Nikko Asset Management: Set those old myths aside – Japan’s investment potential is impossible to ignore

Nikko Asset Management: Set those old myths aside – Japan’s investment potential is impossible to ignore

By John Vail, Chief Global Strategist at Nikko Asset Management

In a new investment guide from Nikko Asset Management (read here), Chief Global Strategist John Vail explains how Japan’s economic, geopolitical and clean energy influence has placed it on an upward trajectory for the next decade and beyond.

Japan has been intentionally overlooked – and underweighted – by global investors for decades. Labelled as a country burdened by public debt, a stale corporate culture, and a shrinking workforce, investment potential would be found elsewhere, according to conventional wisdom. Fast-forward to today, and the picture is completely different, even if the myths persist. So, what has changed?

A growing presence on the world stage with strong economic implications

Japan’s large capital reserves and its financial capabilities are significant tools for geopolitical influence. As well as being the largest trading partner and most influential neighbour of China, Japan is also an essential partner for US policy towards China. This is a delicate geopolitical balancing act, but Japan is arguably one of very few nations capable of maintaining the equilibrium between these two superpowers. Moreover, Japan’s growing reputation as a reliable and trusted trading partner has helped it to emerge as Asia’s leading voice on free trade and investment. Not only does the Trans-Pacific Partnership promote Japan’s economic and trade interests, it also helps ensure political order and stability for the Asia Pacific region as a whole.

Japan is also forging deeper trade and diplomatic connections across the world, including with Europe and the Middle East. The EU-Japan Economic Partnership Agreement has established an economic zone of 635 million people representing 30% of total world GDP and 40% of world trade (and was also the first trade agreement to include a specific commitment to the Paris Agreement on climate change). Additionally, the Regional Comprehensive Economic Partnership Agreement (RCEPA) signed in 2020 will eventually eliminate up to 90% of the tariffs on imports between the signatories – who represents half of the world’s population, 30% of global GDP and about a quarter of world exports and foreign investment. This is the first multi-lateral trade treaty between China, Japan and South Korea, and will significantly expand trade between Japan and China, as well as the ASEAN nations and the other RCEPA members. As other countries have stepped back, Japan has bravely emerged as the new leader in global free trade, and Japanese companies will reap the rewards from Japan’s trade and diplomatic connections across the world.

Japan will be a game-changer for the global green economy, opportunities abound

In the race to become carbon neutral, almost every country in the world is likely to have a degree of reliance on Japan to help them achieve their net-zero ambitions, most likely through Japan’s leadership in the fields of semiconductors and hydrogen. Both China and the West are courting Japan because of the raw materials required specifically for ‘green’ technology and the need for semiconductors. Besides producing advanced semiconductors, Japan also dominates several of the highest value-added portions of the semiconductor production equipment process.

Hydrogen, which has drawn a significant amount of attention as a clean alternative to carbon-emitting fossil fuels, can play a key role in ensuring Japan achieves carbon neutrality by 2050. While the drive towards replacing fossil fuels with hydrogen is still in its early stages, Japan already boasts a global leader in the clean energy market. Kawasaki Heavy Industries owns core technologies related to every stage of the hydrogen supply chain – which few competitors can replicate – which can help with the production, storage and transportation of this notoriously volatile fuel. In the race to become carbon neutral, Japan’s expertise in hydrogen technologies could prove critical in helping nations achieve their net-zero ambitions.

Japan’s economic and corporate reforms are benefitting global investors

Since Shinzo Abe departed office due to ill health in 2020, his successors have continued in the same vein, embedding structural reform efforts to improve Japanese corporate governance and shake the Japanese economy from its slumber. At the same time, the Bank of Japan’s purchases of Japanese government bonds and exchange-traded funds have helped lower the yen’s value, which has supported export-driven companies and boosted Japanese stock prices for almost a decade. Japan’s monetary policy is expected to remain accommodative, which will continue to create a constructive environment for Japanese companies in the decade to come.

In April, the Tokyo Stock Exchange was restructured into three sections (Prime Market, Standard and Growth). Companies will be subject to a more stringent listing criteria, as well as being required to adhere to certain corporate governance standards or face the prospect of being demoted or delisted. The new structure should result in higher shareholder value, thereby attracting more capital into the Japanese market and enhancing the global competitiveness of Tokyo Stock Exchange constituents.

Japan’s demographic challenges have resulted in innovative solutions

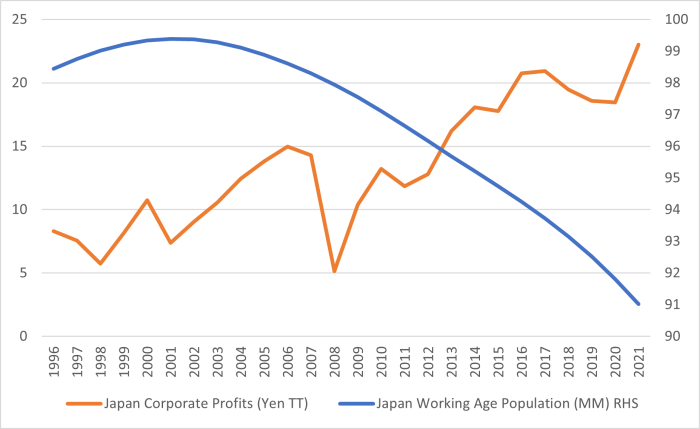

Necessity has helped Japanese companies overcome demographic challenges and given them the upper hand. Aside from interruptions from global crises, Japanese companies have enjoyed a 20-year bull market in profit margins, attributed to a combination of improved corporate governance, enhanced technology, and global, especially Asian, economic growth. Dividend payouts issued to investors have increased significantly during this period also, and earnings per share growth has been heightened ever further due to substantial share buybacks. These already positive factors (profits, dividends) are set to continue as investors engage more directly with Japanese on issues such as ESG and sustainability, helping to unlock even more hidden value for investors.

Secular bull market in profitability not impacted by demographics

Source: OECD, Japan MOF (31 December 2021)

Japan is entering an era of exceptional investment potential

The Japan of today boasts a highly-skilled labour force, has lower wages compared to other developed market competitors, and, thanks to the Bank of Japan’s accommodative policy stance, has cheaper financing than almost anywhere else. More importantly, Japan’s international influence and leadership has given it significant geopolitical authority and trading strength. This in turn is contributing to Japan’s economic growth, creating a positive feedback loop. Set those old myths aside, because right now, the world wants to do business with Japan, and equity investors should recognise the investment potential this brings.

This article is part of a Nikko AM investment guide about unlocking value in Japan. Read the guide here.

References to individual stocks are for illustration purposes only and do not constitute a recommendation to buy or sell.