J.P. Morgan: UK stocks look cheap

J.P. Morgan: UK stocks look cheap

UK stocks look cheap compared to both their international peers and their own long-run history, providing a potentially attractive entry point for long-term investors.

As we discuss in our recent On the Minds of Investors article “UK equities offer value”, the UK’s economic outlook seems promising with real GDP expected to grow by more than 5% next year. Consumers in aggregate have huge excess savings from the pandemic and surveys of business investment intentions have improved sharply.

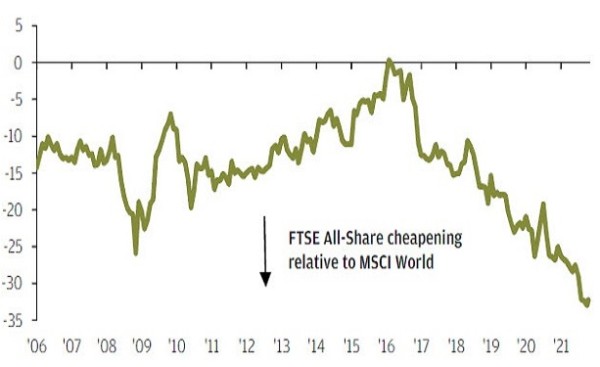

One might expect these strong economic prospects to have been priced into markets already, but when comparing the price-to-earnings ratio of the FTSE All-Share with developed markets (MSCI World), the UK index trades at a near record valuation discount. As strong economic growth lifts company earnings, UK equities should stand to benefit.

%, valuation premium/discount of FTSE All-Share relative to MSCI World

Source: FTSE, IBES, MSCI, Refinitiv Datastream, J.P. Morgan Asset Management. Valuation premium/discount is based on 12-month forward P/E ratio. Data as of 13 October 2021.