Fidelity International: The case for Global Emerging Market Equities

Fidelity International: The case for Global Emerging Market Equities

By Rebecca McVittie, Head of Equity Investment Specialists & Investment Director, Emerging Market Equities at Fidelity International

We continue to live in a world marred with uncertainty: the emergence of the Omicron variant raises questions about what the weeks and months ahead will bring. The path of inflation has and will continue to give rise to debate and exert influence over central bankers. However, 2021 has been a lacklustre year for emerging markets in aggregate, but many matters which have hindered the asset class, appear well known, and largely priced in which could pave the way for attractive relative performance in 2022.

Key observations

- The discount to developed markets is at a multi-year high and with investors underexposed to the asset class this could be an attractive entry point

- Structural demand drivers and favourable industry structure have reduced the cyclicality of pockets of EM

- Interest rates will inevitably rise but many emerging countries are more resilient versus the ‘taper tantrum’

- More divergent and improving ESG standards could be an important determinant of performance

- Higher commodity prices can benefit some EMs and provide an inflationary hedge

- Policy moves, economic indicators and low valuations indicate that China could be bottoming out

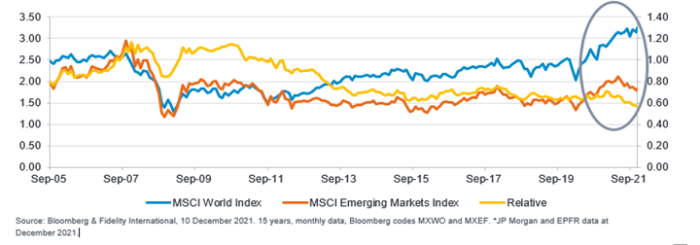

Peak discount provides an attractive entry point

Emerging Markets have underperformed developed markets through 2021. Risk aversion centred on China’s regulatory clampdown, stress within the property sector and a slowing economy. Furthermore, the Fed’s intentions in the face of higher inflation have weighed on risk appetite. Whilst emerging markets are not cheap in absolute terms, the shakeout in markets means that relative to DM, EM is trading at a peak discount, providing an attractive entry point for investors. This is coupled with light positioning - according to EPFR EM equities account for just 6.6% of global equities asset under management, compared to a peak allocation to EM at 13.7% in 2002 and the post-GFC peak was at 13.4% in 2010*.

Figure 1: Indices in absolute terms and relative terms

IT - less pronounced cycles result from more rational industry structure

IT is the largest sector comprising the MSCI Emerging Markets index, so it’s importance should not be underestimated. The developing world is home to industry leading players (both in terms of market share and R&D). Memory remains a commodity product and the industry continues to be susceptible to the cyclical rules that have presided over past cycles. However, memory is seeing structural demand growth as our physical world continues to digitize and that drives the need for more data storage which drives demand for memory semiconductors. The commoditized nature of the product means the industry has been at its most consolidated yet with just 3 major players. This means more rational competition and more disciplined capacity expansion which translates into shorter and less pronounced cycles driven by inventory.

Improvements since the taper tantrum

When the Fed moves to tighten or even indicates that this is the direction of travel emerging market assets feel the effects. The appeal of higher yielding safe havens can cause currency depreciation and have a de-stabilising effect. However, many emerging market countries dealt with the fallout from the 2013 taper tantrum; fiscal positions are better and more significant reserves have been built, aided by stronger commodity prices.

Figures 2 & 3: Indonesia exemplifies Improving balances for the ‘Fragile 5’

Greater scope for differentiation on ESG

One of the most significant hurdles for EM investors is understanding the ESG credentials of companies operating in the developing world. The absence of published information or a backward-looking view can result in negative scoring, which can mask the attractiveness of an opportunity. Improving ESG standards is an important determinant of return potential, and the emerging market universe is undoubtedly one which offers up that scope for improvement. For example, sell side research has indicated that the Middle East has the lowest ESG scores across a series of third providers analysed, but the rate of change has been mostly positive in the past 5 years. Research has identified that in the Middle East, it's not just qualitative ESG measures that matter but also improving disclosure scores - both are driving relative performance*.

Source: Bloomberg and Morgan Stanley Research. Based on simple average performance; top vs bottom quartile performance based on the rate of change if ESG score by providers Bloomberg and S&P Global. Composition is rebalanced every year using country neutral approach for ESG, S and G score and sector neutral for E scores. November 18, 2021, 2022 EEMEA Equities Year Ahead Outlook.

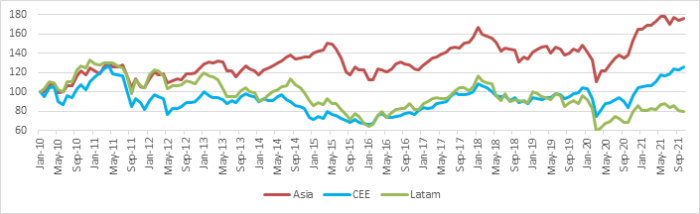

Higher commodity prices - a boon for exporters

Higher energy prices have been a key theme of 2021 at the expense of the consumer; however, stronger pricing can be very positive for resource rich countries, and exposure to commodities can provide an attractive hedge against inflation. Much focus has been placed on demand, with Omicron raising concerns about demand recovery, however, many commentators speak of $100+ oil given gross underinvestment. Wood Mackenzie has pointed to global upstream investment sinking to a 15-year low of $350 billion, down from around $600 billion before the pandemic. Liquified Natural Gas has traded higher as scarce supply and strong demand from Asia, as the move from coal to gas escalates in the absence of sufficient alternatives. Despite, this tailwind some of the resource rich regions of EM have catching up to do.

