Amelia Tan: How to achieve net zero as soon as possible

Amelia Tan: How to achieve net zero as soon as possible

Institutional investors need to fully understand climate change risks and these risks must then be translated into their investment portfolios. Thorough analysis and active ownership are therefore of great importance, according to Amelia Tan, Head of Responsible Investment Strategy at LGIM.

By Amelia Tan, Head of Responsible Investment Strategy, Legal & General Investment Management

What does ‘net zero’ mean and why is it important?

‘Net zero is shorthand for the global effort to balance carbon-emitting ‘assets’ with carbon-absorbing ‘liabilities’. We are focused on our net zero efforts because we recognise that the effects of climate change will be detrimental to the world, to our planet, to people and to national economies.’

Reducing the carbon footprint of a portfolio is also relevant within the framework of net zero. What should be the components of a net zero approach for investors?

‘Given the gravity and scale of the challenge, investors should develop a net zero strategy to inform and define their decision-making. How this is precisely defined will be up to each individual investor, but we see these as the key pillars that should inform any net zero strategy:

- Setting targets.

- Strategic asset allocation.

- Policy advocacy in your communications.

- Activity around engagement and governance.’

In what way could active ownership contribute to net zero in 2050?

‘Active ownership can contribute to reaching net zero by 2050 in three steps: identifying key issues, engagement with stakeholders and, where necessary, escalating to sanctions over ESG issues. By working through these questions, investors can assess the activities of companies, enter a dialogue with stakeholders and through this engagement, hold these companies to account for their progress toward net zero.’

How should or could a decarbonisation strategy work together with an engagement strategy?

‘We see the route forward as being a combination of continuing partnerships with stakeholders and the setting of rigorous targets. For example, we are committed to working with our clients to reach net zero in greenhouse gases (GHGs) by 2050 and we aim to have 70% of our assets under management aligned with this target by 2030.

We are focused on our net zero efforts because we recognise that the effects of climate change will be detrimental to the world, to our planet, to people and to national economies.

By linking votes to specific data points aligned with a principles-based approach, investors can exert influence more consistently and across more markets by targeting companies that are not yet meeting ‘best practice’. Where they are unable to demonstrate sufficient progress, investors can then leverage influence by voting against them and/or divesting their holdings from relevant funds.’

How can institutional investors understand and incorporate climate change risks in their portfolios?

‘GHG emissions have long been the most common means for assessing climate change risk, but to meet the challenge of net zero, we must broaden our analysis.

There are four key questions institutional investors must ask to get a full picture of climate change risk:

- What do different climate outcomes mean for the global economy?

- What risks does climate change expose portfolios to?

- What climate outcome is a portfolio aligned with?

- How far away from the net zero 2050 target are my financed emissions?

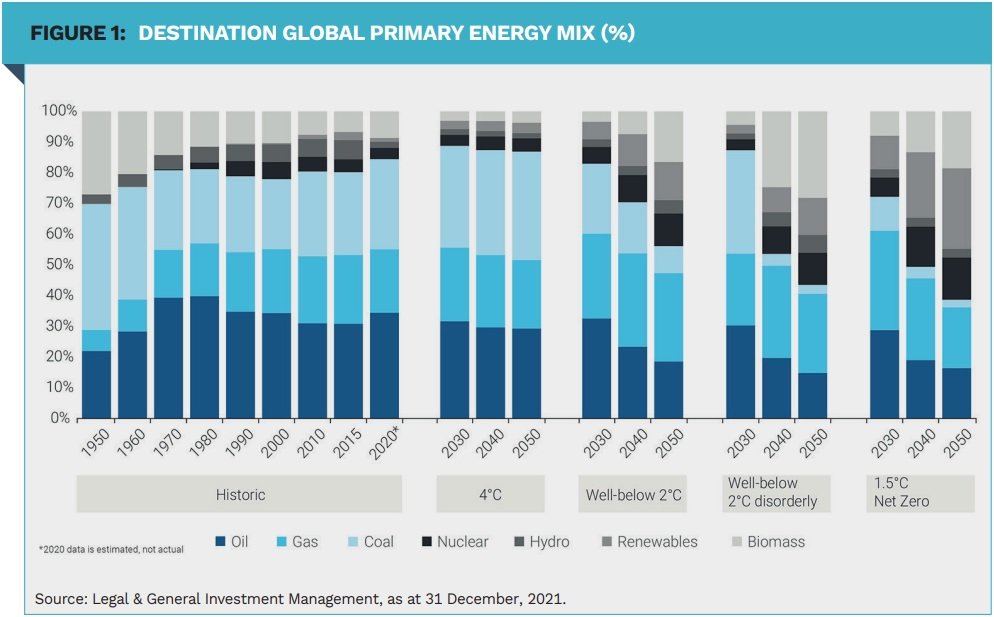

We have developed our own bottom-up energy transition scenarios – or ‘Destinations’ – that factor in inputs including carbon budgets, technology costs, energy demand and mixes, sectoral emissions pathways and furthermore carbon prices. These range from ‘1.5°C net zero’, to ‘orderly’ and ‘disorderly’ scenarios for below 2°C, to the 4°C rise that would arise from ‘inaction’, as Figure 1 shows.

Modelling in this way allows institutional investors to understand the company, sector and portfolio-level implications of climate change risk. Once this understanding is arrived at, it can better inform how investors engage with and invest in both companies and sovereign issuers.’

What challenges do you see on the road to net zero?

‘At present, fewer than 10% of companies are on track for net zero, according to our analysis. There is no minimising the challenges many will face in reaching it. We believe the most significant challenge is not determining whether a portfolio is net zero today, but rather how best to devise strategies that will effect long-term change in the market.

The key challenge here is finding successful ways to link the macro picture with portfolio construction.’

|

SUMMARY Setting targets, strategic asset allocation, policy advocacy and activity around engagement and governance should be the basis of any net zero strategy. Active ownership can contribute to reaching net zero by identifying key issues, engagement with stakeholders and escalating to sanctions over ESG issues. Institutional investors should consider the effect of different climate outcomes on the global economy and on their own portfolios. Most companies still have a long way to go to net zero. |

|

Disclaimer Key risks For professional investors only. Not to be distributed to retail clients. Capital at risk. Past performance is not a guide to the future. The value of an investment and any income taken from it is not guaranteed and can go down as well as up, you may not get back the amount you originally invested. Assumptions, opinions and estimates are provided for illustrative purposes only. There is no guarantee that any forecasts made will come to pass. Important information The information contained in this document (the ‘Information’) has been prepared by LGIM Managers Europe Limited (‘LGIM Europe’), or by its affiliates (‘Legal & General’, ‘we’ or ‘us’). Such Information is the property and/or confidential information of Legal & General and may not be disclosed by you to any other person without the prior written consent of Legal & General. No party shall have any right of action against Legal & General in relation to the accuracy or completeness of the Information, or any other written or oral information made available in connection with this publication. Any investment advice that we provide to you is based solely on the limited initial information which you have provided to us. No part of this or any other document or presentation provided by us shall be deemed to constitute ‘proper advice’ for the purposes of the Investment Intermediaries Act 1995 (as amended). Any limited initial advice given relating to professional services will be further discussed and negotiated in order to agree formal investment guidelines which will form part of written contractual terms between the parties. The Information has been produced for use by a professional investor and their advisors only. It should not be distributed without our permission. |