PineBridge Investments: Understanding sovereign ESG risk in emerging markets

PineBridge Investments: Understanding sovereign ESG risk in emerging markets

One of the primary challenges when considering ESG risk of sovereign bonds lies in identifying which indicators are the most informative and predictive.

By Ilke Pienaar, Head of Sovereign Research Emerging Markets Fixed Income, and Jonathan Davis, Client Portfolio Manager Emerging Markets Fixed Income, both working for PineBridge Investments

Within our Emerging Income Debt Team we have long integrated ESG risk within our fundamental credit analysis. For more than five years we have formally assigned ESG scores to all emerging market issuers under our coverage. Corporate bond markets are supported by standard ESG reporting requirements and by several dedicated ESG research firms, which provide investors with the data necessary to perform in-depth risk analysis and to enable their investment decisions. For sovereign bond issuers, however, those metrics have historically been harder to define and collate.

Investors look for indicators that influence economic growth as well as external and fiscal balances over the near, medium, and long term.

Environmental factors

It’s important to identify near-term risks from weather hazards, medium-term risks associated with the carbon transition, and the longer-term health and productivity implications of environmental risks. To do so, we reference fossil carbon dioxide emissions data, oil rents (the difference between crude oil production value and the total cost of production) as a percentage of GDP, and the sovereign’s exposure and vulnerability to natural hazards, along with its biocapacity reserves or deficits (referring to the ability to regenerate what the population demands).

Social factors

Social conditions have an impact on a country’s labor force and the stability of its institutions. Income inequality feeds discontent, which can evolve into protest movements that may impede productivity and make a country’s economic growth more volatile. Inequalities and labor rights deficiencies can point to potential near-term risks, while education indices and average years of schooling help indicate the future productivity and skill level of a country’s workforce. The age dependency ratio also helps set expectations for how the aging of a population might affect fiscal balances. Lastly, safe and secure societies are more productive, and the World Justice Project indices help quantify order and security.

Governance factors

Strong economies are built on a foundation of stable institutions, sound policies, and regulation – all areas that rule-of-law and economic freedom indices help to quantify. The stability and predictability of government have a direct impact on sovereign creditworthiness, and Transparency International’s Corruption Perceptions Index provides a view of governmental corruption around the world. Investment is a key building block of sustainable economic growth in emerging markets, and low corruption coupled with good-quality institutions and governance work together to give investors comfort in the relative safety of their assets, which in turn encourages higher rates of investment.

Engaging with governments on ESG

Engagement with sovereign issuers can pose challenges, as investors do not have the same recourse to the decisionmakers as they do in the corporate debt or equity markets, and government interests are not always aligned with those of sustainability-focused investors. However, the investment management industry has been addressing the need for greater leverage by, in many cases, formally organizing and approaching governments as a collective group rather than as individual investors.

The ability to effect change may rely on the sovereign’s dependence on external financing, particularly for smaller or poorer countries. Yet by presenting ESG issues as potential economic risks or paths to more robust, sustainable economic development, the market finds that governments are more willing to engage and take investor recommendations into consideration on matters of policy. A powerful example can be found in Brazil, where a coordinated effort among active investors to communicate the risks to future funding and benefits of stronger regulation contributed to policy changes regarding deforestation and protection of the Amazon in 2020.

Putting sovereign ESG investment into practice

For many investors, the sovereign bond market remains the primary access point to EMD. This is particularly true for the growing subset of EMD funds focused on sustainable investment objectives, most of which have a sovereign investment benchmark. To meet growing demand from asset owners and asset managers for sustainable investment strategies, many index providers now offer ESG indices.