Figure 4: Resource rich regions have lagged EM Asia

Source: Jonathan Anderson: Stock market index (EOP, USD, rebased to 100 as at Jan 2010).

Is China bottoming out?

China's central bank has recently moved to ease, cutting the RRR by 0.5 percentage points from mid December. The cut indicates that government priority is to stabilise the economy in 2022. China’s challenges are well known - a beleaguered real estate sector and slowdown in property starts is coupled with simmering geopolitical tensions and uncertainty about the impact of tougher regulations. However, a potential troughing of the China’s credit impulse and a distinct focus on shifting away from speculation, could indicate that China is bottoming out.

Figures 5 & 6: China Credit Impulse & Reserve Ratio Requirements (RRR)

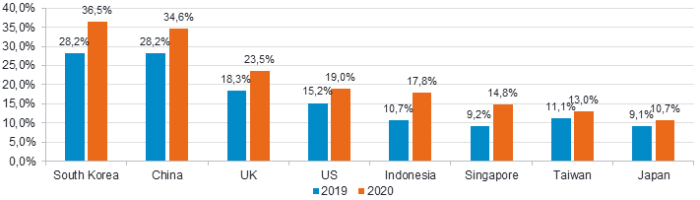

Underpenetrated markets will continue to offer up growth

Historically entrepreneurship and innovation were largely associated with China alone, however the ecommerce is an industry ripe for expansion. Taiwan is a good example of untapped potential with its 20m population, ecommerce penetration is relatively low at 14%. There is no Alibaba or Amazon in this market, and it is fast becoming a two-player market, dominated by local players Momo.com and Shoppee. With penetration levels in Taiwan running at low levels relative to many other countries there is a precedent for growth. More broadly IPO activity sheds light on entrepreneurship in EM. During the first eight months of 2021, Latin America recorded its strongest initial public offering (IPO) activity of the past six years to August 2021. In total, 55 IPOs took place which compares to 36 new issues for the whole of 2020.

Figure 7: EC penetration as % of total retail sales in 2019 and 2020

Euromonitor & Momo.com investor presentation Jan 2021.

Source: https://www.whitecase.com/publications/insight/latin-america-focus/equity-capital-markets

The key features of our emerging markets capability

- Portfolio Managers draw on the expertise of Fidelity’s in-house EM equity analysts.

- An unwavering focus on bottom-up stock selection is underpinned by good corporate access, local presence, and language skills.

- The search for quality is core to our investment philosophy; seeking to reduce the risks of permanent loss of capital.

- Truly active management is supported by independent risk controls.

- Integrated Financial and ESG analysis captures the full range of fundamental factors impacting financial performance and LT shareholder value

- Co-location of EM equity and debt team members further underpins the rigorous investment approach

Important Information

- The value of investments and the income from them can go down as well as up and investors may not get back the amount invested.

- This fund invests in overseas markets and the value of investments can be affected by changes in currency exchange rates.

- This fund invests in emerging markets which can be more volatile than other more developed markets.

- Reference to specific securities should not be construed as a recommendation to buy or sell these securities and is included for the purposes of illustration only.

- Investors should note that the views expressed may no longer be current and may have already been acted upon.

- Past performance is not a reliable indicator of future returns

This information must not be reproduced or circulated without prior permission. Fidelity only offers information on products and services and does not provide investment advice based on individual circumstances, other than when specifically stipulated by an appropriately authorised firm, in a formal communication with the client. Fidelity International refers to the group of companies which form the global investment management organisation that provides information on products and services in designated jurisdictions outside of North America. This communication is not directed at, and must not be acted upon by persons inside the United States and is otherwise only directed at persons residing in jurisdictions where the relevant funds are authorised for distribution or where no such authorisation is required. Unless otherwise stated all products and services are provided by Fidelity International, and all views expressed are those of Fidelity International. Fidelity, Fidelity International, the Fidelity International logo and F symbol are registered trademarks of FIL Limited. Third party trademark, copyright and other intellectual property rights are and remain the property of their respective owners. Issued by FIL Pensions Management. Authorised and regulated by the Financial Conduct Authority.

Netherlands: We recommend that you obtain detailed information before taking any investment decision. Investments should be made on the basis of the current prospectus (in English and Dutch) and the KIID ( Key Investor Information Document), available in Dutch along with the current annual and semi-annual reports free of charge through https://www.fidelityinternational.com, from FIL (Luxembourg) S.A., Netherlands Branch (registered with the AFM), World Trade Centre, Tower H, 6th Floor, Zuidplein 52, 1077 XV Amsterdam (tel. 0031 20 79 77 100) or from www.fidelity.nl. The fund is authorised to offer participation rights in The Netherlands pursuant to article 2:66 (3) in conjunction with article 2:71 and 2:72 Financial Supervision Act. Issued by FIL (Luxembourg) S.A., authorised and supervised by the CSSF (Commission de Surveillance du Secteur Financier). Investors/ potential investors can obtain information on their respective rights regarding complaints and litigation on the following link: https://www.fidelity.nl in Dutch.

GEMS1734