NN IP: Tailwinds for the Chinese recovery

NN IP: Tailwinds for the Chinese recovery

Despite further policy easing in China and resilient consumer demand in the US, concerns about global growth have resulted in risky assets falling further. The Fed keeps on expressing its strong commitment to reduce inflation, even if doing so hits growth prospects, and the ECB has now explicitly committed itself to two rate hikes by September.

As long as the main central banks remain a long way from adopting a more dovish stance, the pressure on risky assets is likely to persist. One of the main drivers of global inflation, the war in Ukraine, is unlikely to de-escalate in the near future, which means that the disruption to the global food and energy markets will continue. Against this backdrop, our multi-asset model portfolio is still cautiously positioned overall, with underweights in Eurozone equities, corporate bonds and US Treasuries and an overweight in crude oil.

The Chinese authorities act again

Apart from ECB President Christine Lagarde’s confirmation that she expects the deposit rate to be out of negative territory by September, the main news over the past week came from China. The sharp slowdown in economic activity due to the lockdowns has forced the Chinese authorities to come up with more aggressive policy stimulus.

Last week, we wrote about the cut in the mortgage floor rate for first-time home buyers, which represented the first time in the current crisis that the central government has directly supported the housing market. Only a few days later, the Chinese central bank cut the five-year loan prime rate, the main benchmark rate for home mortgages. These steps have not only reduced financing costs for house buyers, they also are a clear signal to the market that the central bank is now committed to propping up home purchases.

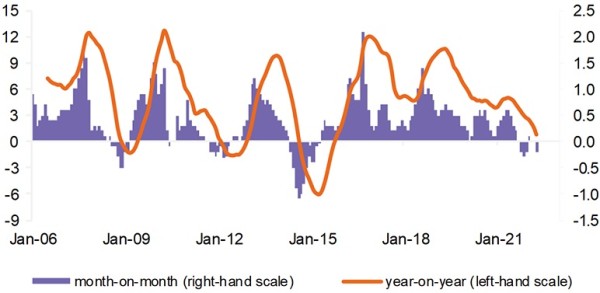

Transactions in the real estate market, which have been weak since last summer, have fallen even more due to the recent lockdowns, and the authorities are clearly worried that house prices will fall even more (see figure).

Chinese house prices

Nationwide, m-o-m and y-o-y % change

Source: NDRC, NBS

Another sign of the increased sense of urgency among Chinese policymakers was the decision to implement a new round of tax relief for the corporate sector and households. This includes a cut in the purchase tax on new passenger cars. The total amount reserved for this tax cut is USD 9 billion, which is equivalent to 17% of the total revenues received from the vehicle purchase tax in 2021. In previous economic slowdowns, tax cuts on car sales have always proven effective in turning around consumer sentiment.

Covid infection data in China has improved a lot in recent weeks, so restrictions should be relaxed further. Everyday life in Shanghai is already almost back to normal, with the seaport now operating at 90% of its former capacity and the airports back to 70%. After the first wave of Covid in early 2020, Chinese demand recovered quickly after lockdowns ended, and we expect demand for services in particular to spike in the coming months.

Meanwhile, the effects of the government’s increased infrastructure investment since Q3 last year are clearly showing up in the data. For instance, new energy investments rose dramatically in the first four months of the year, with new investments in solar energy more than three times higher than the same period last year. Overall, fixed investment growth has held up well in recent months, although consumption and production have struggled. The authorities’ fiscal stimulus measures are proving effective, as they always have done.

The government’s strong fiscal push combined with its new urgency to end the real estate crisis should act as a major tailwind to the economic recovery that is already underway thanks to the easing of Covid restrictions. While some brokerage houses have reduced their Chinese 2022 GDP forecasts to as low as 3%, we still believe a rate of around 5% remains within reach as we expect a strong rebound in Q3 and Q4.

The main risks to our scenario are the pandemic – there is still a lot of uncertainty about how the authorities will exit their zero-Covid policies – and the rapid deterioration in global trade. Over the medium to long term we can add the ongoing frictions between the leadership of the Communist Party and the corporate sector, which are likely to remain a source of regulatory uncertainty, and China’s relationship with the West.

Risky assets continue to struggle

Global equity markets remained volatile over the past week, with US equities posting the worst returns as several US retailers announced profit warnings and negative guidance. This led to renewed concerns about the strength of the US consumer and the country’s growth in general.

High inflation is clearly starting to bite into corporate profit margins, and costs are increasing because of higher wages and energy costs and rising inventories. Despite the strong labour market, consumer confidence has fallen, suggesting that consumers will adapt their purchasing behaviour to the changing price environment.

Sector changes within our multi-asset model portfolio

Following the weak results in the retail sector, we downgraded consumer staples from overweight to neutral and upgraded utilities from neutral to overweight. We maintain our preference for defensive sectors. We are overweight in financials, a sector that benefitted earlier this week from JP Morgan’s positive assessment of its net interest income.

Rising interest rates represent a tailwind for the sector. High-growth sectors remain sensitive to the risk of stagflation, so we remain underweight in communication services and only neutral in IT despite the strong trends towards digitalization and robotization. We are still overweight in energy, in line with our view on oil prices.

We remain neutral in global equities overall. Worsening macro data is being offset by robust corporate health, investor sentiment that is already very cautious and reduced investor positioning in equities. These effects are creating the potential for a technical rebound. However, a more sustained rebound would require better news about inflation, monetary policy and supply chains.

Government bond yields have now not risen for more than two weeks, with investors assessing whether inflation has peaked, growth worries are warranted and the Fed’s and ECB’s hawkishness has peaked. For now, we maintain our moderate underweight in US Treasuries as we believe that inflationary pressures will remain high and that, due to tight labour markets and persistently high energy prices, there is little room for central banks to become less hawkish.

Stagflationary pressures continue to create headwinds for corporate bond markets, so we remain underweight in Eurozone high yield and investment grade credit. We believe European credit spreads are more likely to widen than US spreads, primarily due to the relatively high risks to growth in Europe caused by the Ukraine war. Funding stress in European money markets is an additional concern.