State Street SPDR ETFs: ESG strategies more than doubled in two years

State Street SPDR ETFs: ESG strategies more than doubled in two years

Markets remain challenging given the possibility of recession, the peaking of inflation and the level of terminal interest rates unknown. However, one consistency is that investors returning to the equity markets in recent months have often chosen an ESG ETF exposure.

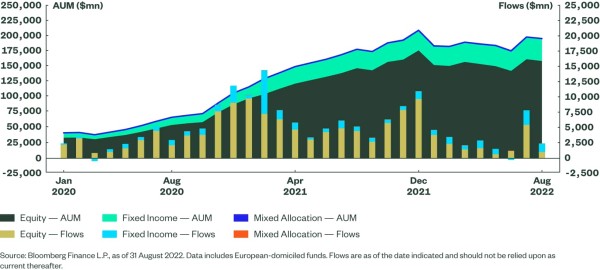

ESG funds have not been immune to the market volatility this year. Many best-in-class ESG stocks have struggled and specialised indices have fallen along with the market. This difficult environment has served as a test for the resilience of the strategies as well as demand from investors for ESG investment. As Figure 1 illustrates, through 2020 and 2021 there were healthy inflows into ESG funds, helped by ESG strategies posting the strongest returns versus other styles. Moreover, the higher returns were combined with relatively low volatility. During this period, there was a rapid pace of new fund launches.

In 2022, the relative underperformance of ESG strategies stems partly from underweight positions in the energy sector (MSCI World Energy is up 30% year to date versus a fall of 22% in the broad market). Another common area of low exposure is aerospace and defence, which has been driven up by the war in Ukraine. ESG portfolios tend to have a growth bias and are more expensive, which has also been unhelpful amid rising inflation and interest rates.

Figure 1: ESG ETF Flows Recovering from 2022 Lows

We’ve had a lot to worry about

Through 2020 and 2021, flows into ESG ETFs (both equity and fixed income) were driven by investors switching their core allocations to ESG-compliant equivalents. This trend gained momentum in light of the greater consideration given to social factors during the COVID pandemic. The trend was further reinforced by activity from the EU to support a climate agenda and enhancing regulations to support sustainable investing (such as SFDR), and the UK hosting COP26. Assets invested in ETFs with ESG strategies more than doubled during this two-year period.

Rebecca Chesworth, Equity ETF Strategist at State Street SPDR ETFs:

“This year, investors have had a lot to worry about. Flows slowed as investors sought higher levels of portfolio protection rather than continue switching into ESG. Focus has turned to central banks and monetary policy and their impact on economic growth. Nevertheless, the underlying drivers of end-user demand and regulation remain supportive. Figure 1 suggests a tentative return of inflows over the two previous months and continuing in September. This is more meaningful because of the weak flows in equity and fixed income ETFs in general.”