WisdomTree: Quality, the style that doesn’t go out of style

WisdomTree: Quality, the style that doesn’t go out of style

By Pierre Debru, Head of Quantitative Research and Multi Asset Solutions at WisdomTree

Short of a miracle, 2022 will be remembered as a pretty difficult year for investors. Stock markets have posted their worst first half in decades. Bonds have completely failed to diversify, posting incredibly deep losses.

Equity investors have had to contend with decade-high inflation, increased uncertainty, elevated volatility and increasingly hawkish central banks.

Recessions, across developed economies, are now becoming more likely. Equity investors’ latest hope of a respite, delivered in the form of less rapid rate hikes from the Federal Reserve, were dashed by Fed Chairman Powell’s speech at Jackson Hole.

How should investors position their portfolios in this environment?

In such an uncertain environment, picking the right allocation is incredibly difficult:

- Low volatility stocks tend to do well in recessions, but they suffer greatly when rates go up.

- Value stocks do well when rates and inflation go up, but they tend to be more cyclical and suffer from sharp declines in economic growth.

- Growth or small-cap stocks are ill-suited to periods of low growth and rate increases due to the large negative impact of discount factor repricing of their valuation.

If history is any guide, it would seem that a robust approach to the current environment would be stocks that combine:

- Defensive aspects, such as the capacity to resist strongly in recessions and equity drawdowns.

High pricing power to be able to fight margin compressions.

Capacity to outperform later on in the cycle when investors become more selective in their allocation.

All of this appears to point toward high-quality stocks.

The all-weather style

Investment factors ebb and flow between periods of relative under- and outperformance, depending on where we are in the cycle. Value and size have historically tended to fare best in early cycle periods.

One big exception is quality—in our view, the most consistent of all factors.

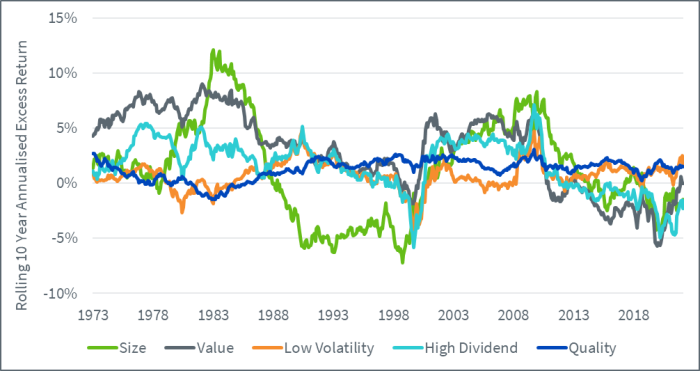

Sure, quality can lag in the sharp risk-on rallies that typically mark the start of an early cycle snapback. But those environments don’t tend to last, and neither does quality underperformance. In fact, there hasn’t been a rolling 10-year period when quality underperformed since the late 1980s.

Figure 1 exhibits the rolling outperformance of different US equity factors versus the market over periods of 10 years since the 1970s, based on the data from a famous academic: Kenneth French.

On average, over periods of 10 years, quality is the factor that has historically delivered outperformance the most often by a significant margin (88% of the time, the second best only hit 77%). It is also the factor that exhibited the smallest worst performance. This highlights the potential of quality as the ‘all-weather’ factor.

Investors would be wise to consider quality as their portfolio anchor—not just today, but always.

Figure 1: Rolling 10 year annualised excess returns of US factors versus the market

Sources: WisdomTree, Kenneth French, data as of 31 July 2022 and represents the latest date of available data. Value: High 30% Book to Price portfolio. Size: Low 30% portfolio. Quality: High 30% portfolio. Low Vol: Low 20% portfolio. High Div: High 30 portfolio. Market: all CRSP firms incorporated in the US and listed on the NYSE, AMEX or NASDAQ. Historical performance is not an indication of future performance, and any investments may go down in value.

Quality or Quality+

Building an equity portfolio to focus on a given equity factor is a delicate exercise. All factors are interconnected, and all companies have some exposure to all the factors. When portfolio managers push the cursor toward one factor, it tends to change the overall portfolio exposure.

This is particularly true with quality. When trying to create a ‘pure’ quality exposure, it is easy to:

- Focus only on a handful of high-quality companies and create a portfolio that is full of idiosyncratic risk (that is, company-specific risk), and smaller caps leading to a portfolio that loses its all-weather characteristics.

- Forget about valuations and create an expensive stocks/growth tilt that turns the portfolio from defensive to cyclical.

When investors and brokers are thinking about a core equity exposure with all-weather characteristics and that is well suited for the current environment, a combination of highly profitable companies with solid dividend paying credentials appears to tick most of the boxes.