J.P. Morgan: Fed expects higher rates for longer

J.P. Morgan: Fed expects higher rates for longer

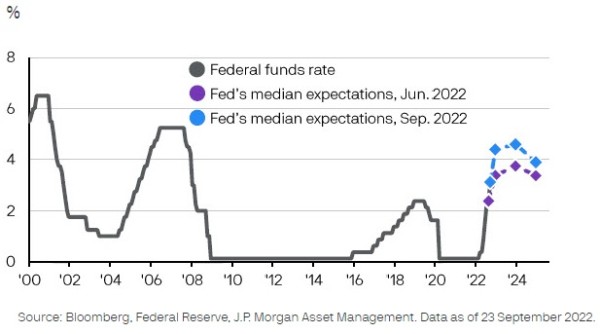

The Federal Reserve (Fed) raised rates by 75 basis points as expected in September. While Chairman Powell's press conference offered little new for investors relative to the hawkish tones at Jackson Hole, revisions to the Fed's 'dot plot' forecasts were more interesting.

The median participant of the Federal Open Market Committee now expects rates to hit 4.375% by year end, which implies a further 125 bps of rate hikes over the two remaining meetings in 2022. Importantly, the forecasts now also project that rates will remain above 4.5% by the end of 2023 despite an expected rise in unemployment, highlighting the Fed's willingness to tolerate some economic weakness to bring inflation back under control.