Fidelity: Three structural factors making for stickier inflation

Fidelity: Three structural factors making for stickier inflation

Inflation has dominated front pages in recent months, with headline consumer price increases in the US reaching 40-year highs. While we don’t expect global inflation rates to remain at these record-breaking levels, we see several medium to long-term factors that should continue to place upward pressure on inflation.

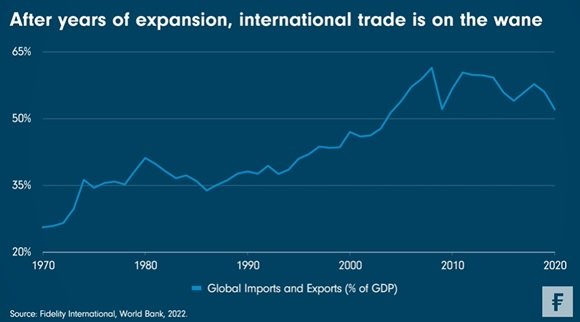

In the three decades since the end of the Cold War, a dramatic expansion of international trade has benefitted the global economy and broadly helped to keep price increases in check. That trend has recently started to reverse.

This week’s Chart Room shows how trade tensions among the US, China, and other major trading nations have led to a relative decline in levels of global imports and exports ever since the 2008 financial crisis. The fallout from the Covid-19 pandemic has accelerated this while forcing companies and governments to reflect on their regional dependencies as global supply chains have come under greater pressure. Vladimir Putin’s invasion of Ukraine and the resulting sanctions aimed at Russia are likely to exacerbate this trend of deglobalisation.

Structural inflation factors

We expect this decline to prove inflationary in the medium term, as companies’ efforts to onshore their supply chains leave them facing generally higher costs. Intel, a semiconductor manufacturer, is one example of this. As the EU looks to become less dependent on Asia for chips used in technology, the American company has announced that it is set to receive a German government subsidy to cover 30 per cent of its investment into a €17bn research and development facility in Germany.

This process of deglobalisation could go hand-in-hand with two other structural changes to keep inflation higher for longer.

The first is shifting demographics. The World Health Organisation projects that between 2015 and 2050, the proportion of the world’s population over 60 will almost double from 12 per cent to 22 per cent. We believe that aging populations will raise demand for goods and services to levels that a shrinking working-age population will struggle to meet, piling upward pressure on prices.

The second factor is the impact of so-called “greenflation”. The shift to a greener economy will involve significant investment into decarbonisation technologies and renewable energy sources, as well as potentially ushering in carbon taxes. All of this will leave a significant mark on medum-term inflation. The impact has been felt on German CPI, for instance, which was boosted by approximately 0.6 per cent last year following the introduction of a carbon tax on heating and transportation. Deutsche Bank anticipates that an ambitious EU climate policy could add 0.35 per cent to Eurozone inflation per year.

None of this is to suggest that we see inflation staying at today’s eye-watering heights; we don’t. However, we do think these three factors will keep price increases elevated on a structural basis over the medium term.