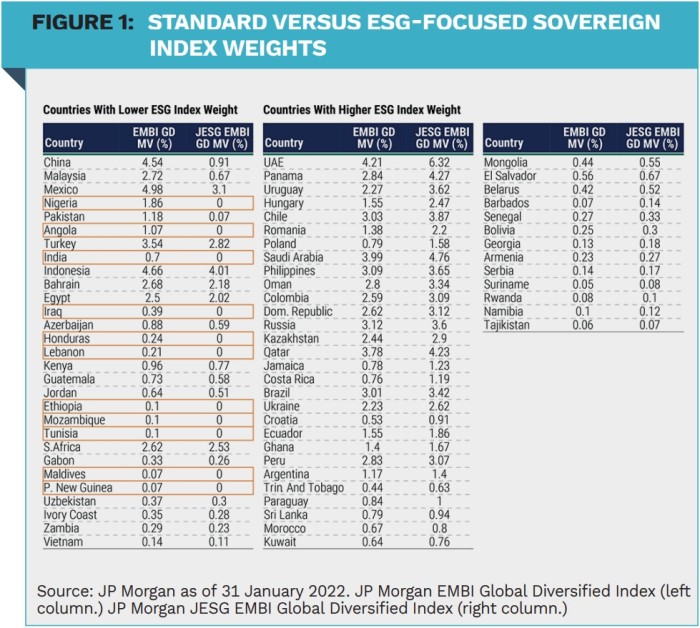

JP Morgan’s suite of EM bond indices are among the most widely used benchmarks, and in 2018 JP Morgan launched the ESG version of its flagship EM Bond Global Diversified Index, which is designed to provide a benchmark for sustainable sovereign bond investment strategies. While the intent is clear, the screening methodology may be more opaque. ESG integration is defined simply as being based on a scoring framework that utilizes Sustainalytics and RepRisk data, where better-scoring issuers are given a larger weight within the ESG index than in the standard EMBI Global Diversified index. Of the 71 countries within the standard index, only twelve – Angola, Ethiopia, Honduras, India, Iraq, Lebanon, Maldives, Mozambique, Nigeria, Papua New Guinea, and Tunisia – are excluded from the ESG index (see Figure 1).

Whereas investors in corporate bonds or equities can analyze uniform data with respect to environmental objectives, such as climate change mitigation or adaptation, sovereign investment strategies rely on the discretion of investment managers to decide which governments are best aligned with their clients’ sustainable investment objectives. Looking across the ESG index universe, we believe several countries with meaningful index weights are likely not aligned with such objectives, given concerns regarding environmental and social impact of general governance risks.

Among EM sovereign bond issuers, the strong links between ESG risk and credit-worthiness suggest that forward-looking ESG analysis can help identify credits that are improving and offer opportunities for attractive returns. Reform efforts and improvements in risk factors for specific companies and industries may be ahead of official government efforts, including changes to fiscal or regulatory policy, that would improve weaker ESG rankings, and tapping into these misalignments may provide ESG-driven alpha opportunities for portfolios.

We believe investment in sovereign bonds within sustainable investment strategies should be more country-specific in the context of a global portfolio, where investments can span the breadth of EM fixed income markets, both sovereign and corporate. In short, our view is that sovereign investment should be focused on countries that are truly aligned with our investment objectives, rather than managed against an index that may itself introduce concerns for sustainability-focused investors.

|

SUMMARY While the analysis of ESG risk in emerging markets is universal and well understood for corporate issuers, it’s less clear how investors should quantify the ESG risk of sovereign bonds. Investor engagement can also shine a light on important ESG issues that might otherwise go unaddressed in parts of the world where access to information or freedom of the press may be limited. Investors should consider not only the current state of sustainability risks, but also the trajectory of those risks over the medium to long term in their ESG analysis of sovereign bond issuers. |

|

Disclosure Investing involves risk, including possible loss of principal. The information presented herein is for illustrative purposes only and should not be considered reflective of any particular security, strategy, or investment product. PineBridge Investments is not soliciting or recommending any action based on information in this document. Any opinions, projections, or forward-looking statements expressed herein are solely those of the author, may differ from the views or opinions expressed by other areas of PineBridge Investments, and are only for general informational purposes as of the date indicated. |