increasing the deposit facility rate from -0.50 to 0.75 – is very favourable to institutional investors, who can thus invest in levels of yield to maturity positive after more than ten years into

negative territory.

Furthermore, money markets funds have a sensitivity to interest rates close to zero, which makes them resilient while preserving relatively well the valuation of the securities in portfolios from central bank rate hikes. The benefit for investors is therefore to invest in funds with very low volatility and near zero rate sensitivity with an attractive yield. The risk/return ratio seems attractive for institutional investors.’

How can investing in money markets be combined with an ESG approach? How can a successful coexistence be realised?

‘The ESG elements are integrated at all stages of our analysis because they may affect the sector or the company’s own business model and as such they may have a material impact on its financial condition today or in the future.

These indicators must be considered when we invest in money markets. Each issuer is monitored by our teams of analysts who assign an ESG rating. Our money market funds are also SRI labelled by the French government. I believe that investing in a security with a strong ESG rating reduces its specific risk because the probability for this issuer to have a controversy is reduced.

In addition, we believe in the energy transition and the decarbonisation of the economy. We also attach importance to gender parity and to the transparency of data: these are our axes of engagement. It is therefore natural that we favour the investment on issuers with a virtuous attitude over those who do not, because we think that the former will outlast the latter.

A successful coexistence can be achieved without significantly deteriorating the performance of money market funds. We have seen in the past that many issuers with good governance, and which are considering extra-financial criteria, were those with very good valuation levels and lower risks. We found a correlation between issuers with a good ESG rating and those with good resilience in the money markets.’

What role can money market funds play in the ESG mission pursued by institutional investors?

‘Money market funds could play a key role in the ESG mission pursued by institutional investors. Our engagement leads us to invest in issuers with good ESG ratings. Because this market is very important because of its size, it influences a large proportion of issuers looking for refinancing.

By taking extra-financial elements into account when we invest, it constrains companies to comply with ESG requirements. Indeed, companies with poor ESG ratings – such as those with high carbon emissions – will have a lower demand from investors and consequently higher refinancing costs in the market.

This will encourage them to take measures to improve their extrafinancial guidelines if they want to continue to be able to be refinanced without additional costs. We believe that this method can significantly constrain companies in view of the results it has demonstrated these last years.’

Do you also believe in exclusion? And is a good level of engagement possible?

‘We believe in exclusion and we apply it to certain sectors or companies whose practices are not in line with our values. For example, our company has not made any new investments in issuers where more than 10% of the production is related to oil and unconventional gas and which are making more than 10 million barrels of oil equivalent. This policy extends to companies involved in the entire production value chain of the upstream sector known as ‘Upstream’ (exploration, development and exploitation). We also exclude from our investments those who make their profit from controversial weapons, but also issuers with a governance classified as worst offenders and whose governance practices are, in our opinion, not fundable.

I think that exclusion is necessary because it is a stronger measure than that of a poor ESG rating. The threat of no longer investing in issuers which are considered as worst offenders leads companies to comply with ESG requirements if they would like to be able to be financed by our company.’

What returns do you expect can be achieved from investing in money markets in the coming years?

‘According to market considerations regarding the expectations of future central bank increases referring to the ESTR 1-year swap rate curve, the market already anticipates a return of around 2% in mid-2023, to which we add a credit premium. This can bring the yields of money market funds to around 2.5% over the coming months and years.’

|

SUMMARY

The current market environment is very favourable to institutional investors.

Money markets funds have a sensitivity to interest rates close to zero, which makes them resilient and preserve relatively well the valuation of the securities in portfolios from central bank rate hikes.

A successful coexistence between investing in money markets and an ESG approach can be achieved without significantly deteriorating the performance of money market funds.

|

|

Disclosure

For Professional Investors only. All investing involves risk, including the risk of capital loss. Please refer to the prospectus of the fund and to the KIID before making any final investment decisions. For more information on the exclusions approach, please refer to the following website: https://www.ostrum.com/en/acting-responsible-investor. This material has been provided for information purposes only. Provided by Natixis Investment Managers International, Nederlands. (Registration number 000050438298). Registered office: Stadsplateau 7, 3521AZ Utrecht, the Netherlands.

|