SSGA-SPDR: Emerging Market Debt - Fighting US Dollar Headwinds

SSGA-SPDR: Emerging Market Debt - Fighting US Dollar Headwinds

A spike in the US dollar, a hawkish turn by central banks and an element of risk aversion have all conspired to put emerging market (EM) local currency debt under pressure.

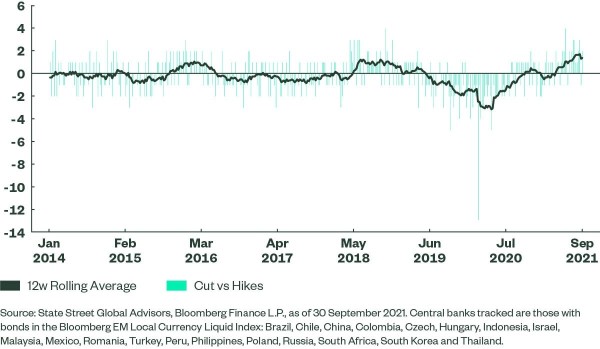

Fears persist that the phasing out of asset purchases by the Federal Reserve (Fed) and, ultimately, rising rates may favour US dollar assets and restrict capital flows into EM debt. However, from a yield differential perspective, spreads have been going against the US dollar.

Figure 1 below shows the difference in the yield-to-worst between the Bloomberg EM Local Currency Liquid Index and the Bloomberg US Treasury Index. There has been a clear widening out of spreads to levels not seen since late 2016 (aside from the spike in spreads during the COVID crisis). Driven by policy tightening by EM central banks, the spread at the end of September was just 5bp below its five-year average.

Figure 1: Emerging Market Yield Spreads to US Treasuries Have Widened

March 2021 saw similarly negative returns from EM local currency debt as Treasury yields and the US dollar spiked. However, the negative tone did not persist and the following two months saw positive returns as the currency rebounded. The latest rally in the US dollar has left it looking 7.6% overvalued versus the basket of currencies that make up the Bloomberg EM Local Currency Liquid Index, according to the longer-term valuation model used by State Street Global Advisors.

There could be several trigger factors for a rebound in EM currencies: a resolution to the US debt ceiling issue, a more dovish Fed or a benign resolution to China’s Evergrande problems – all could lead to better support for riskier assets.

Looking at the Bloomberg EM Local Currency Liquid Index, there were only a few countries that made positive returns in September: China, as domestic growth indicators slowed; Indonesia, thanks to already-wide spreads to Treasuries and relatively tame inflation; and Russia, as gas prices soared, supporting the ruble.

As we also point out in a recent article, Emerging Market Debt: Unfulfilled Potential, EM debt markets already price a high degree of tightening into the yield curve. Yields are currently high relative to US Treasuries because the tightening cycle by EM central banks is already well under way.

The slope for the 0-2 year part of the curve is back at its steepest levels, which suggests a high degree of policy tightening is already priced into the market. This may not end up being validated by central banks: the PriceStats® measure of inflation looks like it has stabilised for several key EM nations such as Brazil, South Korea and South Africa.

Global growth is pushing into its mid-cycle phase, with the OECD forecasting a slowing from 5.7% in 2021 to 4.5% in 2022. This deceleration is prominent in EM nations, with the most extreme moves being Turkey, down to 3.1% from 8.4%, Brazil, to 2.3% from 5.2%, and South Africa, to 2.5% from 4.6%.

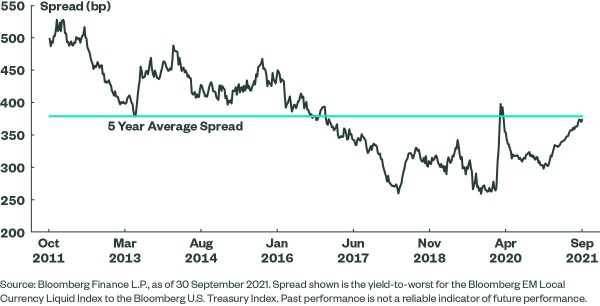

Slower growth and a turn in the inflation dynamic hints that pressure for EM central banks to continue to tighten policy may start to ease. It is notable that, as illustrated in Figure 2, the 12-week average of central banks that have raised rates versus those that have cut has started to turn lower (helped in part by the recent cut in Turkish interest rates).

Overall, the recent rise in Treasury yields and the US dollar has once again weighed on EM debt. However, the longer-term prospects seem better with the yield on EM debt looking appealing versus developed markets and the currencies are back to being cheap against the US dollar. While the rate hiking cycle for EM central banks has further to run, weaker growth and inflation should start to alleviate pressure to hike rates. With tighter policy already priced into bond markets, this could prove supportive for local market debt.

Figure 2: Emerging Market Central Bank Hiking Momentum is Starting to Turn Down