Quoniam AM: Integrating the UN Sustainable Development Goals

Quoniam AM: Integrating the UN Sustainable Development Goals

By Mara Schneider, SRI Manager, and Johannes Probst, Portfolio Manager, both working at Quoniam Asset Management GmbH

The 17 United Nations Sustainable Development Goals are increasingly becoming a focal point for numerous investors. Together with the Paris Agreement, they offer concepts for a more sustainable future.

The EU Taxonomy adopted in 2020 underpins increasing regulatory efforts to push for these objectives to be met. It does not, however, replace the SDG Framework, which allows for a more comprehensive view of environmental and social challenges, and is recognised worldwide. According to a KPMG study (2020 Survey of Sustainability Reporting), 69% of Nasdaq 100-listed companies report on their positive contribution to the SDGs. However, in order to redirect further capital flows into impact-oriented investments to achieve the goals by 2030, there is still a need for concrete links between the SDGs and corporate objectives as well as uniform reporting standards. In this environment, one of the biggest challenges facing the financial sector is how to make decisions on impact investments based on the information that is currently available. Various methods for making effects on the SDGs measurable have become established in recent years. Given the complexity of – and differences between – the large number of impact mechanisms, however, the process of finding a solution to this problem is still in its infancy and requires continuous action to analyse, tap into and aggregate new sources of information.

Traditionally, many data providers have used product and service category information to classify revenue based on its contribution to the SDGs. It is often questionable whether the mere existence of a product or service justifies a positive rating. To use one example, while much of a pharmaceutical company’s revenue can be attributed to the objective of ‘Good health and well-being’ (SDG 3), controversial pricing practices – or the fact that particular services are only offered in certain regions – often stand in the way of an actual contribution. This means that increasingly, operational processes, controversies and geographical aspects are being taken into account in such assessments as well. There are also other options available for measuring contributions. For example, companies often patent new technologies and functions, usually before a product is even ready to be launched on the market. This can give the company a competitive advantage or allow it to generate a monetary return through licensing. If, in addition to its monetary value, this patent also contributes to one of the 17 SDGs, an attractive opportunity opens up for impact-oriented investors: the potential to generate returns combined with simultaneous alignment with the Sustainable Development Goals.

One of the biggest challenges facing the financial sector is how to make decisions on impact investments based on the information that is currently available.

What is more, there is the option of comparing the environmental costs caused by the corporate sector in different areas, such as ‘air pollution’, ‘land and water pollution’ or ‘greenhouse gases’. By expressing the monetary costs associated with units of pollution in relation to revenue, the company’s contribution to gross domestic product is weighed up against the resulting costs to society. This means that external ecological costs put one-sidedly sustainable revenue into perspective. While the production of lithium-ion batteries, for example, can make a positive contribution to mitigating climate change, the external costs in terms of waste and the use of natural resources can be enormous. Another central aspect is the commitment to the SDGs at management level. The data on corresponding efforts made by a company’s management is often very diverse and ranges from measures to improve health in the workplace to offering micro-loans to micro-entrepreneurs. On the one hand, information like this can be used to identify companies with committed management teams, while on the other hand, it provides a starting point for possible company dialogue in a shareholder engagement context.

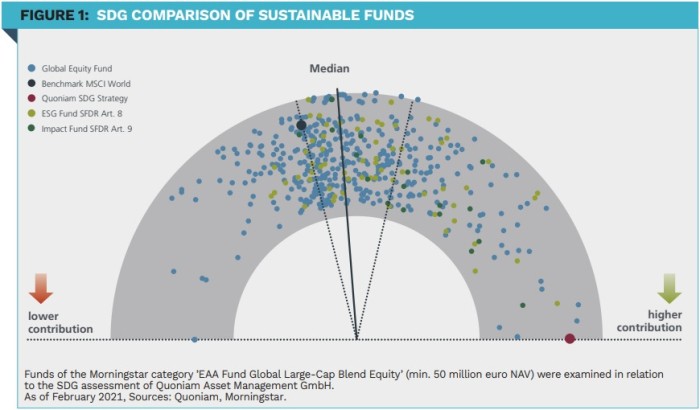

The investment process should take all of the data sources that are relevant for measuring SDG alignment into account. Decisive factors in this respect include aggregating the data in a meaningful manner, customising it and then reflecting it systematically in the portfolios. As an active quantitative asset manager, we prepare an impact assessment for more than 20,000 companies in relation to each of the 17 Sustainable Development Goals that extends beyond an evaluation of product revenue. Alignment with all 17 SDGs, or only a selected subset, can be managed for each individual portfolio. As part of a dedicated SDG strategy, sustainability and return targets are weighed up against each other at the same time and integrated into the portfolio on the basis of a bottom-up stock selection. The graphic compares global equity funds in different sustainability categories (ESG and impact funds) in terms of their aggregated SDG contribution (products, operating processes, environmental costs, patents, management commitment, controversies). The information is based on the calculation of weighted averages of the individual stock contributions. Overall, most portfolios achieve a comparatively neutral rating. Impact funds that make impact-oriented investments according to Article 9 of the EU Sustainable Finance Disclosure Regulation, however, perform better on average and can achieve positive contributions.

In order to maximise the impact on the SDGs, different dimensions should be considered simultaneously. Due to the mounting interest in impact investments, combined with regulatory advances and reporting standards, the information situation is expected to improve further. This will allow quantitative asset managers to make use of new analytic angles whilst ensuring improved comparability and higher-quality impact measurement.

|

SUMMARY The SDGs are becoming increasingly important for investors. There is still a need for concrete links between the SDGs and corporate objectives as well as uniform reporting standards. Different options are available for measuring contributions to the SDGs. To maximise the impact on the SDGs, different dimensions should be considered simultaneously. The information situation is expected to improve, which will allow quantitative asset managers to provide higher-quality impact measurement. |