Columbia Threadneedle: UK is a rich seam to mine… and not just in commodities

Columbia Threadneedle: UK is a rich seam to mine… and not just in commodities

By Richard Colwell, Head of UK Equities, Columbia Threadneedle Investments

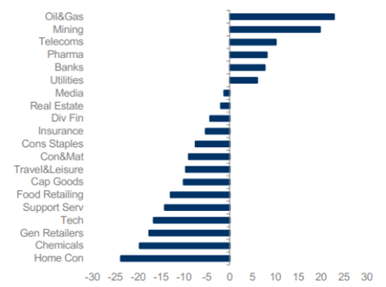

It’s been a volatile start to 2022, with the conflict in Ukraine creating huge disruption in oil markets, and adding to ongoing pressures seen in markets already dealing with the ongoing Covid-19 situation and supply chain issues; Q1 22 has seen narrow markets led by commodities and mining.(Figure 1)

“Energy and materials mega-caps form a large proportion of the FTSE All Share index. However, the Columbia Threadneedle UK equities team see a multitude of better opportunities for truly active managers to pursue risk-adjusted returns elsewhere and believe we have an edge in other sectors”, Richard Colwell said.

In this viewpoint Richard Colwell explains why the UK market remains a reliable alternative to highly valued, crowded trades.

Figure 1: Q1 relative performance (%)